Summary

[Carbon emission rights can be used as collateral in the future to pay attention to the investment opportunities of related concept stocks]On July 14, Ye Yanfei, head of the Policy Research Bureau of the China Banking and Insurance Regulatory Commission, said at a press conference held by the State Council Information Office that the carbon emission rights market will soon The transaction has begun, and the value of carbon emission rights has gradually emerged. Therefore, carbon emission rights will be used as a very effective collateral in the future, which can provide an important pledge basis for banks to expand financing. (China Business News)

On July 14, Ye Yanfei, head of the Policy Research Bureau of the China Banking and Insurance Regulatory Commission, stated at a press conference held by the State Council Information Office that now the carbon emission rights market will soon begin trading, and the value of carbon emission rights is gradually emerging, so carbon emission rights As a very effective countermeasure in the futurePledge品, can bebankExpanding financing provides an important pledge basis.

According to Zhao Yingmin, Vice Minister of the Ministry of Ecology and Environment, the executive meeting of the State Council decided that the national carbon emission trading market will be launched online in July this year, and all work is now ready. Improve the allocation plan of allowances by industry, and further expand the coverage of the carbon market after the carbon market in the power generation industry is improved.

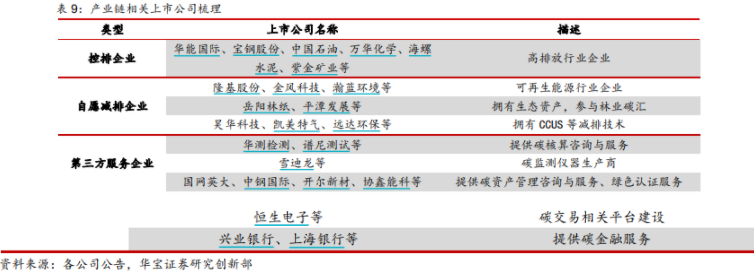

Huabao Securities pointed out that the construction of a national carbon emissions trading market is gradually advancing, and the carbon trading market will be transformed from a regional pilot stage to a national trading stage. The establishment of the carbon trading market system is conducive to high-emission enterprises to reduce carbon emissions through energy-saving emission reduction technologies, and market-based trading of emission allowances provides them with arranging power and economic support. On the other hand, renewable energy enterprises will also benefit from The promotion of the voluntary certification mechanism, through the National Certified Voluntary Emission Reduction (CCER) transaction to achieve corporate value revaluation.

Huachuang Securities pointed out that how to accurately verify and monitor greenhouse gas emissions is the top priority of the carbon market construction. It is predicted that under the background of the full launch of the carbon market, the carbon emissions verification and monitoring market will be the first to benefit.It is recommended to pay attention to the production enterprises that produce online carbon dioxide monitoring equipmentSnow Dillon、Pioneering environmental protection、Jiahua TechnologywithBlue Shield Optoelectronics。

(Source: China Business News)

Article source: China Business News

Editor in charge: DF407

Original title: Carbon emission rights can be used as collateral in the future, pay attention to investment opportunities in related concept stocks丨Bull bear eyes

Solemnly declare: The purpose of this information is to spread more information, and it has nothing to do with this stand.

Report

Scan the QR code to follow

Oriental Wealth Official Website WeChat

.