News from the Financial Associated Press on December 1 (edited by Xia Junxiong)On Thursday (December 1), local time, the U.S. Department of Commerce’s Bureau of Economic Analysis released its personal income and expenditure report for October. U.S. consumer spending rose solidly in October, helped by moderating inflation.

The data show that personal expenditures in the United States rose by 0.8% month-on-month in October, in line with expectations, and the previous value was 0.6%. slow down.

As the Fed’s favorite inflation indicator, the U.S. October core PCE price index (excluding food and energy factors) rose 0.2% month-on-month and 5% year-on-year, lower than the expected 0.3% and 5.1% respectively, and the previous value was 0.5% respectively and 5.1%.

It should be noted that since 2000, the Federal Reserve has used personal consumption expenditures (PCE) as the main basis for judging inflation. Compared with the consumer price index (CPI), PCE can better reflect consumer behavior.

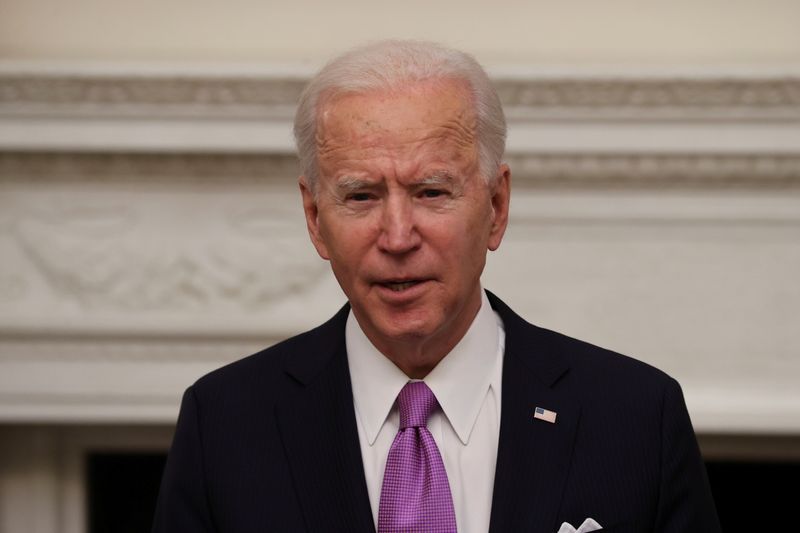

After the release of the October PCE data, U.S. President Joe Biden said initial signs were that the Fed had made progress in fighting inflation, but it would still take time to return to normal inflation levels.

Ryan Sweet, chief U.S. economist at Oxford Economics, commented: “U.S. households are entering the holiday season in pretty good shape. Overall, this will be another solid holiday shopping season with low unemployment and wage growth. Still solid.”

Consumer spending in October was boosted by wage gains from a strong labor market, a tax rebate in California and cost-of-living adjustments for food stamp recipients, among other factors.

Solid consumer spending, which accounts for more than two-thirds of U.S. economic activity, helped drive U.S. economic growth in the third quarter. Data released on Wednesday showed that the U.S. GDP grew at an annualized rate of 2.9% in the third quarter and 1.9% year-on-year.

However, there are signs that consumer spending may have reached a limit. U.S. household spending grew faster than income in both August and September, suggesting more people are dipping into savings to sustain consumption amid high inflation. The U.S. personal savings rate has fallen in recent months to its lowest level since 2008.

The Fed is in the midst of its fastest rate hike cycle since the 1980s, with the central bank raising rates by a total of 375 basis points this year, taking the federal funds rate from near zero to 3.75%-4.00%, and at the last four rate meetings. The average interest rate hike was 75 basis points.

However, Federal Reserve Chairman Jerome Powell said on Wednesday that the pace of rate hikes will be slowed as soon as December. It was widely read by the market as a signal for a 50 basis point rate hike in December.

Powell also emphasized that the United States is still far from price stability and that a lot more evidence is needed to convince people that inflation is falling.