Bloomage Bio(688363.SH) March 11announcementin 2021, the company will achieveOperating income4.948 billion yuan, a year-on-year increase of 87.93%; attributable to the parent companyshareholderofnet profitIt was 782 million yuan, an increase of 21.13% year-on-year; the net cash flow from operating activities was 1.276 billion yuan, an increase of 80.79% year-on-year.

The “Economic Information Daily” reporter noted that althoughBloomage BioLast year’s operating income hit a record high, but due to the substantial increase in operating costs and period expenses, the company’s profit growth rate was not as fast as the revenue growth rate.interest rateA year-on-year decrease of 4.11 percentage points, net salesinterest rateIt has declined for three consecutive years, hitting a record low.

Operating income growth hit a record high

Bloomage BioThe main business is the research and development, production and sales of hyaluronic acid and other bioactive material raw materials and end products of biomedical materials; the company’s main products are sodium hyaluronate, sodium hyaluronate, sodium hyaluronate 1% solution, enzyme-cut oligosaccharide polysodium hyaluronate and many other products.

The data shows that in 2021, the year-on-year growth rate of Bloomage Bio’s operating income and revenue will reach a record high.

In terms of products, in 2021, Bloomage Bio’s operating income will mainly come from raw material products, medical terminal products, and functional skin care products. On the whole, the company’s three major categories of products have achieved growth in operating income during the period, especially functional skin care products, which achieved operating income of 3.319 billion yuan during the period, an increase of 146.57% year-on-year. During the reporting period, the company’s total operating cost was 4.166 billion yuan, a year-on-year increase of 116.36% and a record high.

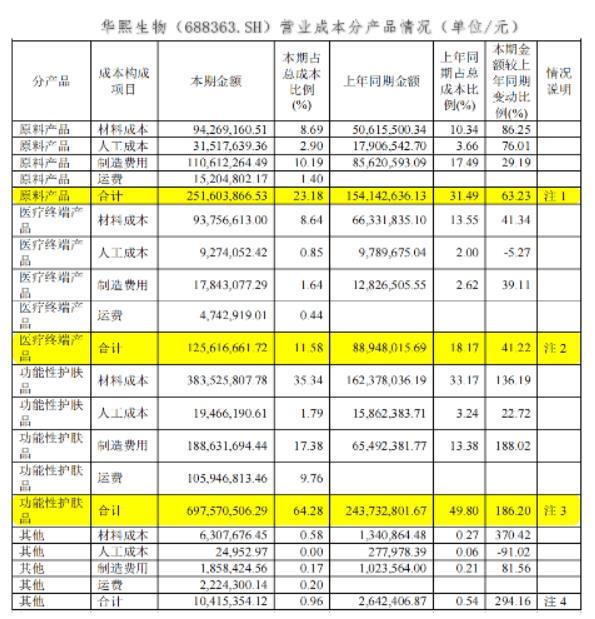

However, during the reporting period, the operating costs of the company’s three major categories of products increased far more than revenue. Among them, the operating costs of raw material products, medical terminal products, and functional skin care products during the period were 252 million yuan, 126 million yuan, and 698 million yuan, respectively, up 63.23%, 41.22%, and 186.20% year-on-year.

Bloomage Bio said that the company’s main business costs increased with the growth of sales revenue, and the company did not give a detailed explanation.

Specifically, during the reporting period, the company’s raw material product operating costs totaled 252 million yuan, a year-on-year increase of 63.23%. The operating cost of raw material products consists of four parts: material cost, labor cost, manufacturing cost, and shipping cost. %.

During the reporting period, the operating cost of functional skin care products totaled 698 million yuan, a year-on-year increase of 186.20%. From the perspective of the operating cost composition of this product, the manufacturing cost during the period was 189 million yuan, a year-on-year increase of 188.02%.

Bloomage Bio said that during the reporting period, according to accounting standards, the company will adjust the freight to operating costs from 2021. Shipping costs included in operating costs in 2021 will be 128 million yuan.

Net sales margin declines for three consecutive years

It is worth noting that in 2021, although Bloomage Bio’s operating income has reached a record high, its profit growth rate will not be as fast as its revenue growth rate.

