On March 24, the schedule for the scheduled disclosure of the first quarterly report of the Shanghai Stock Exchange in 2022 was released.Agricultural Seed IndustryTaking the lead, the company expects to disclose its first quarterly report on April 8, 2022.Jinjing Technology、Kangyuan Pharmaceutical、Zijin Mining、Putailai、Kibing GroupThe quarterly report will be disclosed on April 12.

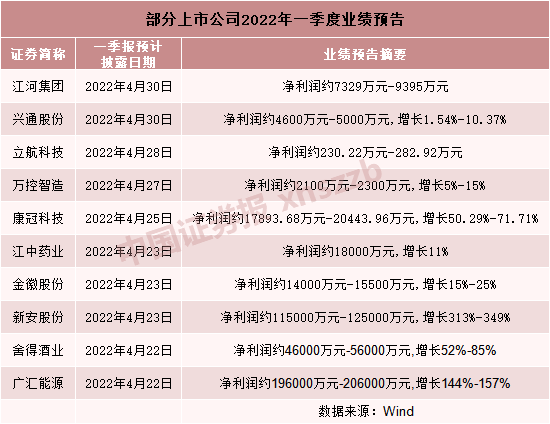

Wind data shows that as of the evening of March 24, a total of 59 A-share listed companies disclosed the first quarter of 2022performanceAccording to the notice, 48 of them are pre-happy, accounting for 81.36%. Among the 48 companies, 17 pre-increased, 4 turned losses, 4 continued profits, and 23 slightly increased. Listed companies that have disclosed performance forecasts have maintained good performance growth as a whole.

48 companies predict good news in the first quarter

According to statistics, 10 of the listed companies that have made an appointment for the disclosure of their first-quarter report have disclosed their first-quarter performance forecast.

From the time of disclosure,Guanghui Energy、Shede Wine IndustryIt plans to disclose the first quarterly report on April 22, becoming the earliest company that plans to disclose the first quarterly report among the listed companies that have disclosed the performance forecast.two companiesnet profithave grown substantially.

in,Guanghui EnergyIt is expected that in the first quarter of 2022, a total of attributable to listed companies will be realizedshareholderIts net profit was 1.96 billion yuan to 2.06 billion yuan, a year-on-year increase of 144% to 157%.

Shede Wine IndustryIt is estimated that in the first quarter of 2022, the net profit attributable to shareholders of listed companies will be 460 million to 560 million yuan, a year-on-year increase of 52% to 85%.

In terms of net profit growth,Xin’an SharesNet profit is expected to increase year-on-year.Xin’an SharesIt is expected that the net profit attributable to shareholders of listed companies in the first quarter of 2022 will be 1.15 billion to 1.25 billion yuan, a year-on-year increase of 313% to 349%. The company plans to disclose its first quarterly report on April 23.

Xin’an SharesannouncementIt is said that the improvement of the market prosperity of major products is the main reason for the pre-increase in performance. During the reporting period, the company’s main products, including glyphosate, silicone, and industrial silicon, were affected by the relationship between supply and demand, continuing the state of continuous prosperity since 2021, and product prices continued to run at high levels.

These industries are booming

From an industry perspective, among the listed companies that have disclosed their performance forecasts, the chemical, pharmaceutical, non-ferrous, petroleum, coal and other industries are more prosperous.

In the chemical industry, with new energy, lithiumBatteryRelevant listed companies have higher net profit growth.

byYahua GroupFor example, the company expects that the net profit attributable to shareholders of listed companies in the first quarter of 2022 is 900 million yuan to 1.2 billion yuan, a year-on-year increase of 1053.67% to 1438.22%. The main reason for the change in performance is that the performance of the company’s civil explosives business has grown steadily; the demand in the lithium industry has continued to rise, and the price of lithium salt products has continued to rise. The company seized the opportunity to release production capacity and increase sales. increase.

In the non-ferrous industry, benefiting from the increase in product sales prices, the performance of related listed companies has been significantly boosted.

Cloud Sea MetalIt is expected that the net profit attributable to shareholders of listed companies in the first quarter of 2022 will be 270 million to 370 million yuan, a year-on-year increase of 419.22% to 625.26%. In the first quarter of 2022, compared with the same period last year, the sales price of products increased, the product structure was optimized, and the grossinterest rateThe performance increased significantly year-on-year.

In contrast, industries such as cement are affected by rising prices of raw materials such as coal, and their first-quarter results may be lower than expected.

(Article source: Chinasecuritiesnewspaper)