Dongxu Optoelectronics Hold Can’t Live | Sustained huge losses for three and a half years, nearly 6 billion bonds defaulted, will they face delisting?

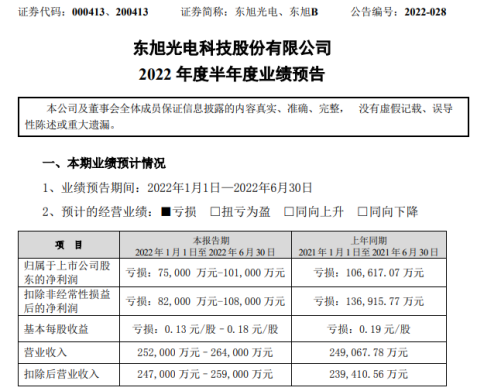

On July 14, 2022, Dongxu Optoelectronics Technology Co., Ltd. (hereinafter referred to as Dongxu Optoelectronics) released the2022 Semi-annual Results Forecastthe expected performance loss.During the reporting period, the net profit attributable to shareholders of the listed company was a loss of RMB 750 million to RMB 1,010 million, and a loss of RMB 1,066,170,700 in the same period of the previous year.; Basic earnings per share loss 0.13 yuan / share – 0.18 yuan / share.

Image source: Dongxu Optoelectronics

Dongxu Optoelectronics saidThe main reason for the lossYes: the company’s commitment to optoelectronicsshowThe R&D investment in material-related production lines and products, coupled with the amortization of intangible assets and fixed assets in the early stage, led to a large fixed cost of the company, which in turn reduced the company’s net profit;The company’s interest-bearing liabilities include some bank loans that have not yet been extended or renewed, and the corresponding interest expense of this liability is one of the main factors that constitute the continuous loss in the first half of 2022.; The sales volume and gross profit margin of the company’s optoelectronic display materials business declined slightly, resulting in a low contribution of this business segment to the company’s overall net profit.

According to public information, Dongxu Optoelectronics is a company withPhotoelectric display materialshigh-end equipment manufacturing, new energy vehicle manufacturing as the main business of intelligent manufacturing high-tech enterprises, supplemented by construction and installation engineering and graphene technology application business.

Dongxu Optoelectronics has sustained huge losses for three years, and there is uncertainty in its ability to continue operating!

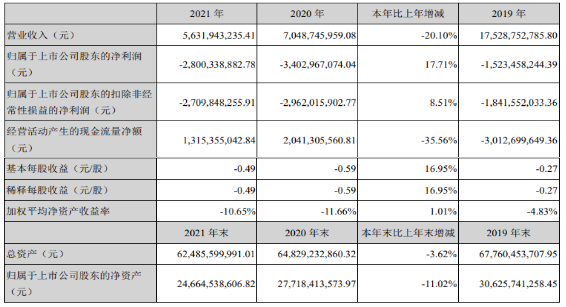

2019-2021Dongxu Optoelectronics has been losing money for three yearsthe net profit attributable to shareholders of listed companies in 2019 was a loss of 1.5 billion yuan, a loss of 3.4 billion yuan in 2020, and a loss of 2.8 billion yuan in 2021.

Image source: Tunghsu Optoelectronics 2021 Annual Report

Tunghsu Optoelectronics stated in the report that in 2019, due to the global economic downturn, the real economy was struggling.Display industrysuffered a slump. Entering 2020, all walks of life are experiencing the test of economic downturn, and at the same time, they must bear the operating losses caused by the epidemic.The negative impact of the company’s debt default and liquidity difficulties continued to expand, further dragging down the operation of the company’s various business segments., except for the optoelectronic display material segment, which was improved by the improvement of the market boom, other business segments were operating at a low level. In 2021, corporate bonds will continue to default,The annual audit report shows that there is uncertainty in the company’s ability to continue as a going concern.

For the stable development of the company | Dongxu Optoelectronics strategic self-help

In order to get rid of the predicament, in 2020, Tunghsu Optoelectronics will choose to return to its main business for strategic adjustment to consolidate its leading position in the optoelectronic display industry, and actively develop in line with market trends.OLEDflexible display business,At the same time, it chooses to continue to develop equipment and technical service business, new energy vehicle business and other auxiliary businesses. In 2021, the company will continue to follow the development strategy established in 2020, fully focus on the development of the main business of optoelectronic display, and divest and reduce investment in non-core industries.In 2022, the company will still focus on the core business of optoelectronic display and divest assets that are not positively related to the existing industry as the main development direction. This strategy seems to have little effect now, and the company has continued to suffer huge losses, and its operation has encountered great difficulties.

Trapped in the quagmire of debt | The negative impact continues to expand

In the 2021 annual report of Dongxu Optoelectronics,Due to the company’s liquidity difficulties have not been fully resolved, the company failed to repay the due corporate bonds as scheduled“15 Dongxu Debt (112243.SZ)” Principal of 956,042,700 yuan and its interest; Failed to pay the “2016 first tranche of medium-term notes (variety 1)” (bond abbreviation: 16 Dongxu Optoelectronics MTN001A, bond code: 101659065), “2016 first tranche of medium-term notes (variety 2)” (bond abbreviation: 101659065) : 16 Tunghsu Optoelectronics MTN001B, bond code: 101659066) and “2016 Second Phase Medium-Term Notes” (bond abbreviation: 16 Tunghsu Optoelectronics MTN002, bond code: 101659069)The principal and interest are 4.7 billion yuan.

As of December 31, 2021,The deposit balance of Tunghsu Optoelectronics in Tunghsu Group Finance Co., Ltd. is 7.905 billion yuan. Due to the liquidity problem of Tunghsu Group Finance Co., Ltd., the deposit withdrawal of Tunghsu Optoelectronics in Tunghsu Group Finance Co., Ltd. is restricted.there is uncertainty about whether the deposit of Tunghsu Optoelectronics in Tunghsu Group Finance Co., Ltd. can be recovered on schedule.The book balance of Dongxu Optoelectronics monetary capital is 9.377 billion yuan, of which restricted funds are 8.577 billion yuan;The book balance of financial interest-bearing liabilities listed in liabilities was 24.868 billion yuan, of whichFailed to repay debt principal and interest amounted to 17.581 billion yuanthe above situation shows that the company’s ability to repay matured bonds and other matured debts is uncertain.

summary

It is understood that in 2017, Tunghsu Optoelectronics spent 3 billion to acquire 100% equity of Sunlong Bus, and has since set foot in the “graphene material – graphene-based lithium ion battery – new energy vehicle” industry chain. In addition, Tunghsu Optoelectronics has also been involved in popular concepts such as photovoltaics and 5G.

It can be seen that before, Dongxu Optoelectronics has aggressively expanded other fields and diversified its layout in the field of “outlets”.If you are blindly optimistic about the benefits of the “wind outlet” field and blindly raise large-scale debt investment, and do not do a good job in crisis management, then as long as there are unstable factors in the “wind outlet” field (epidemic, war, trade war, etc.), the company will have debts. crisis and fall into a situation of tight capital chain.