GEM 50ETFThe strong absorption of gold reflects the willingness of investors to buy dips from the side.

Recently, the volatility of the A-share market has increased, and the three major indexes have been bottoming out.fundLayout, showing the operation of buying more and more as it falls.securitiesTimes Databao statistics, this week (March 7-11),The total shares of 667 ETF funds in the whole market increased by 29.275 billion shares to 1.19 trillion shares.

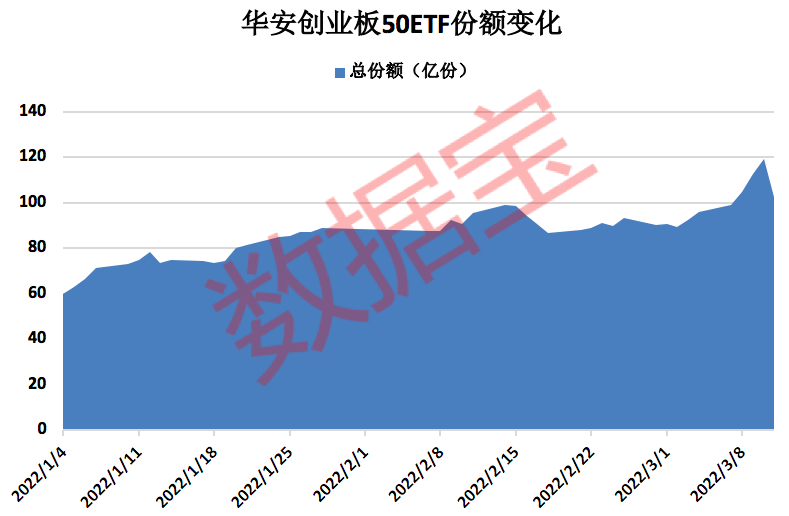

Hua’an Growth Enterprise Market 50ETF fund share exceeded 10 billion

Classified by investment type, the size of stock ETF funds has an absolute advantage. Among the 609 stock ETFs (stock ETF funds +QDIIStock ETF funds), the latest share of 17 funds exceeds 10 billion.

The Huaan Growth Enterprise Market 50ETF Fund received capital to increase its positions against the market.This Tuesday, the Huaan Growth Enterprise Market 50ETF fund share exceeded 10 billion for the first time, an increase of 4.266 billion shares from the beginning of the year. It is the first GEM ETF with a market share exceeding 10 billion.

Huaan Fundsaid, “In the past three years,GEM refers toThere have been three retracements of more than 20%. By observing the recovery situation of the ChiNext Index and ChiNext 50 Index after the sharp correction, it can be found that the ChiNext 50 Index performed better after the three major drops, and the recovery days after the largest retracement were even longer. Short”. The GEM 50ETF attracts gold strongly, reflecting investors’ willingness to buy dips from the side.

Photovoltaic ETF shares hit a new high in the year

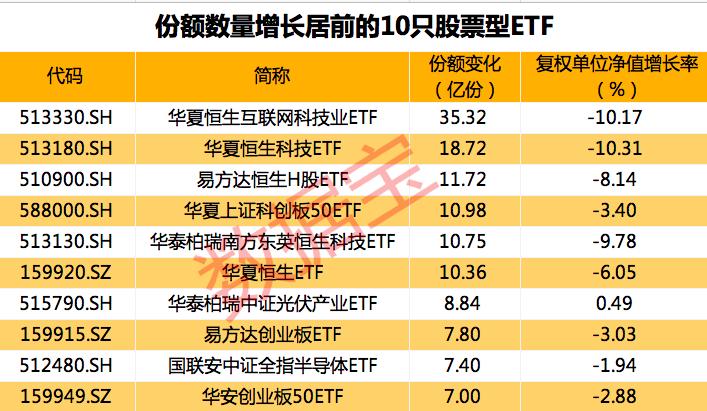

From the perspective of share changes, the share of more than half of the stock ETFs still achieved growth in the volatile and downward market this week. Hong Kong stock ETF funds and some industry-themed ETF funds are very popular. This week, the Huaxia CSI Petrochemical Industry ETF had the highest share growth rate this week, reaching 215.94%. The share growth rate of Wells Fargo Growth Enterprise Market ETF, Cathay Pacific Shanghai Composite Index ETF, Rongtong Growth Enterprise Market ETF, and Harvest Growth Enterprise Market ETF all exceeded 25%, ranking 2nd to 5th on the share growth list respectively.

The share of 19 industry-themed ETFs increased by over 100 million. with chips,semiconductor, photovoltaic and other industry themes have the most share increments, of which the photovoltaic ETF fund (515790) has an increase of 884 million shares this week, an increase of 10.04%, and the latest share reaches 9.681 billion shares, a new high for the year. Photovoltaic ETF funds bucked the trend and rose 0.49% this week, having risen for four consecutive weeks.

semiconductorThe shares of the ETF and the two chip ETFs increased by 740 million, 606 million and 538 million, respectively. But the performance of these three ETFs fell this week.

