Are you looking for information on Fineco Pension Fund, perhaps to compare it to the offer of other institutes and get your own idea about this tool? If the answer is yes, then you are in the right place because today I will tell you about this product.

Inquire today for your own future retirement it is extremely important because time passes quickly and society changes with it, often taking unexpected paths for us. Gone are the days when after working hard all your life you could see your retirement coming in a totally safe way.

Ours has been for years now pension system is experiencing a deep crisis that seems to have no end and this becomes the fundamental reason why many begin to consider subscribing to one supplementary pension. But is it really the right solution to deal with these problems?

Today I start from the analysis of the offer of this bank for the supplementary pension, so as to shed light on what are the most important aspects that you need to look at when you are about to subscribe to it.

Read on if you want the right tools to evaluate the Fineco pension fund (in particular Core Pension) and figure out how you can invest your savings.

This article talks about:

Who is Fineco?

FinecoBank is one of the most important FinTech banks in Europe and is the multi-channel bank belonging to the UniCredit Group: it offers banking, credit, trading e investment. Deals with brokerage and has one of the largest networks of consultants financial.

The technologies used to offer these services are characterized by an innovative component, useful for facilitating their use by customers.

FinecoBank is one of the most important players in the Private Banking in Italy, since it offers personalized consultancy to also propose fiduciary services, protection and transmission of personal and corporate assets, legal and tax consultancy and management of discontinuity events.

Starting from 2017 FinecoBank is also active in Great Britain, with an offer focused on brokerage and transactional services.

But now let’s focus on the pension offer.

Not sure how to invest?

Find out which investor you are. Are enough 3 minutes to discover the best strategy for you.

>> START NOW! <

What does the bank offer from a pension point of view?

FinecoBank for pension provision offers you a single individual package: Core Pensioni.e. a pension fund where you can choose between five different lines: Guaranteed, Bond, Balanced, Equity e Equity plus.

Core Pension it’s a pension fund which has various types of annuity, based on different needs that you can evaluate according to your situation.

Characteristics of the Fineco Pension Fund

After this introduction ai pension funds of Fineco Bank, I want to show you the individual offers in every detail.

