(Source = NH Investment & Securities 100 Years Old Research Institute)

The importance of retirement pensions is growing as public pensions are projected to run out faster than expected due to low birth rates and population aging. The default option (pre-designated management system) will be mandatory from July in order to raise the rate of return on retirement pensions, which have been neglected amidst the indifference of subscribers. Experts advise that retirement pensions should carefully examine the types and investment targets so that they can properly function as a guarantee for old-age income.

(Source = NH Investment & Securities 100 Years Old Research Institute)

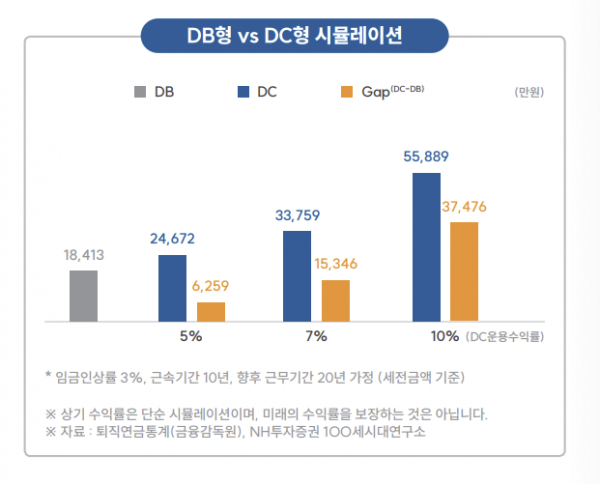

Retirement pensions are divided into defined benefit (DB) and defined contribution (DC) plans.

The DB type is a system in which the company manages the reserve fund, but receives a fixed retirement benefit when the employee retires regardless of the management result. If the investment propensity is stable or if the rate of increase in wages until retirement is higher than the rate of return on investment, the DB type is advantageous.

In the DC type, the employee manages the reserve fund, and the amount of pension after retirement is determined according to the performance. If you are facing a wage peak, the DC type is advantageous. As wages are cut, the principal of retirement pension is likely to be reduced. Workers who are interested in financial technology can also choose the DC type. However, the investment limit is set according to the purpose of ‘guaranteeing old age’. Risky assets can only be invested up to 70%, and leverage and inverse exchange-traded funds (ETFs) and convertible bonds cannot be invested.

There is also an Individual Retirement Pension Account (IRP) that all workers and self-employed people with income can join. The IRP account can deposit up to 18 million won a year, including pension savings and additional DC-type payments, and receives various tax benefits such as tax credits and tax deferrals.

Among them, DC type and IRP subscribers must choose the default option product by July 11th. Product types include principal and interest guaranteed products such as time deposits and interest rate guarantee insurance (GIC), target date funds (TDF), balanced funds (BF), stable value funds (SVF), and real estate and infrastructure funds. A product portfolio can consist of up to three items.

(Source = NH Investment & Securities 100 Years Old Research Institute)

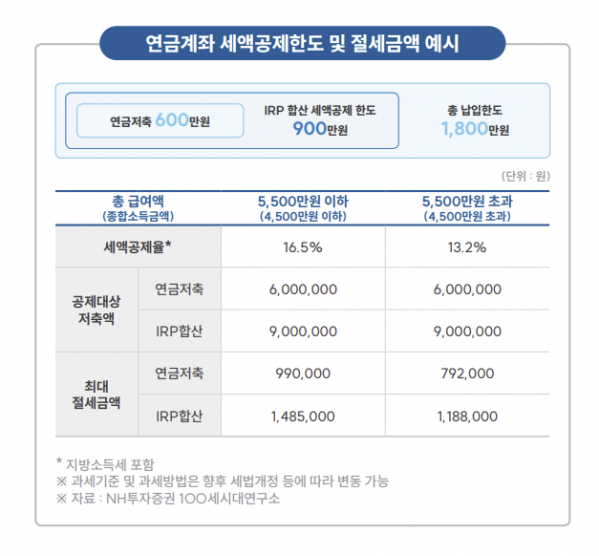

You should also be aware of the pension tax benefits that change from this year.

First of all, the total amount of contributions to a pension account (pension savings/IRP) can be up to 18 million won per year, and as the pension savings payment limit is increased from 4 million won to 6 million won, a maximum of 9 million won per year is added by adding 3 million won for retirement pension such as IRP. tax deductible up to The standard for applying the tax credit rate (16.5%) has also been raised from 40 million won to 45 million won in comprehensive income.

The method of taxation when receiving an annuity has also changed. Previously, if the amount of pension received was 12 million won or more, the entire amount was unconditionally comprehensively taxed. However, starting this year, even when receiving a pension of more than 12 million won, you can choose between comprehensive taxation (6.6-49.5%) and separate taxation (16.5%).

The retirement income tax burden has also been reduced. For those with less than 5 years of service, the amount increased from 300,000 won to 1 million won per year of service, and from 1.2 million won to 2 million won for those with more than 20 years of service.

The NH Investment & Securities 100-Year-Old Age Research Institute cited △long-term investment △distributed investment △periodic inspection as the three principles of retirement pension investment.

Retirement pensions are suitable for long-term investments because they are generally managed for 10 years or more. In fact, if you invest in the domestic stock market (KOSPI) and the US stock market (Dow Jones) for 10 years, the rate of return is 52.2% and 180.76%, respectively.

You can also aim for the ‘compound interest effect’, in which the difference in returns widens over time. Assuming that workers A and B, who save 5 million won each year, record an average annual rate of return of 2% and 7%, respectively, 30 years later, the difference in retirement pension between the two is more than doubled.

However, long-term investment and ‘neglect’ are different things. Portfolio readjustment (rebalancing) is necessary through periodic inspection. According to market conditions, it is possible to flexibly adjust the proportion of risky assets and safe assets to get closer to the target rate of return.

Diversification to reduce volatility is also key. It is to invest evenly in multiple assets and countries such as stocks, bonds, and real estate. There is also a way to increase the rate of return by dividing the purchase price by spreading the investment timing.

Han Se-yeon, senior researcher at the 100-Year-Old Age Research Center at NH Investment & Securities, said, “If you do not have enough investment experience or do not have enough time to pay attention to pension assets, you can use TDF, which automatically adjusts the proportion of risky assets according to the life cycle, to more easily achieve the asset allocation effect. “If you want to enjoy the active diversification effect, it is good to use index funds such as ETFs,” he said.