(Original title: A-share closing in 2022: the number of listed companies exceeds 5,000! 3 black horse stocks topped the annual gain list, and pharmaceutical and biotech regained the market capitalization champion! The number of delisted stocks hit a record high)

Guide: In 2022, the world will be impacted by multiple uncertain factors such as the inflation cycle, the conflict between Russia and Ukraine, the Fed’s continuous interest rate hikes, and repeated epidemics. The A-share market has also experienced a long round of bottoming. The market index stuck to the 3,000-point mark despite the ups and downs. Driven by favorable policies, the new energy track has become the top stream of A-shares, and a large number of leading companies have taken advantage of the situation to rise.

Securities Times·Databao and Tencent Finance jointly launched the 2022 capital portrait. This article is the first in the series “Market Portrait”, which outlines the new changes in the A-share capital market in eight dimensions.

1. The volatility of A-shares has accelerated, and the education leader of Chinese concept stocks has risen sharply against the market

In 2022, the major stock indexes of A shares will all be in decline. According to the statistics of Securities Times·Databao, the Science and Technology 50 Index ranked first with a cumulative decline of 31.35% during the year, and the ChiNext Index fell by 29.37%. The relative decline of the Shanghai Composite Index was relatively small, with a cumulative decline of 15.13% during the year, but it was the largest decline in the past four years. Compared with 2021, the overall volatility of A shares has intensified. The amplitude of the Shanghai Composite Index has increased by 9.59 percentage points, and the amplitude of the Shenzhen Component Index has increased by 11.65 percentage points.

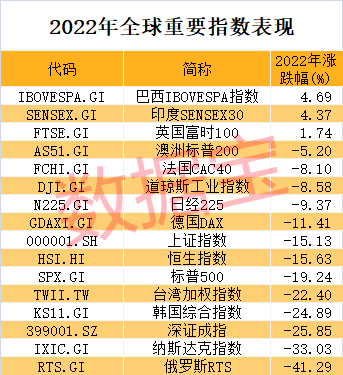

From a global perspective, Russia’s RTS index fell the most, with a year-on-year drop of more than 40%; followed by the Nasdaq index. Brazil’s IBOVESPA index, India’s SENSEX 30 index, and the UK’s FTSE 100 index rose against the trend.

Among the U.S. stocks and Chinese concept stocks, the new energy vehicle giants Xiaopeng Motors, Weilai, and Ideal Automobile will all suffer large declines in 2022; among them, Xiaopeng Motors has fallen by 80.37% for the whole year, and its latest market value is less than 100 billion yuan. Among the Chinese concept stocks with a market value of over 10 billion, TAL, New Oriental, Vipshop, Ctrip, and Pinduoduo recorded considerable gains, among which TAL’s annual increase reached 88.55%.

2. The number of A-share companies exceeded 5,000, and the market value decreased by more than 16 trillion

According to data from Zhongdeng, as of November 2022, the number of investors who have opened A-share accounts has reached 210 million, an increase of 13.98 million or 7.12% from the end of 2021.

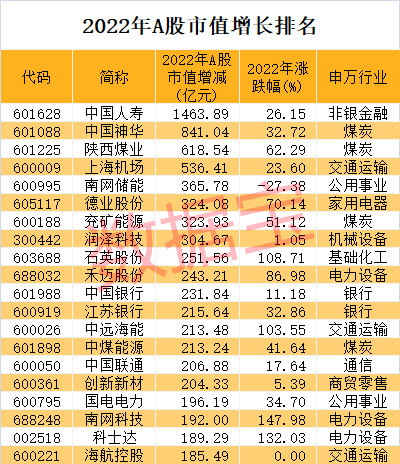

According to the statistics of Databao, the total market value of A-share listed companies reached 78.87 trillion. Excluding companies newly listed in 2022, the total value of the A-share market in 2022 will decrease by more than 16 trillion yuan. The A-share market value of 15 companies decreased by more than 100 billion yuan, and Ningde Times, Kweichow Moutai, and China Merchants Bank ranked the top three in terms of market value reduction. The value of 63 A-share stocks increased by more than 10 billion yuan, among which the market value of China Life Insurance increased most significantly, reaching 146.4 billion yuan within one year.

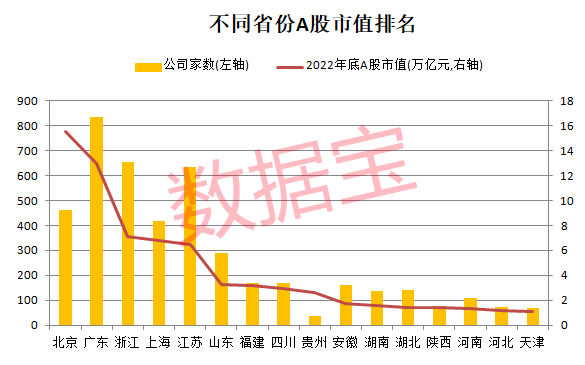

In 2022, the number of A-share listed companies will reach a new level. Up to now, the number of A-share listed companies has exceeded 5,000, and the number of listed companies in 12 provinces exceeds 100. The number of listed companies in Guangdong, Zhejiang, and Jiangsu ranked the top three, with more than 600 companies each.

