Accidents will happen!

On the evening of the 18th, Zhongzhi Group issued an obituary on its website stating that the husband of famous singer Mao Amin and founder of Zhongzhi Enterprise Group, Mr. Xie Zhikun, died of a heart attack.

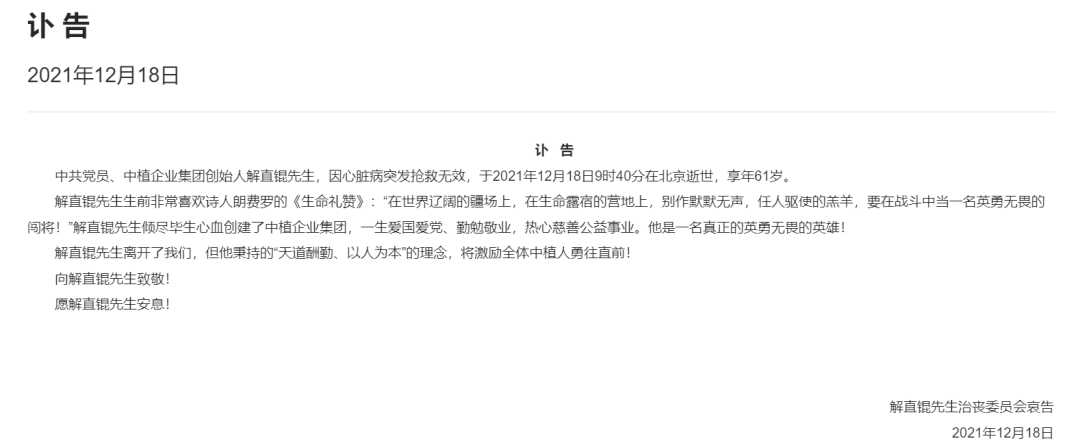

The full text of the obituary is as follows:

Mr. Xie Zhikun, a member of the Communist Party of China and the founder of Zhongzhi Enterprise Group, died of a heart attack in Beijing at 9:40 on December 18, 2021 at the age of 61.

Mr. Xie Zhikun liked the poet Lang very much during his lifetimeFerro“A Praise to Life”: “On the vast field of the world, in the camp where life is sleeping, don’t be a silent, driven lamb, and be a brave and fearless trespasser in battle!” Mr. Xie Zhikun spent his entire life. He has worked hard to create the Zhongzhi Enterprise Group, patriotic, loving the party, diligent and dedicated all his life, and enthusiastic about charity and public welfare. He is a true brave and fearless hero!

Mr. Xie Zhikun has left us, but his philosophy of “God rewards hard work and people-oriented” will inspire all Zhongzhi people to move forward!

Tribute to Mr. Xie Zhikun!

May Jie Zhikun rest in peace!

Mr. Xie Zhikun’s funeral committee mourned

December 18, 2021

Mao Amin, Chen Kaige, Xie Zhichun and others formed a funeral committee

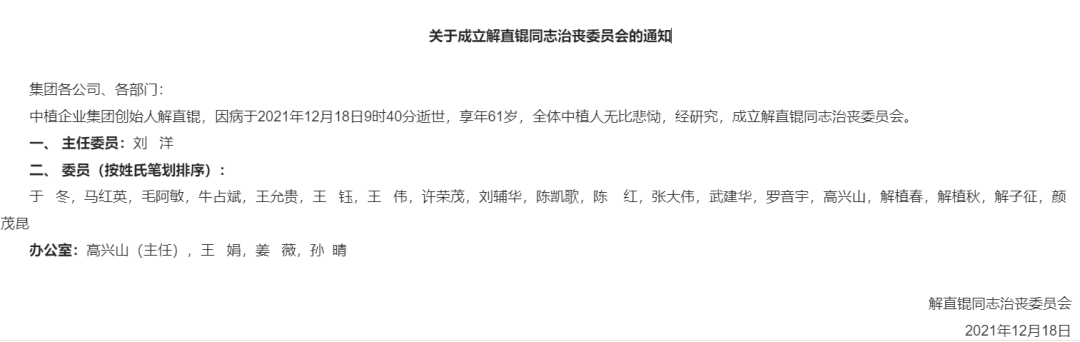

Along with the obituary, there is also a “Notice on the Establishment of Comrade Xie Zhikun’s Funeral Committee.”

