Are you looking for information about Personal Style policy from AXA MPS Financial DAC?

Perhaps you have heard of the unit-linked policies and you want to know more, trying to figure out if it might be convenient to subscribe to one.

In this article we will analyze together the characteristics of AXA MPS Personal Style unit-linked policy, we will see the costs, advantages, disadvantages, and then at the end of the guide you will find mine opinions on the tool.

Enjoy the reading!

This article talks about:

Due parole su AXA MPS Financial

AXA MPS Financial is a life insurance company incorporated under Irish law, and is regulated by the Central Bank of Ireland. It operates on the Italian market under the freedom to provide services, and does so through a capillary network of banks.

The company was born in 1999 in Dublin, and was born as a company specialized in Unit and Index Linked insurance products.

Since January 2014, the company has also become part of the insurance group AXA Italy.

The company has 105 million customers worldwide, and is present in 54 countries; it can also count on the satisfaction of 4 million families in Italy.

Are Unit Linked policies safe?

From what we have been able to see in the short presentation, we note how AXA MPS is a solid and reliable institution, so now there is nothing left to do but understand if we can say the same thing about the product we are about to analyse.

What is one unit-linked policy? A unit-linked policy has no protection on the policyholder’s capital regarding future market performance, i.e. they do not guarantee any minimum return or even the return of capital.

What does this mean? It basically means that you could find yourself losing all or part of your capital, precisely because the policy has a potential risk of this type.

The unit linked policy follows the performance of an underlying financial security, so the money you invest in the product is converted into units of the fund, and subsequently they are invested.

We are in the world of managed savings: this means that it will not be entirely easy to fully understand which instruments the policy invests in, since it has various linked funds with a different risk profile.

You can understand that this is a very complex instrument, and if you decide to invest in this policy, know that you must not underestimate it.

Not sure how to invest?

Find out which investor you are. Are enough 3 minutes to discover the best strategy for you.

>> START NOW! <

Product features

Personal Style is a unit-linked whole-life insurance financial investment contract.

The peculiarity of this product lies in the free choice between internal and external funds, with the possibility of paying accessible and customizable minimum premiums according to one’s needs.

We are dealing with an insurance investment product that can be subscribed to with both a single premium and a recurring premium.

The contract in question is suitable for diversification, and moreover it is able to adapt to any of your needs.

What are the performances?

The policy we are analyzing provides for different benefits, which I am now going to list and which you can also consult in KID with more detail.

The contract includes the following services:

- Benefits in the event of the life of the insured: the services are those connected to the value of the assets contained in the internal funds, held by the insurance company, where the premium invested by the policyholder, net of the applicable costs, is invested in the units of the internal fund;

- Benefits in the event of death: in the event of the insured’s death during the term of the contract, there is the repayment of a variable capital based on the date of death of the insured and his age. The value of the quotas attributed to the contract is defined as follows, and it is different according to the age group:

– 105% if the insured is between 18 and 35 years of age at the date of death;

– 103% if the insured is between 36 and 50 years of age at the date of death;

– 102% if the insured is between 51 and 65 years of age at the date of death;

– 101% if the insured is between 66 and 76 years of age at the date of death;

– 100.1% if the insured is over 77 years of age at the date of death;

- Financial decumulation plan: can be activated at the request of the contractor. This plan allows the policyholder to make scheduled partial redemptions with frequency and amounts chosen by the policyholder at the time of activation;

- Scheduled additional payments plan: with which the policyholder has the possibility to carry out the redirection of the prizes;

- Switch: the policyholder can carry out six transfer operations between internal/external funds per year free of charge.

Payment of premiums

The contract provides for the signing and choice of two methods:

- Single prize: provides for the payment of a minimum amount of 5,000 euros, to be paid in a lump sum upon conclusion of the contract;

- Recurring premium: provides for the payment of regular premiums of variable amount and frequency, of which the first premium paid upon conclusion of the contract, and subsequent ones on a monthly, quarterly, half-yearly or annual basis from the effective date.

Duration

The contract is a whole lifeand therefore coincides with the life of the insured. Furthermore, a suspension from the insurance coverage is not possible.