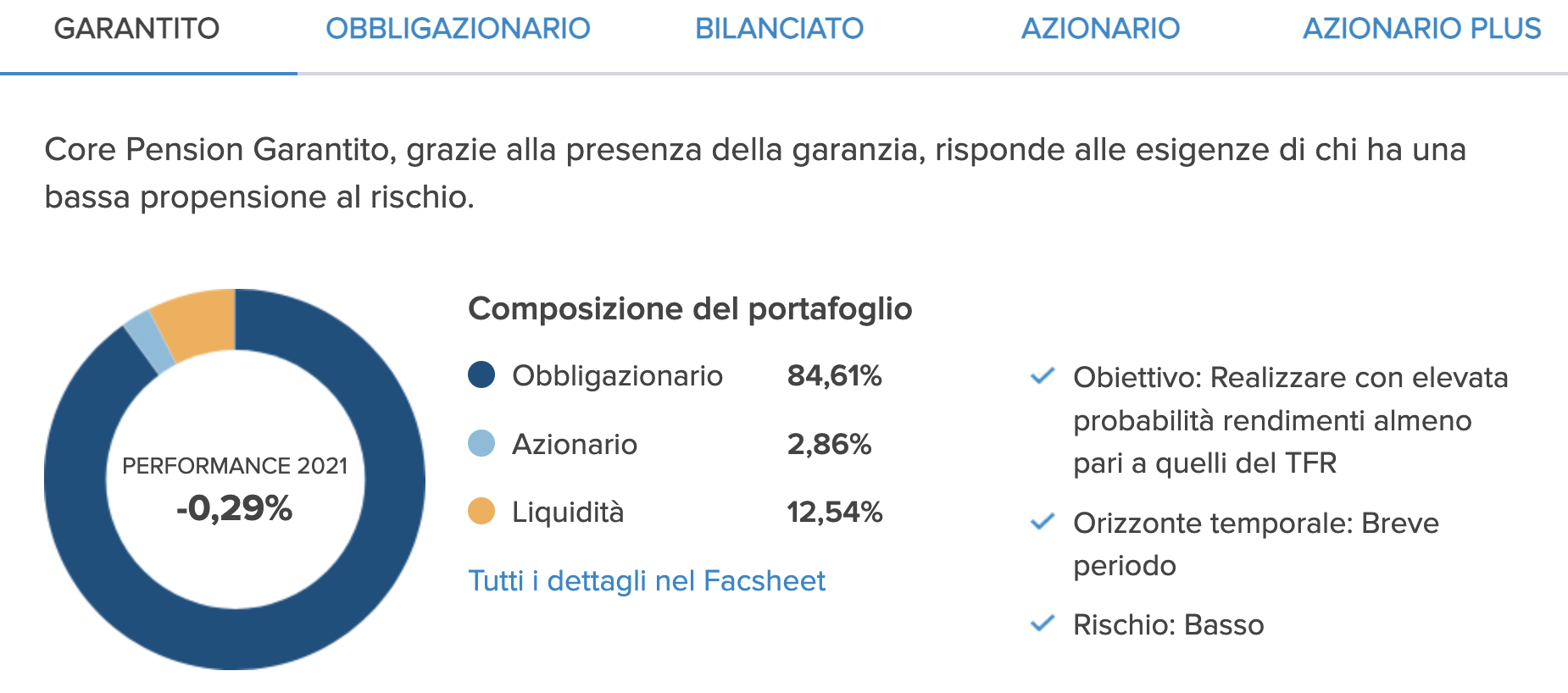

Core Pension Guaranteed

Core Pension Guaranteed is a pension fund that aims to achieve returns at least equal to those of the TFR in a short time horizon. The goal is to provide a guarantee that allows you to run one low probability of risk with this product.

In fact, the portfolio has a predominantly bond composition, with a percentage of approximately 84%.

As far as the equity portion is concerned, the breakdown by sector sees the industrial sector in first place, followed by new technologies and the financial sector.

Here is an image taken from the official page.

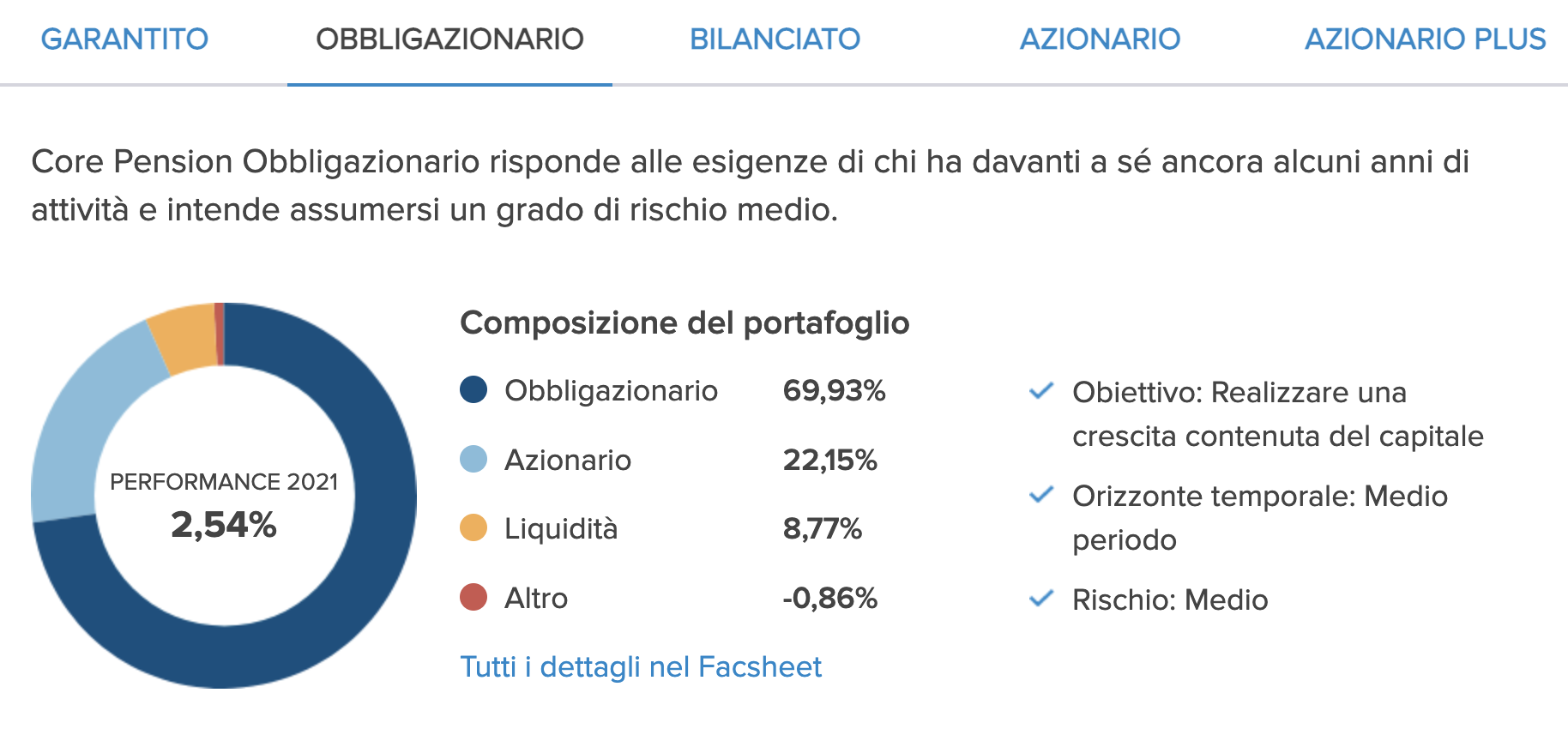

Core Pension Bond

Core Pension Bond it’s a pension fund with the aim of realizing a generally medium-term time horizon limited capital growth, in order to respond to the needs of those who still have a few years of activity ahead of them. The risk that you run in this case is level half.