According to the notice, after research, the Committee for Comrade Xie Zhikun’s Funeral Management was established. The chairman is Liu Yang, and the members include Yu Dong, Ma Hongying, Mao Amin, Niu Zhanbin, Wang Yungui, Wang Yu, Wang Wei, Xu Rongmao, Liu Fuhua, Chen Kaige, Chen Hong, Zhang Dawei, Wu Jianhua, Luo Yinyu, Happy Mountain, Xie Zhichun, Xie Zhiqiu, Xie Zizheng, Yan Maokun, etc.

He was 61 years old and had a net worth of 26 billion

Founded a trillion financial empire

Public information shows that Xie Zhikun, born in 1961, was from Wuying District, Yichun City, Heilongjiang Province. Before 1991, Xie Zhikun was a worker in a printing plant in Wuying District.

In 1995, the core Zhongzhi Enterprise Group Company of Zhongzhi Department was established, and the 34-year-old Jie Zhikun served as the chairman of the board. During this period, the company’s main business scope was timber and semi-finished wooden products.

Since 1997, Zhongzhi Group has begun to dabble in papermaking,Real estate development, Industrial investment, mining investment and other fields.

It is because of finance that really made the Zhongzhi system widely noticed by the people across the country. In 2002, with the ownership of Zhongrong Trust, the Zhongzhi Department gradually penetrated into the financial field by relying on the former, completing the transformation from an industrial to a “full license” financial holding empire.

In 2009, Zhongrong Trust seized the 4 trillion investment opportunity at that time and quickly grabbed the market through large-scale expansion. As of the end of 2009, the scale of Zhongrong Trust’s trust asset management exceeded RMB 100 billion for the first time.

In 2010, the first largestshareholderThe identity of the company was transferred to a central enterprise, and Zhongrong Trust gained a background in state-owned assets. At the same time, the actual controller of Zhongrong Trust is considered to be Zhongzhi. With Zhongrong Trust as the hub and capital platform, Zhongzhi Department participates in the capital operation of a number of listed companies and obtains equity. Xie Zhikun hides himself behind the scenes through the holding of relatives and friends and the complicated shareholding structure.

According to the official website of the Hurun Report, Jie Zhikun will be ranked 241st on the Hurun Report with a net worth of 26 billion in 2021.

In 2021, Xie Zhikun ranked 26th in the “2021 Forbes China Charity List” with a total cash donation of 180 million yuan.

Xie Zhikun, who has always been secretive and low-key, hardly accepts media interviews. “Being a low-key person and doing things high-key” is the industry’s evaluation of him.

In the eyes of his employees, Jie Zhikun is a cautious person. Although worth more than tens of billions, he still often eats fast food when traveling on business.He has always been passionate about philanthropy, especiallyeducateIn 2016, he was rated as one of the top ten public welfare celebrities in China.

The husband of the famous singer Mao Amin, the brother of the former general manager of the Central Huijin Company, a capital crocodile, a rich man on the Hurun list, a philanthropist… For a long time, the founder of the Zhongzhi Department, Xie Zhikun, has been labeled one after another.

For these labels, Jie Zhikun has never admitted, but never denied it. However, as the soul of the Chinese plant system, as the risks of the Chinese plant system are gradually exposed around 2019, Jie Zhikun, who once planned to retire, returns to the forefront and leads the Chinese plant system to resolve the risks.

Actual control of 9 listed companies

Zhongzhi Group has financial investment,M&AFour major business segments, wealth management, and new finance. The core financial platform includes Zhongrong Trust; the four major wealth companies-Hengtian Wealth, Xinhu Wealth, Datang Wealth, and Gaosheng Wealth, among which the scale of Hengtian Wealth has exceeded one trillion .

