Zhang Yaoxi: The risk of a short-term pullback in gold has increased, but the long-term outlook is still bullish

Last trading day on Wednesday (December 28): International gold/London gold continued to fall on Tuesday, showing lower strength and closing in the negative, but remained stable above the track in the daily chart, and continued to rebound near the support, and the overall trend remained volatile Climbing mode, but if it falls below the middle track, there will be a retracement force of about 60 US dollars.

In terms of specific trends, since the Asian market opened at 1813.72 US dollars per ounce, the price of gold first recorded an intraday high of 1814.40 US dollars, and then continued to fall back overnight and fluctuated within a narrow range. Below the low point, it remained a roller coaster ride around US$10-12, and recorded an intraday low of US$1,796.83 in the U.S. trading session, and finally bottomed out, and once again encountered obstacles to maintain shocks and reduce operations, closing at US$1,804.09, daily The amplitude was 17.57 US dollars, and it closed down 9.63 US dollars, a decrease of 0.53%.

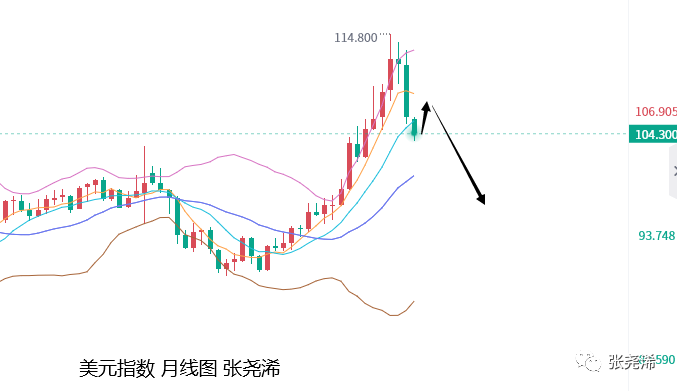

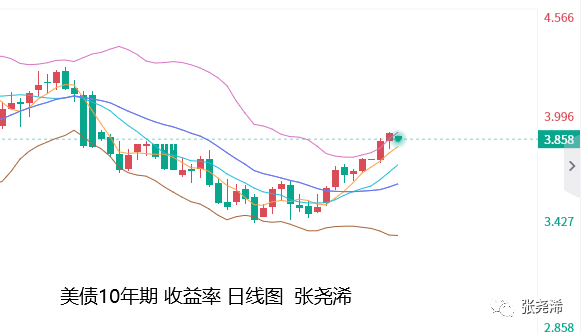

In terms of impact, the U.S. dollar index and U.S. bond yields fell first and then rose, bottomed out and closed positive, which did not produce a significant boost to the gold price first. The gold price continued to fall overnight and weakened. The subsequent bottoming out of the U.S. dollar caused a certain However, the U.S. stock market fell sharply again, and the gold price was technically supported, and finally recovered and closed.

Other precious metals also fell: Spot silver closed down 2.06% at $23.535/oz; spot platinum closed down 1.27% at $1008.68/oz; spot palladium closed down 2.52% at $1785.75/oz.

Looking forward to today’s Thursday (December 29): International gold continued its overnight recovery at the opening and showed strength first. The U.S. dollar index and U.S. bond yields opened lower first, which supported it. Also increased its buying demand. On the whole, before the gold price falls below the support of the middle rail, it will still maintain a volatile and rising trend. However, technical indicators still suggest that there is a large demand for a pullback. Therefore, the recent rising support line, the middle rail support, is still a position that needs to be paid attention to and can also be used as a short-term bullish stop loss point.

The day will focus on the European Central Bank’s economic communiqué. And the number of people applying for unemployment benefits in the United States until December 24th (10,000 people). The former expects the economy to improve, which will put pressure on the US dollar and support the strengthening of gold prices. The latter expects the number of unemployment benefits to rise, which will once again support gold prices. The focus is still on the line closing situation this week.

Fundamentally, this week’s trend has fallen back significantly after rising, but it still maintains a rebound momentum and remains above $1,800. This suggests that the recent uptrend remains intact. However, if the gold price closes below this level, there will be a large demand for a callback.

Now that the market momentum has weakened, it is expected that there will no longer be a sharp technical rebound. As long as there is no obvious inverted pattern this week, the market outlook will maintain the expectation of strength. After that, it can climb stronger again.

If there is no dovish turn in the Fed’s subsequent remarks, or some favorable economic data, gold prices may come out of the correction at the beginning of the new year.

But in the long run, although the Fed is still increasing the peak rate hike and prolonging the rate hike cycle, its strength has begun to weaken, and the pressure on gold prices has also diminished. At the same time, the market also has the possibility of ending the rate hike It is expected to support the price of gold;

Now, because China’s cancellation of border epidemic prevention and control measures will boost demand for industrial metals, it will also strengthen consumer demand for gold, which will also benefit gold prices.

Looking ahead, for most of 2022, gold prices will weaken due to aggressive monetary policy tightening, rising real yields and a stronger dollar. But gold rose nearly $200 after falling to more than two-year lows in late September as the Fed shifted to policy-calibration mode, amid expectations the central bank would slow rate hikes and reduce the dollar’s appeal. The trend has reversed and the recovery in gold prices is likely to continue.