In terms of market capitalization rankings, the top three A-share market capitalization rankings in Beijing, Guangdong, and Zhejiang remain unchanged. Beijing and Guangdong are still the two provinces and cities with the highest A-share market capitalization, with the latest market capitalization exceeding 10 trillion. At the end of 2022, Chongqing and Yunnan’s A-share market value will withdraw from the trillion-dollar ranks.

3. Bull and bear stocks: 3 black horse stocks win the top three

According to the statistics of Databao, excluding the new stocks listed in 2022, a total of 49 stocks have doubled, which is a significant decrease from 2021. Lvkang Biochemical, Xi’an Food and Beverage, and Baoming Technology ranked the top three in the A-share annual gain list.

Lvkang Biochemical won the championship with a cumulative increase of 381.32% in 2022. The company focuses on the microbial fermentation industry, and its performance has continued to decline in the past few years. In the first three quarters of 2022, its net profit loss was 68 million yuan. At the end of July 2022, the company announced that it plans to purchase 100% equity of Jiangxi Veco New Material Technology Co., Ltd., so as to enter the photovoltaic industry.

More than 200 stocks will fall by more than 50% in 2022, a substantial increase from the previous year. The science and technology innovation board stock *ST Zeda ranked first with a cumulative decline of 89.39%, and its latest market value was less than 500 million yuan. As of December 30, the company has issued six risk warning announcements that stocks may be forced to delist due to major violations of the law.

4. The turnover of A shares has shrunk by more than 10%, and new energy occupies six seats in the T0P10 transaction

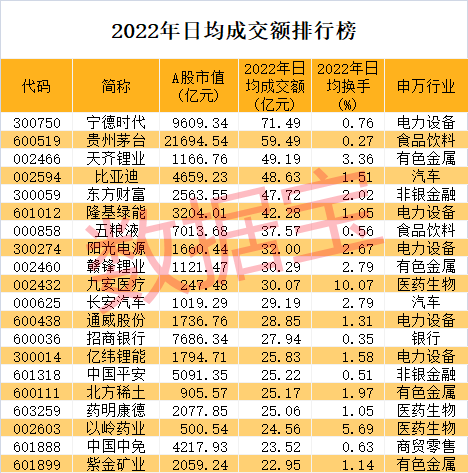

In 2022, the average daily turnover of the A-share market will be 925.2 billion yuan, down 12.6% from 2021. In the whole year of 2022, there will be 79 trading days with turnover exceeding one trillion yuan, accounting for 32.64%, equivalent to half of 2021.

The first, second and third places in average daily turnover were won by Ningde Times, Kweichow Moutai, and Tianqi Lithium respectively. The Ningde era jumped from the fifth place in 2021 to the first place in 2022, and Tianqi Lithium jumped from the seventh place in 2021 to the third place in 2022. Among the top ten, a total of 6 shares are related to the new energy track, 2 shares are related to liquor, 1 share is related to finance, and only 1 share is related to medical treatment.

Jiu’an Medical is the most obvious increase in the average daily turnover among the top ten. The average daily turnover of the stock will reach 3.007 billion yuan in 2022, an increase of 9 times. Due to the strong demand for the company’s iHealth kit products in the US market, the company will achieve a profit of 16.05 billion yuan in the first three quarters of 2022, with both revenue and net profit hitting a record high.

5. Biomedical regains the market capitalization champion of the industry

According to the statistics of Databao, the coal sector will be the best in 2022, with an annual increase of 10.95%, ranking first in the annual industry increase list. Affected by the superposition of the international energy crisis and the epidemic, the supply and demand of coal will be out of balance in 2022, and the price trend of the coal market will remain firm. According to the annual coal market report “Coal 2022” released by the International Energy Agency (IEA), the growth of global coal demand will slow down significantly in 2022, with an increase of only 1.2%, but it still hits a new record of 8.025 billion tons.

Industries such as electronics, construction materials, media, computers, and electrical equipment will see the largest declines in 2022. Among them, the electronics industry suffered the largest decline, with an annual decline of 36.54%.

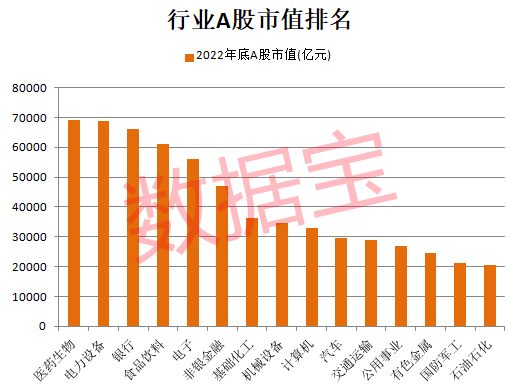

By the end of 2022, the value of the A-share market in the medical and biological, power equipment, banking, food and beverage, and electronics industries will all exceed 5 trillion yuan; the medical and biological industry will overtake the power equipment and regain the industry’s market value champion.

