The Russian invasion of Ukraine began a year ago just at a time when the world economy was recovering after two years of the pandemic, after the restrictions and after the serious economic crisis that followed. 2022 should have been the year of restart after the pandemic and in part it was. But with the start of the war in Ukraine many things have changed, and the European and world economy have suffered new blows: sanctions, energy and food crises, inflation were just some of the consequences of the war on the economy.

The role of sanctions

The sanctions that the West has imposed on Russia are many. They serve to hit the Russian economy from various fronts and fall into roughly four categories: individual sanctions against members of the Russian elite and government, sanctions that have reduced the movement of people and goods to and from Russia, sanctions financial, such as those that have blocked Russian reserves deposited abroad, and trade sanctions, such as those that prohibit the export to Russia of certain products, such as luxury goods or high-tech goods, and the import of energy goods from Russia. According to the institute Castellum.Ai – an association that monitors economic crimes and financial frauds – since the beginning of the war more than 11,000 sanctions have been imposed on Russia by the G7 countries, Switzerland and Australia. Including those imposed after the occupation of Crimea in 2014, Russia is the most sanctioned country in the world and alone suffers more sanctions than those imposed on the rest of the countries combined.

Despite the sanctions, according to the new estimates of the International Monetary Fund, Russia’s Gross Domestic Product (GDP) in 2023 could grow by 0.3 percent, against the October forecasts which saw it fall by 2.3 percent precisely as a result of the sanctions. According to the IMF, Russia’s economy is buoyed by oil exports, which continue to bring it substantial gains, and by the fact that it is circumventing trade sanctions. Many investigations – such as some of the New York Times – have effectively shown that Russia has managed to circumvent the sanctions over time, also thanks to the complicity of some countries, such as China, India and Turkey. This does not mean that the sanctions are useless: in 2022, however, Russia’s GDP contracted by 2.2 percent. Not as much as expected, but the sanctions take time to produce effects, especially the more effective ones, such as the ban on the export of strategic technology.

– Read also: Russia has become adept at circumventing sanctions

The end of energy dependence on Russia, at a cost

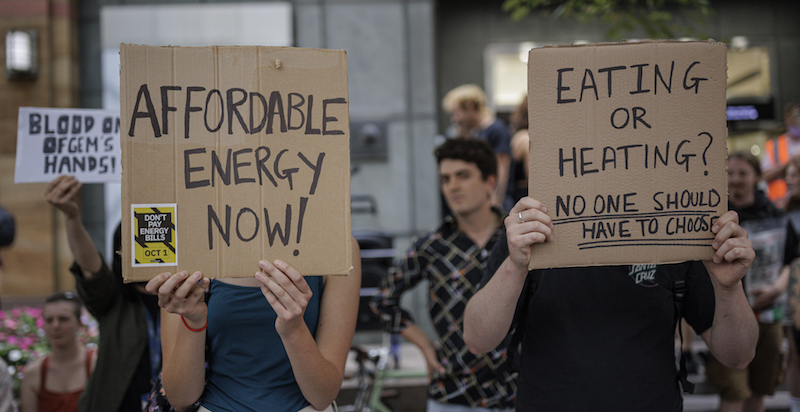

The very important role played by Russia as a gas exporting country has put many countries in serious difficulty, especially members of the European Union, which were heavily dependent on Russian raw materials. From the autumn of 2021 and with the start of the war in Ukraine, the price of gas had increased significantly due to the fear that Russia would stop supplying it in response to the sanctions: prices had reached their all-time highs last August, exceeding 300 euros per megawatt hour (in normal times it’s around 20 euros).

Today the price has dropped considerably compared to the moments of maximum gravity of the crisis, because there is no longer any fear of running out of gas. In this year the European Union has worked hard to limit dependence on Russian gas. Although European countries still import it, Russia is now a residual supplier: before the war it supplied the European Union with 40 percent of its gas imports, while today it is limited to 7.5 percent. Russian gas has been replaced by strengthening the agreements with Norway and Algeria, and also by importing more of that in liquid form which arrives by sea from the United States and other countries.

Today we can say that all in all this winter went well because there was never a shortage of gas and there was no forced rationing. However, the economic and social cost has been very high: in Italy it is estimated that in 2022 families spent over 60 percent more than in 2021 on gas bills and more than double on energy bills.electric energy; companies reduced their production and effectively rationed gas, because it had become too expensive to produce with such high energy prices.

Even for Russian oil, the European Union needed time to get organized in order to stop importing it. The European Union, as in the case of gas, needed time to find alternative suppliers and the embargo on Russian oil finally entered into force on 5 December: today no more than 600 thousand barrels are imported per day, a quarter of before the war. From February 5, the ban on the import of petroleum products from Russia, such as diesel, was also triggered.

The big energy companies had one of the best years ever

Huge energy price hikes have brought big profits in 2022 to energy companies and Russia itself. The latter more than compensated for the drop in exports to the West: in 2022 oil and gas still guaranteed Russia over a third of state revenues, around 9 trillion rubles (112 billion euros), almost a third more than in 2021.

Furthermore, the large Western multinational oil companies have earned much more than in the past, because their costs (for extraction, refining, sale) have remained in fact the same, while the price of oil has risen considerably. Throughout the supply chain, from extraction to sale at the gas pump, companies have achieved exceptionally high returns. According to the calculations of Reutersthe profits of the largest Western energy companies (Shell, BP, TotalEnergies, Chevron, ExxonMobil) reached $200 billion in 2022, more than double the previous year.

– Read also: The outstanding profits of oil companies

The food crisis

The price increases have not only involved energy goods and last year the prices of many things increased, especially those of food. Only a few weeks after the start of the war, the price of soft wheat had increased by more than 30 percent and that of maize by 41 percent. And over the months the increases have become increasingly consistent. The blockade of the ports of Odessa and others on the Black Sea had caused a sudden shortage of grain on global markets, which sent prices soaring sharply. However, the situation stabilized a few months after the start of the war, thanks also to the fact that after months of negotiations Russia decided to guarantee cereal exports from Ukraine.

The price of food increased in a generalized way after the beginning of the war because it discounted the significant increases in energy, which is used for the production and also for the transport of the food itself (as in the case of milk and sugar). One year after the start of the war, however, food prices are back to more or less the same as before: in January, the FAO food price index – which measures the average price of food worldwide on a monthly basis – was equal to 131.2, close to the values of January 2022, when it was 135.6.

Inflation has returned after decades, not just because of the war

The war in Ukraine has intensified a trend that had already been underway since mid-2021, namely that of a generalized increase in prices. We have therefore returned to hearing about inflation, which is the parameter that measures the price increases of a set of products and services representative of the average cost of living.

The inflation observed in recent months has had mixed origins: on the one hand, the prices of many goods have increased due to the global trade crisis generated by the pandemic, which, for example, made many raw materials unobtainable and therefore more expensive (such as chips ). Then there was an increase in demand caused in part by subsidies granted by governments during the pandemic. To this we must add the substantial increases in energy prices, which have made production and transport more expensive, which has led companies to pass these increases onto the final prices.

To avoid or limit this type of distortion, central banks – such as the European Central Bank and the US Federal Reserve – adopt policies trying to normalize the economy and slow down the rise in inflation. The instrument traditionally used is the increase in the reference interest rates.

– Read also: What is inflation, explained