[Epoch Times November 13, 2021](The Epoch Times reporter Lin Yan compiled a report) The latest Wall Street Journal survey found that US Silicon Valley venture capital firms and chip giants are stepping up investment in China’s chip industry to help the Chinese Communist government The fight for global dominance in the chip industry shocked the White House.

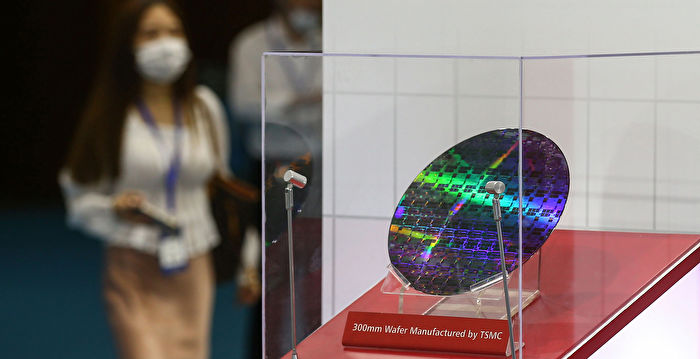

Chips have always been a key technology leader in the United States. At the same time, the focus of the Sino-US trade war is the core area where the United States is in the neck of the CCP and China’s attempts to obtain or steal technology from the United States.

Huari’s survey shows that in the past four years, well-known American companies and venture capital companies such as Intel and Redshirt Capital have more than tripled their investment in China’s semiconductor industry, which is like helping the enemy in this technological war.

U.S. companies have invested billions of dollars in China’s chip industry in the past year

According to the report, data analysis by Rhodium Group, a New York research company, shows that from 2017 to 2020, US venture capital companies, major chip companies and other private investors participated in 58 investment transactions in China’s chip industry; 2020 A sudden increase to 20 transactions each year, a record high.

San Francisco-based Walden International is one of the most prolific American investors in China’s chip industry. Data show that during 2017-20, it made 25 investments in Chinese chip companies, covering more than 40% of the chip investment transactions tracked by Rhodium. The company declined to comment.

In addition, since the beginning of 2020, the Chinese branches of venture capital companies Sequoia Capital, Lightspeed Venture Partners, Matrix Partners, and Redpoint Ventures have invested in Chinese chips. The industry has made at least 67 industry investments.

The report also said that although the investment amount of most transactions was not disclosed, the total amount of financing in the Chinese chip industry that these US investment companies participated in is estimated to be more than billions of dollars.

Huari conducted another analysis on the data of the analysis company PitchBook Data and found that Intel is an active investment company in China and is supporting a Chinese chip design tool company called Primarius Technologies. The company specializes in the production of the leading chip design tools currently used by American companies.

These companies tried to downplay the impact of their investments in China during the interview. Intel’s venture capital department stated that the company’s return on Chinese chip companies was less than 10% of the global investment portfolio. Red Shirt Capital and Red Dot Capital also stated that the above investment cases were all investment decisions made by their local independent teams.

Chips are used in a wide range, from mobile phones and automobiles to artificial intelligence and nuclear weapons. Since 2020, the world has been in a state of chip shortage.

The White House is shocked by the scale of the deal and considers filling the regulatory gap

The United States and China are vying for the dominance of this chip technology, which is considered essential to future geopolitical advantages. The wave of US investment in China is hitting the starting point of this competition.

Huari reported that Washington was shocked by this series of transactions, and some White House officials and members of Congress are considering filling the regulatory gap.

National security adviser Jack Sullivan said in a speech in July that the Biden administration is “studying the impact of U.S. foreign investment flows, which may circumvent the spirit of export controls or enhance competition in a way that harms national security.” The opponent’s technical capabilities”.

According to the report, officials of the White House National Security Council met with aides of two congressional senators Bob Casey (Democrat) and John Cornyn (Republican). One of the aides said that they are initiating a legislation to screen foreign investment from the United States and transfer key supply chain and technology industry resources offshore to rivals such as China and Russia.

The purpose of the bill is to review foreign investment that is not currently within the scope of export controls or the Foreign Investment Commission in the United States.

China share subsidies and tax cuts and other concessions attract U.S. chip companies

Beijing is currently using large subsidies to promote self-sufficiency in the chip industry, US national security officials and industry consultants say, and private investment in the United States is helping. The State Council of the Communist Party of China and the Ministry of Industry and Information Technology did not respond to requests for comment.

In August 2020, the State Council of the Communist Party of China proposed a set of financial incentives to encourage EDA software companies to provide years of substantial tax cuts for investment in such enterprises.

Chinese analysts and technology investors say that Beijing’s near-guaranteed government support prospects are attracting US companies. They say that a chip start-up will almost certainly receive government funding, which can increase the company’s valuation and accelerate growth, or at least keep the company from going bankrupt.

According to statistics released by the American Chip Industry Association, the number of newly established Chinese chip companies in 2020 will exceed 22,000, an increase of 200% over the previous year.

Editor in charge: Ye Ziwei

.