The ranking of the market value of the banking industry has risen by 1, from the fourth place in 2021 to the third place. Excluding the new shares listed in 2022, compared with 2021, the A-share market value of the coal industry has increased by more than 200 billion yuan, which is the industry with the largest market value increase. The value of the A-share market in industries such as food and beverage, pharmaceutical biology, power equipment, and electronics has shrunk by more than one trillion yuan.

6. The number of 100-yuan shares has dropped sharply, and the stock price distribution has a spindle shape

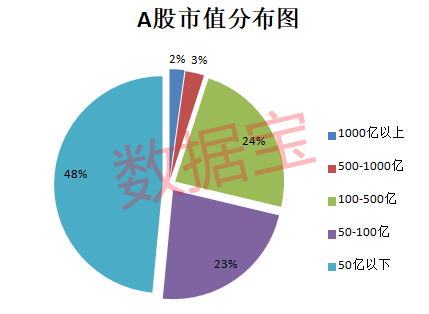

By the end of 2022, the overall distribution of the value of the A-share market will be in a pyramid shape, with more than 3,600 companies with a market value of less than 10 billion, accounting for 71.28%. The number of companies below 5 billion is the largest, accounting for nearly half. There are 111 listed companies with a market value of more than 100 billion yuan, a decrease of 38 compared with the end of 2021.

Members of the “Trillion Club” include Kweichow Moutai and Industrial and Commercial Bank of China; compared with the end of 2021, Ningde Times and China Merchants Bank have withdrawn from the trillion-dollar market value ranks.

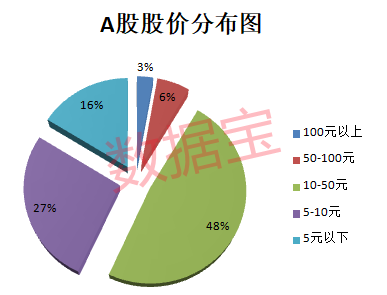

In terms of stock price, 100-yuan stocks have dropped sharply, with only 143 shares remaining at the end of 2022, a decrease of 73 shares compared to 2021. Kweichow Moutai is still the most expensive stock, with the latest stock price of 1,727 yuan/share; the second most expensive stock is Hemai, with the latest stock price of 937.15 yuan/share. Stone Technology, the second most expensive stock in 2021, has dropped out of the top ten. The company’s share price has fallen by more than 50% in the past year.

The stock price distribution of A shares presents a spindle shape, with the largest number in the range of 10 yuan to 50 yuan, with 2450 shares, accounting for 48.35%. Hundred-yuan stocks are the least distributed, accounting for less than 3%. There are a total of 821 stocks below 5 yuan, accounting for 16.2% of the total.

7. The number of delisted stocks hit a record high

In 2022, with the in-depth implementation of the registration system, forced delisting has become a hot word for A shares this year.

According to the statistics of Databao, as of December 30, a total of 46 A-share companies have been delisted and delisted, which is double the figure compared with 2021.

Since the breaking of the A-share situation of “only advancing but not retreating” in 2019, the number of delisted listed companies has increased year after year. From 2019 to 2021, the number of delisted companies will be 10, 16, and 20 respectively.

Judging from the delisting companies in 2022, most of the delistings are due to deteriorating operations, negative net profit in 2021, and operating income of less than 100 million yuan. There are also some delisting companies with difficult annual reports and annual reports issued by accounting firms. Related to non-standard opinions.

8. Institutions are optimistic about economic recovery in 2023

In 2022, the complex and changeable macro environment will have a greater impact on the stock market. A-shares have undergone multiple shocks and adjustments, the industry has rapid rotation, and the market lasts for a short time.

According to statistics from Databao, as of December 30, the price-earnings ratios of the Shanghai Composite Index and the Shanghai-Shenzhen 300 Index were 12.28 times and 11.27 times, respectively, which are around 27% of the quantile point in the past ten years. The GEM refers to a price-earnings ratio of 38.96 times, which is at a low point in ten years.

Recently, a number of institutions issued strategic reports, arguing that A-shares are expected to usher in structural opportunities in 2023. Galaxy Securities said that looking forward to 2023, based on the current low valuation of A-shares and strong economic recovery momentum, the market has upward momentum, but the market may also have twists and turns; affected by the performance restoration of listed companies, the upward momentum of A-shares in the second quarter may be even greater. obvious. On the whole, 2023 is a new year of transformation and a year for the layout of the A-share market.

Guoyuan Securities believes that the dislocation of the economic cycle will continue in 2023, and the domestic and foreign economies will show one left and one right. Under the background of continuous domestic steady growth, optimization of epidemic prevention policies, and stabilization of real estate, it is worth looking forward to stabilization and recovery, and consumption recovery is expected As the biggest bright spot of economic growth, investment is likely to remain an important point of “steady growth” and is expected to maintain a good growth rate.

Everbright Securities pointed out that even though the current market has rebounded, the price of A-share assets is still relatively low, and profit restoration will be the core driving force supporting the market. With the addition of credit restoration and the inflow of micro-funds, there will be a higher certainty that the market will go up sex.