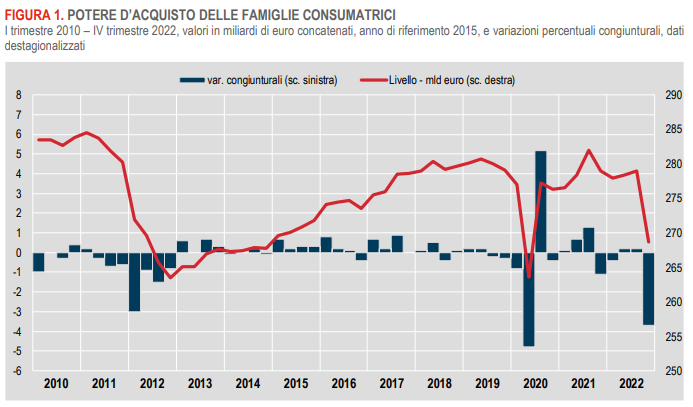

Cala the purchasing power from the familiesincreases the profit share from the companies. In recent weeks also the Bce came to the conclusion that last year to push theinflation it was mainly corporate profits made by increasing i prices. And give it State on the last quarter of 2022 they confirm. Between October and December the income it grew slightly (+0.8%), but by far too little to keep up with the increases in all goods. The “particularly strong” growth in consumer prices – it reads – “has led to a significant decrease in the purchasing power (-3,7%)“. Businesses, on the other hand, have celebrated: the profit share of non-financial companies in the same quarter was 44.8%, +1.9% on the previous one e +3% on the fourth quarter of 2021. Gross operating income soared 7.8%. Despite this, gross fixed investment increased by only 1.7%, with a decrease of 0.4 percentage points in the investment rate, which stood at 24.4%. THE graphs below, which show (red line) the trend of purchasing power on the left and that of the profit share on the right, are eloquent.

In the same period “the estate of the final consumption expenditure (+3% in nominal terms) was accompanied by a marked decrease in the interest rate savings“, dropped by 2 points to 5.3%, warns Istat. And the impact was already seen in the first months of 2023: in February, after the year-on-year decline in January, a first also cyclical decline for retail sales: -0.1% in value and -0.9% in volume. With a decrease in food sales of 0.3% in value and 1.8% in volumewhile those of non-food goods recorded a slight increase in value (+0.1%) and a decrease in volume (-0.3%).

“Inflationas we have denounced for years, has eroded the purchasing power of families. A knot that will soon come home to roost in the form of a fall in consumption“. “Italians hungry for high prices”, according to Dona. “On a trend basis, the gap between food data in value and in volume becomes even abysmal, from +7.9 to -4.9%, a gap of 12.8 percentage points, practically a precipice”. According to the association study, the food sales by volume plummet not only on February 2022, but also on February 2021 (-6.5%), in February 2020 (-11.7%) or 2019 (-4.4%). “In short, the Italians have never tightened their belts so much and are on a forced diet”.

For Dona, what happens is that “Italians eat away at their savings in a vain attempt to maintain their standard of living, but the loss of purchasing power, high bills and the skyrocketing cost of living will have repercussions on the growth of our economy”. Even if we manage to escape the recession – concludes the consumers’ association – it will grow by the usual zero point. This is why it is urgent that the government revise the decree on billsrestoring all the help introduced by Draghi at least until the prices of electricity and gas they will not return to the pre-crisis levels of 2020. Structural measures are also needed, such as the scala mobile to programmed inflation, which allow for adjust salaries at the cost of living”.

As for the other indicators, Istat notes that in the fourth quarter of 2022 the deficit/GDP ratio it worsened by 0.7 percentage points. The general government net debt to GDP ratio was -5.6% (it was -4.9% in the same quarter of 2021). Instead, it improves by 0.5 percentage points primary balance (Meaning what the debt net of interests passive), this was negative, with an impact on GDP of -0.7% (-1.2% in the fourth quarter of 2021). The current balance was positive, with an incidence on GDP of 1.3% (3.2% in the fourth quarter of 2021). The tax burden was equal to 50.5%, a reduction of 1 percentage point compared to the same period of the previous year.