According to Tianyan Check, Jie Zhikun holds a total of 45.1562% of Hengtian Wealth Investment Management Co., Ltd., 48.8738% of Xinhu Wealth Investment Management Co., Ltd., 85% of Datang Wealth Investment Management Co., Ltd., and Gaosheng Wealth Holding Group 90% of the shares in the limited company.

In addition, Zhongzhi Group has tens of billions of public offeringsfund—— Zhongrong Fund, and hundreds of private equity. Xie Zhikun holds a total of 43.8189% of the equity of Zhongrong Fund Management Co., Ltd.

In addition, Xie Zhikun also relies on Situo Ronghui, Zhongxin Rongchuang, Zhongzhi Rongyun and other vests to make frequent moves in the capital market.

However, since 2019, the ecology of the capital market has changed. Zhongzhi often gains control of listed companies in “helplessness”.Kane shares、Kangsheng sharesThe actual controller.

According to incomplete statistics, Shou Tuo Ronghui and its controlling shareholder Xie Zhikun have 19 listed companies holding more than 5% of the shares, of which 9 are actually controlled (excluding Zhongzhi International). Specifically,Mei Jim(Shareholding ratio 30.02%),Yushun Electronics(Holding 29.19% of the shares and owning 32% of the voting rights), Huaiyou Stock (holding 30% of the shares),Merya(20.39% shareholding ratio),CICC Technology Services(Hong Kong stocks, 68.41% shareholding ratio),Kangsheng shares(Ownership ratio 27.63%),Rongyu Group(Shareholding ratio of 25.6%, with 23.81% of the voting rights),Kane shares(Holds 17.59% of shares and owns 25% of voting rights),*ST Baode(Holds 10% of the shares and owns 28.17% of the voting rights).

However, today, most of the 9 listed companies actually controlled by Zhongzhi are on the verge of delisting, and most of them are fighting for their shells.

In 2020, the non-deduction of the above 9 companiesNet profitThe total is 1.035 billion yuan, of which, in addition toKane sharesandCICC Technology ServicesExcept for profits, the remaining 7 companies all suffered losses. In the first three quarters of this year, there were still 4 companies deducting non-net profits as losses, and the total deduction of non-net profits of 9 companies was only 23 million yuan.

Although Kane is the only company among the 9 listed companies actually controlled by Zhongzhi that does not belong to the ranks of shell companies, the company’s equity held by its controlling shareholder, Kane Group, is all in a state of judicial freeze.

Recently, the Zhongzhi system, which has always been good at long sleeves in the capital market, has broken down one after another, and all three listed companies have declared their capital operation failures.

On November 2, Baode shares, which has been engaged in major asset acquisitions for nearly a year, announced that it intends to terminate major assets.ReorganizationThe reason is that the major asset reorganization has taken a long time and the market environment has undergone major changes from the beginning of the reorganization plan.

November 3,Yushun ElectronicsThe reorganization of Qianhai Shouke, which has been busy for more than half a year, was rejected by the China Securities Regulatory Commission.

In April of this year, Cain shares signed with Wang Bailang and the holding subsidiary Cainte PaperEquity transferAccording to the agreement, it is proposed to transfer the assets and liabilities related to the industrial supporting paper to the wholly-owned subsidiary Kain New Material, and to transfer the 47.2% equity of Kainte Paper to Wang Bailang, and at the same time to transfer the 60% of Kain New Material held. % Equity and other related subsidiary equity are transferred to Caiente Paper. After this transfer of assets, the listed company will complete the divestiture of the industrial paper business.

Wang Bailang is the founder and former actual controller of Kane shares, but on the evening of October 21 this year, Kane sharesannouncementSaid that they could not get in touch with Wang Bailang, and the operation failed.

Previously, Cain shares had carried out capital operations in 2016 and 2017, and they all ended in failure.

Currently,Rongyu GroupThe reorganization of assets is still in progress. But with the departure of Zhikun Xie, the soul of the Zhongzhi department, where will these companies go, waiting for the market’s results.

In the end, I still wish the deceased to rest in peace, and good people live in peace.

(Source: China Fund News)

.