Fund Sweeping Hong Kong Stock ETF

The Hong Kong stock market has been fluctuating and declining since the Spring Festival. Among the top five stock ETF funds with share growth last week, 4 ETF funds track the Hong Kong stock market index, including China AMC Hang Seng Internet Technology ETF Fund,Huaxia Hengsheng TechnologyETF Fund, E Fund Hang Seng H-Share ETF Fund and Huatai-Pineapple CSOPHang Seng Technology ETFFunds, the shares increased by 3.532 billion, 1.872 billion, 1.172 billion and 1.075 billion respectively.

HuaxiaSSE 50The ETF’s fund share fell by 890 million last week, the largest decline in the range share of stock ETF funds. Since the beginning of this year, the share of China AMC SSE 50 ETF has continued to decrease, with a cumulative decrease of 3.046 billion shares during the year. The shares of the Southern China Securities 500ETF decreased by 849 million shares last week, a decrease of 12.04%.

11 stock-based ETFs show resilience

This week, 11 stock-based ETF funds bucked the market and achieved positive returns, showing a defensive attribute.Data show that Huaan Fund’s Huaan Germany 30 (DAX) ETF and Huaan France CAC40ETF have returned 2.35% and 2.25% this week, respectively. China Universal SecuritiesBatteryThe weekly returns of the thematic ETF fund, E Fund CSI All Index Building Materials ETF Fund, and Cathay CSI Photovoltaic Industry ETF Fund all exceeded 1%.

In contrast, there are 13 stock ETF funds whose net unit value fell by more than 10% this week.Stock ConnectThe net unit value of the Internet ETF and the Wells Fargo CSI Hong Kong Stock Connect Internet ETF fell by 11.06% and 11.47%, respectively. The net unit value of these two ETFs has decreased by 24.73% and 28.07% respectively this year.

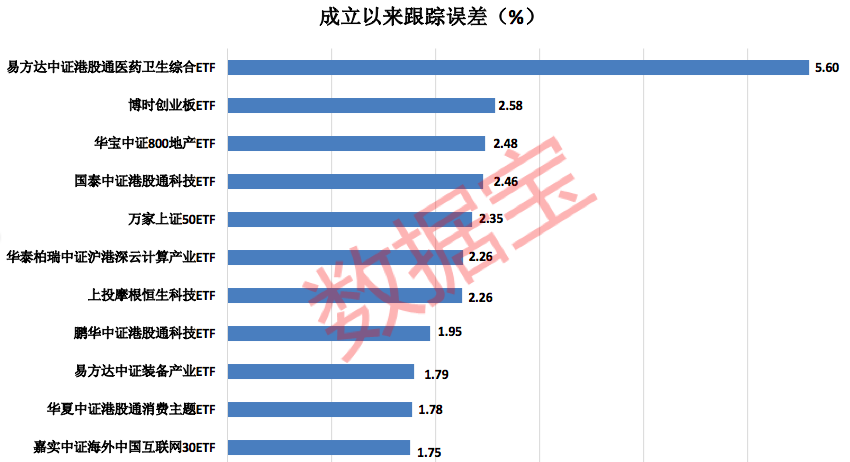

The tracking error of many ETF funds exceeds 2%

Generally speaking, the main investment objective of ETF funds is the index, and the pursuit of tracking deviation and tracking error minimization. Therefore, the size of the tracking error is an important consideration to measure whether an ETF fund achieves its investment objective.

Data treasure statistics,Since its establishment, among all 609 stock ETF funds, the CSI Hong Kong Stock Connect Medical and Health Comprehensive ETF Fund has the largest tracking error, reaching 5.6%.The fund was established on January 19, 2022, and its prospectus shows that the absolute value of the fund’s daily average tracking deviation is controlled within 0.35%, and the annualized tracking error is controlled within 3%. Judging from the current operating results, the performance of the fund has not yet met expectations. As of the latest, the fund share has been reduced to 62 million.

In addition, among the latest ETF funds with more than 10 billion fund shares, China AMC Hang Seng Internet Technology ETF Fund, E Fund Hang Seng H-Share ETF Fund,Huaxia Hengsheng TechnologyThe tracking errors of ETF funds and E Fund CSI Overseas Internet ETF funds are relatively large, both exceeding 0.85%.

ETF funds appear “stock short position” status

ETF funds must complete the establishment of positions before listing, and meet the requirements of the fund at the time of listing.contractThe specified minimum position.However, this week, newly listed ETF funds have 0 stock positions, Nanhuafund companyThe net value of its South China Fenghui Fund stayed at 1 yuan for five consecutive days from February 28 to March 4, and the net value of the fund did not fluctuate to 1.0001 yuan until March 7 and March 8. This also shows a short position strategy.

On the evening of March 9, the listing transaction released by E Fund Building Materials ETF FundannouncementThe book shows that as of March 8, 2022, the fund heldBankDeposits and settlement reserves totaled 240 million yuan, accounting for 100% of the fund’s assets, that is, the fund does not hold stock assets, and the fund will be listed on March 15.

(Article source: Data Treasure)