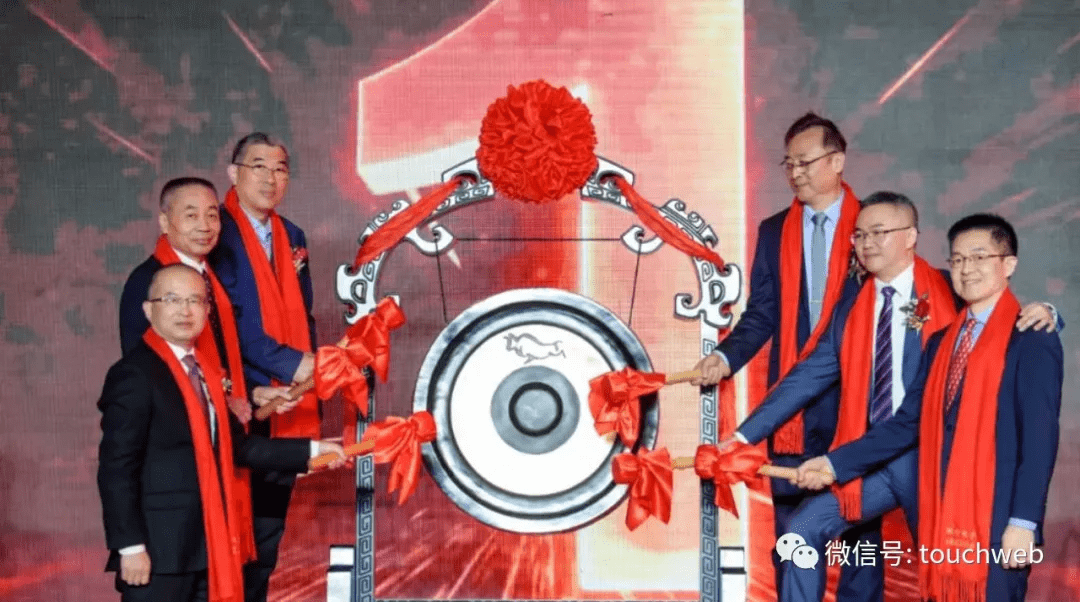

Shanghai Gelun Electronics Co., Ltd. (abbreviated as “Gelun Electronics”, stock code: “688206”) was listed on the Science and Technology Innovation Board today.

The issue price of General Lun Electronics is 28.28 yuan, 43.38 million shares are issued, and the total fund-raising is 1.227 billion yuan.

The opening price of Gailun Electronics was 55 yuan, which was 94.5% higher than the issue price; the closing price was 42.71 yuan, which was 51% higher than the issue price. Based on the closing price, Gailun Electronics had a market value of 18.5 billion yuan.

Gelun Electronics is an EDA company with international market competitiveness, committed to improving the overall technical level and market value of the integrated circuit industry, and providing professional and efficient EDA process and tool support.

The main business of Gelun Electronics is to provide customers with EDA products and solutions that have been widely verified and used by the world‘s leading integrated circuit design and manufacturing companies for a long time. The main products and services include manufacturing EDA tools, design EDA tools, and semiconductor device characteristics. Testing equipment and semiconductor engineering services, etc.

The main customers of General Lun Electronics include TSMC, Samsung Electronics, SK Hynix, Micron Technology, UMC, SMIC and other integrated circuit companies.

In 2019, Gelun Electronics completed the acquisition and integration of Barda Micro; in June 2021, the company once again acquired 100% equity of Entasys, a South Korean EDA company.

According to the prospectus, General Lun Electronics’ 2018, 2019, and 2020 revenues were 51.94 million yuan, 65.486 million yuan, and 137 million yuan respectively; net profits were -7.9 million yuan, -87 billion yuan, and 27.89 million yuan, respectively.

The net profit after deduction of non-profits in 2018, 2019 and 2020 of General Lun Electronics will be -7.9887 million yuan, 2.98 million yuan and 21.325 million yuan respectively.

In the first nine months of 2021, General Electric’s revenue was 125 million yuan, an increase of 43.62% from 86.92 million yuan in the same period of the previous year; net profit was 15.88 million yuan, an increase of 3.38% from 15.36 million yuan in the same period last year.

Gelun Electronics expects its annual revenue of 180 million to 200 million in 2021, a year-on-year increase of 31% to 45%, mainly due to the expansion of the company’s downstream fab customers’ capacity, and the company continues to obtain software and hardware orders;

Gelun Electronics predicts that the net profit attributable to shareholders of the parent company in 2021 will be between 22 million yuan and 26 million yuan, a year-on-year decrease of 10%-24%, mainly due to relatively high non-recurring gains and losses such as government subsidies and wealth management product income in 2020; Net profit deducted from 20 million to 24 million, a year-on-year change of -6% to 13%.

The actual controller is American Intel as a shareholder

Before the IPO, LIU ZHIHONG (刘志宏) was the company’s controlling shareholder and actual controller. LIU ZHIHONG (刘志宏), American nationality, has permanent residency in China. LIU ZHIHONG (刘志宏) directly holds 17.9435% of the shares and serves as the chairman of the board of directors of Gelun Electronics;

LIU ZHIHONG (刘志宏) has signed the “Concert Agreement” with Gongqingcheng Fenglun and KLProTech, which can control the 6.2013% shares of Gailun Electronics held by Gongqingcheng Fenglun and 23.4712% of Gailun Electronics held by KLProTech; LIU ZHIHONG (Liu Zhihong) controls a total of 47.6160% of the shares of Gelun Electronics and is the actual controller of the company.

LIU ZHIHONG (刘志宏) and LI JING (李晶) are husband and wife, and LIU HANYANG (刘瀚洋) is a father-son relationship.

Liu ZHIHONG (刘志宏), LI JING (李晶) and LIU HANYANG (刘汉洋) indirectly hold the shares of Sino-Electronics through Khai Long Cayman LP (the main body holding 100% of KLProTech) are 2.26%, 0.25% and 0.55, respectively %.

In addition, Golden Autumn Investment holds 8.6030%, Gongqingcheng Minglun holds 7.9007%, Gongqingcheng Fenglun holds 6.2013%, Gongqingcheng Weilun holds 5.5496%, and Intel holds 5.4107%. Hengchen Ventures holds 4.1663% of shares, and Boda Investment holds 3.7875%.

After the IPO, KLProTech holds 21.1241%, Liu ZHIHONG directly holds 16.1491%, Jinqiu Investment holds 7.7427%, and Komsomolsk Minglun holds 7.1107%;

Gongqingcheng Fenglun holds 5.5812%, Gongqingcheng Weilun holds 4.9947%, Intel holds 4.8696%, Hengchen Ventures holds 3.7496%, Boda Investment holds 3.4088%, and Jiacheng Investment holdings are 2.4835%.

———————————————

Lei Di was founded by Lei Jianping, a senior media person. If reprinted, please indicate the source.Return to Sohu to see more

.