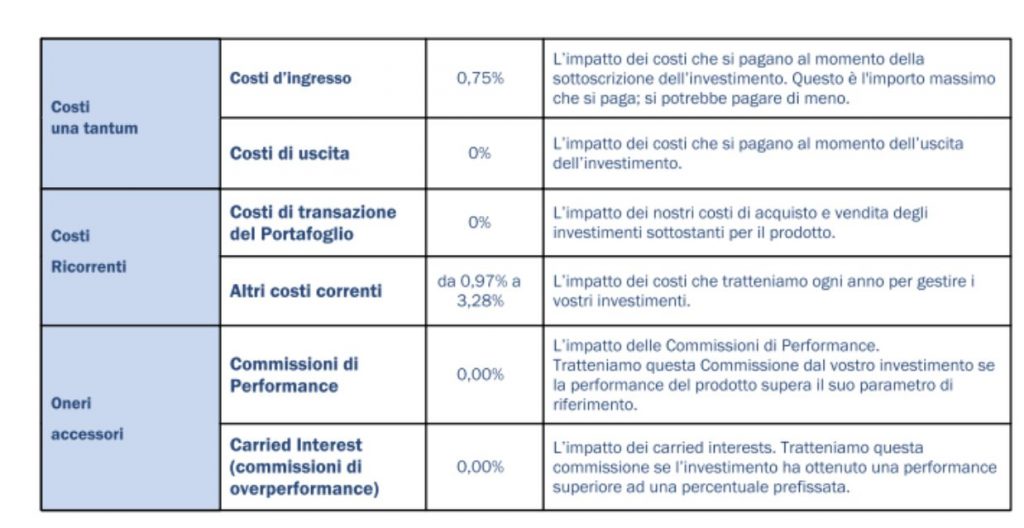

Costs

After carefully looking at the performance part, we can now move on to analyzing the part of the costs.

Costs are an element that should not be underestimated when choosing an investment product, as it is one of the most important parts in a contract. In fact, costs have an impact on investment returns, and sometimes we are unable to fully understand them, as they are explained in a difficult or approximate way.

So let’s see specifically the costs that you will have to face if you decide to subscribe to this policy:

- Issue fees: 25 euros in the single premium mode, 15 euros in the recurring premium mode;

- Loading costs: the contract provides for a loading cost equal to 0.65% of the premiums paid;

- Costs of insurance coverage: the contract provides for a cost for the insurance benefit in the event of death equal to 0.1%;

- Redemption costs: there is a decreasing penalty over time in case of total or partial redemption, according to the date of the request;

- Costs of switches: the first 6 operations are free, while the subsequent ones cost 25 euros;

- Management Fee: from 0.97% to 3.28% depending on the fund in which you invest.

For completeness, I am also attaching the cost tableso that you can get a more detailed overview:

Tax regime

We also dedicate a part of our guide to the fiscal aspectsas they are often used to attract potential customers.

In fact, the sums that are paid by the insurance company, in the event of the death of the insured, are not subject to IRPEF taxation and are also exempt from inheritance tax.

Life insurance premiums are exempt from insurance taxes, while a substitute tax of 26% is applied to income deriving from capital paid to the company.

Not sure how to invest?

Find out which investor you are. Are enough 3 minutes to discover the best strategy for you.

>> START NOW! <

Who is the product for?

This policy is aimed at investors who possess a basic level of knowledge of financial and insurance investments, with a time horizon and a medium risk appetite.

Furthermore, the contractors must be natural or legal persons and must be between 18 and 85 years of age.

Revocation and withdrawal

The proposal can be revokedand in this case the insurance company undertakes to return the premium paid to the policyholder within 30 days of receipt of the notice of revocation.

The policyholder may also withdraw from the contract, provided he does so within 30 days of its conclusion. The withdrawal it must be communicated to the insurance company by registered mail and acknowledgment of receipt.

Redemption and reduction

If at least 30 days have passed since the effective date, then the policyholder can collect the redemption value.

In the case of the total redemptionthe contract is considered concluded with effect from the date of receipt of the request.

There is also the possibility to exercise the partial redemptionto the minimum amount of 1,000 euros, with the same methods envisaged for the total redemption.

In this case, the contract remains in force for the residual amount, provided that the residual value of the units of the selected funds, for the purposes of the partial redemption, is not less than 25 euro, and the residual value of the contract is not less than 1,000 euros.

Axa Personal Style: My Business Opinions

Axa MPS policies are safe? Do they agree? We’ve finished our discussion, so now I can give you mine opinions on the contract.

If you have already read my other content, you may know that I personally don’t really like products like these, as I find them very complex, hybrid, and full of management costs which then impact on the final yields.

For example if you are looking for protection, I suggest you look and evaluate a simple one death policywhich fulfills its protection commitment, which is what an insurance company should do.

If, on the other hand, you are interested in the world of investments and financial instruments, I think there are better solutions to turn to, such as ETFa very useful tool that I think could be right for you, and which, furthermore, being passively managed, is able to greatly lower management costs.

I can’t tell you for sure whether it’s better for you to choose this product, but I can warn you: with managed savings, only the management companies, in this case also the insurance company, make money, and almost never the customer or the investor.

Also I refer you to commissions: paying up to 3% commissions a year could be very penalizing in an investment, as they end up “eating” your return, and consequently making your investment almost useless.

If you are a conscious investor and are able to bear losses, you could also opt for this investment, even if you must know that you risk a lot and above all that you have little guarantee of returns.

In any case, the Institute in question has a very solid history behind it. It is a Group that offers security and professionalism, therefore, if you really think you want to delegate the management of any form of investment to an institution (without having to take care of it yourself because you don’t feel like it), then you will certainly be in good hands.

Before saying goodbye, I want to leave you with these resources that may be useful to you:

Enjoy the reading.

Find out which Investor You are

I have created a short questionnaire to help you understand what kind of investor you are. At the end, I will guide you towards the best contents selected according to your starting situation:

>> Start Now <