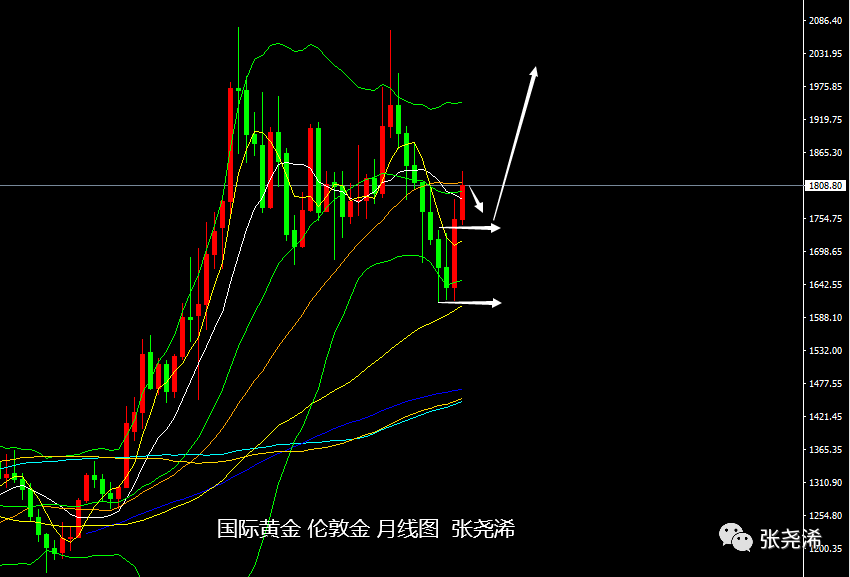

Personally, not only continue to be optimistic about the performance of gold prices in 2023, but also from the perspective of the annual trend, the overall trend is still in the bull market trend that started in 2001. In terms of strength, an optimistic attitude can be maintained in the next 10 years. repeatedly said.

It is worth noting that in this trend, from 2011 to 2015, we experienced a considerable correction and bottomed out. Now it has started to adjust again from 2020. Therefore, the next two years may maintain a wide range of shocks, and the real ups and downs may start in 2025. It is difficult to refresh the low point, so in this operation, you must either deal with shocks, or wait for the market to continue to climb and strengthen. Even if the low point is accidentally refreshed, you can quickly enter the market and wait for a long-term rise. On the upside, as long as the double-top resistance of the past two years is broken, the market outlook will become a new floor support, which will start a long-term bull market climb again.

Technically: at the monthly chart level, the price of gold rebounded this month. It has repeatedly encountered resistance above the 30-month moving average and then retreated below it again. It is still difficult to stand above this resistance. At present, the monthly chart is about to close. If it will close below this resistance, then in early January next year, there will be a wave of retracement first; however, given the strong bullish momentum of the attached indicators, the rebound is also higher than the September-October high. Reversal, even if there is a fall at the beginning of next year, it will touch the support of the moving average in October or May, which can continue to be bullish, and wait for the double-top pressure to be touched again. If the double-top is broken, a further bull market will occur.

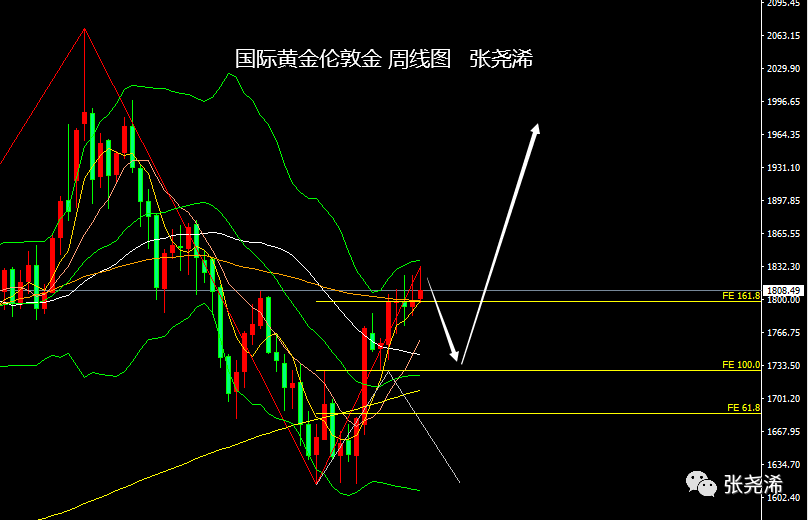

Weekly level: The price of gold is currently rising and falling, maintaining an inverted vertical line. If the line closes this week and cannot weaken its inverted pattern, the market outlook will face a greater demand for a callback. Fork expectations are significantly reduced, and the market outlook will have a higher probability of opening up again. Therefore, even if the market is out of the correction, it is expected to start rising again near the support of the lower middle rail or the support of the 200-week moving average. However, if this week’s closing line is above the high point of the previous two weeks, the market outlook’s drop is expected to be extended.

Daily line level: The overall trend of gold price this month remains above the support of the middle rail and maintains a trend of oscillating and rising. Although there has been a significant fall, it still has not fallen below the support of the middle rail. However, the overall trend of the indicators MACD and KDJ in the attached picture is trending downward This has a certain deviation from the trend, so there is a certain greater risk of a callback in the future market. However, before falling below the middle rail, it is still treated as a shock and climb, and if it falls below the middle rail support, the bottom will focus on the 30-day moving average or the lower rail support for another bullish rebound.

Intraday preliminary point reference:

International Gold: Focus on support around $1805 and $1801 below; focus on resistance around $1812 and $1819 above;

Spot silver: Focus on resistance at $23.70 and $24.00 at the top; support at $23.37 and $23.20 at the bottom;

Note:

Gold TD=(international gold price x exchange rate)/31.1035

International gold fluctuates by 1 US dollar, and gold TD fluctuates by about 0.22 yuan (in theory).

U.S. futures gold price = London spot price × (1 + gold swap rate × futures expiration days / 365)

Predict boldly, trade cautiously. The above viewpoints and analysis only represent the author’s personal thinking, and are for reference only, not as a basis for trading. your money your decision.

A must-have book for the basic skills of gold investment: “Playing and Earning Gold Investment Trading”