The company stated that the main reason why the profit growth rate was lower than the revenue growth rate during the reporting period was that the company adhered to long-termism and attached great importance to the strategic investment required for long-term sustainable development, including the pre-production capacity layout, key capacity building, and investment in basic research. Incubation of new businesses, equity incentives, brand building, etc.The above-mentioned strategic investment is short-termperformanceThe contribution is not large, but it is of great significance for the company to widen its moat, continuously consolidate its core competitiveness, continuously expand its leading edge, and obtain new strategic opportunities. It will gradually produce a direct contribution to the operation in the next 2-5 years.

The reporter from the “Economic Information Daily” noticed that while the profit growth rate is not as fast as the revenue growth rate, the company’s net sales profit margin has declined for three consecutive years, reaching a record low of 15.67% in 2021; the company’s sales gross profit margin in 2021 is 78.07%, a year-on-year A decrease of 4.11 percentage points.

Specifically, in 2021, the company’s raw material products will achieve operating income of 905 million yuan, a year-on-year increase of 28.62%, accounting for 18.29% of the company’s main business income, and gross profit margin of 72.19%, a year-on-year decrease of 5.9 percentage points; medical terminal products achieved operating income of 7 100 million yuan, an increase of 21.54% year-on-year, accounting for 14.15% of the company’s main business income, gross profit margin was 82.05%, a year-on-year decrease of 2.5 percentage points; functional skin care products achieved operating income of 3.320 billion yuan, an increase of 146.57% year-on-year, and gross profit margin was 78.98 %, a year-on-year decrease of 2.91 percentage points.

Selling expenses hit a record high

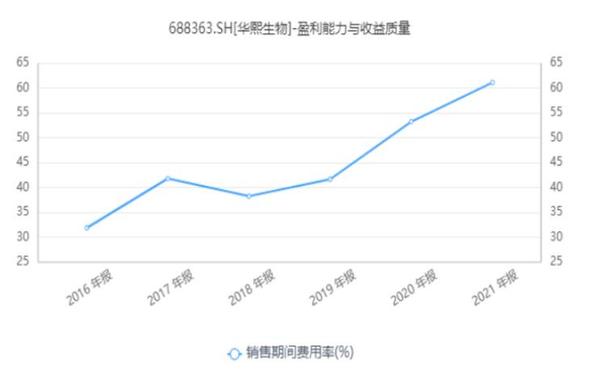

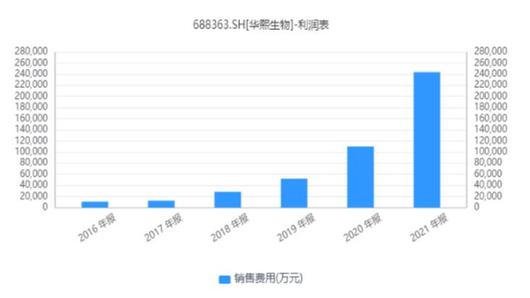

In terms of period expenses, the company’s period expense ratio has shown an upward trend in recent years. The data shows that in 2021, the expense ratio of Bloomage Bio will hit a record high of 61.10%.

Specifically, the company’s sales expenses were 2.436 billion yuan, an increase of 121.62% year-on-year; the company’s management expenses were 303 million yuan, an increase of 87.28% year-on-year; the increase in management personnel led to an increase in employee compensation; the company implemented an equity incentive plan this year. Incentive expenses increased; company scale increased, office and conference fees, service fees, hospitality fees and other daily operating expenses increased. The company’s financial expenses are -494,700 yuan.

In addition, the company’s research and development expenses were 284 million yuan, an increase of 101.43% over 2020. Mainly, the number of R&D projects in this period reached 239, an increase of 94.31% over the same period.

“Economic Information Daily” reporter noted that the company’s sales expenses hit a record high. During the reporting period, the company’s sales expenses were mainly used for the advertising and promotion expenses and market development expenses of the company’s functional skin care products.

Bloomage Bio said that the increase in selling expenses was mainly due to the increase in sales staff during the reporting period to meet the needs of the company’s sales business expansion, and the increase in sales staff led to an increase in employee compensation.

Choice dataIt shows that Bloomage Bio has continued to decline since the historical high price of 314.58 yuan/share on July 5, 2021, and to March 11 (closing price of 114.48 yuan/share), the cumulative decline was 58.95%, and the sector fell 27.40% in the same period. The broader market fell 5.94%.

Bloomage Bio said that the company plans to distribute a cash dividend of 4.90 yuan (tax included) for every 10 shares to all shareholders.

(Article source: Economic Reference Network)