122

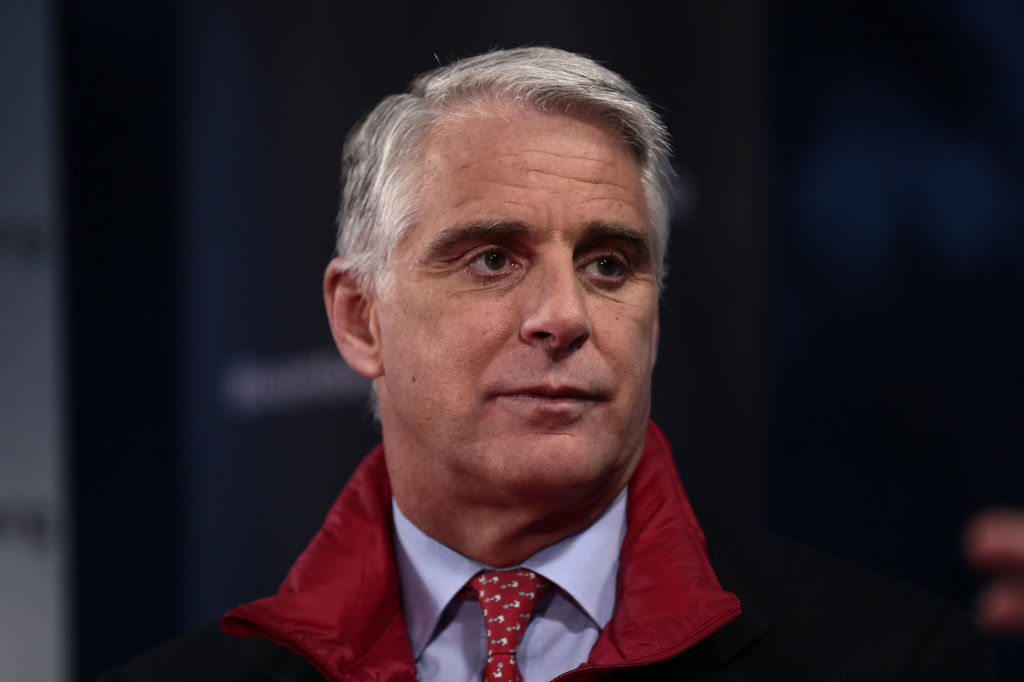

‘Buying a large asset manager doesn’t make much sense to us’. Thus Andrea Orcel, number one of UniCredit, during a press conference, commenting on the partnership signed with Azimut on asset management.

“M&A in asset management is not the right strategy. The goal is not to acquire extra masses outside the perimeter but to offer our customers the best product. I’m not interested in paying a lot for managed masses, I have to have the brains”. Regarding the impact on UniCredit’s accounts from the partnership with Azimut, Orcel said that the numbers “we will see them from 2024 onwards”.