But let’s go into the details:

The compartment can use OICR until the 100% of his heritage.

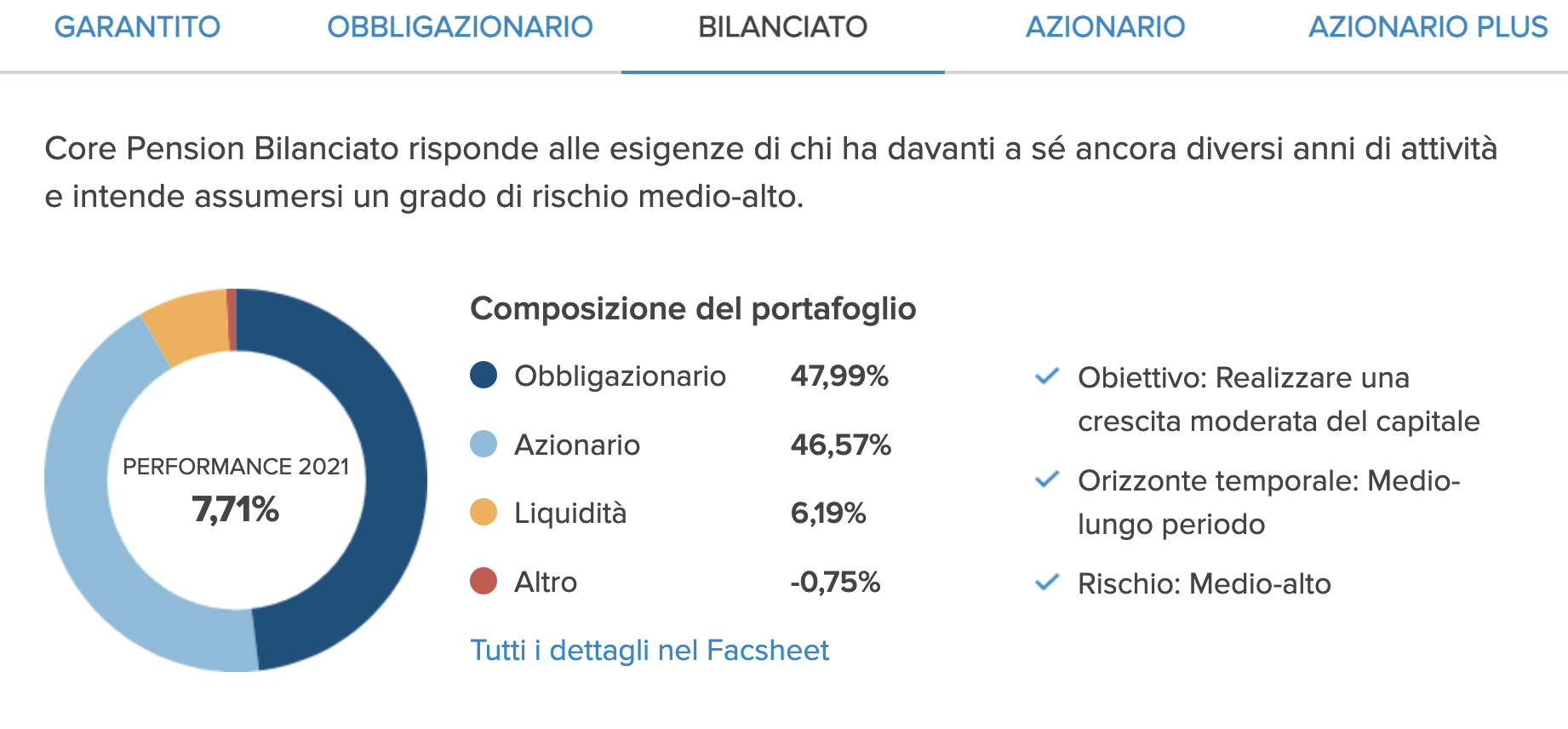

Balanced Core Pension

Balanced Core Pension has the purpose of achieving moderate capital growth over a basically medium-long term time horizon.

The comparator is characterized by a medium-high degree of risk and can use OICR until the 100%. The features are as follows:

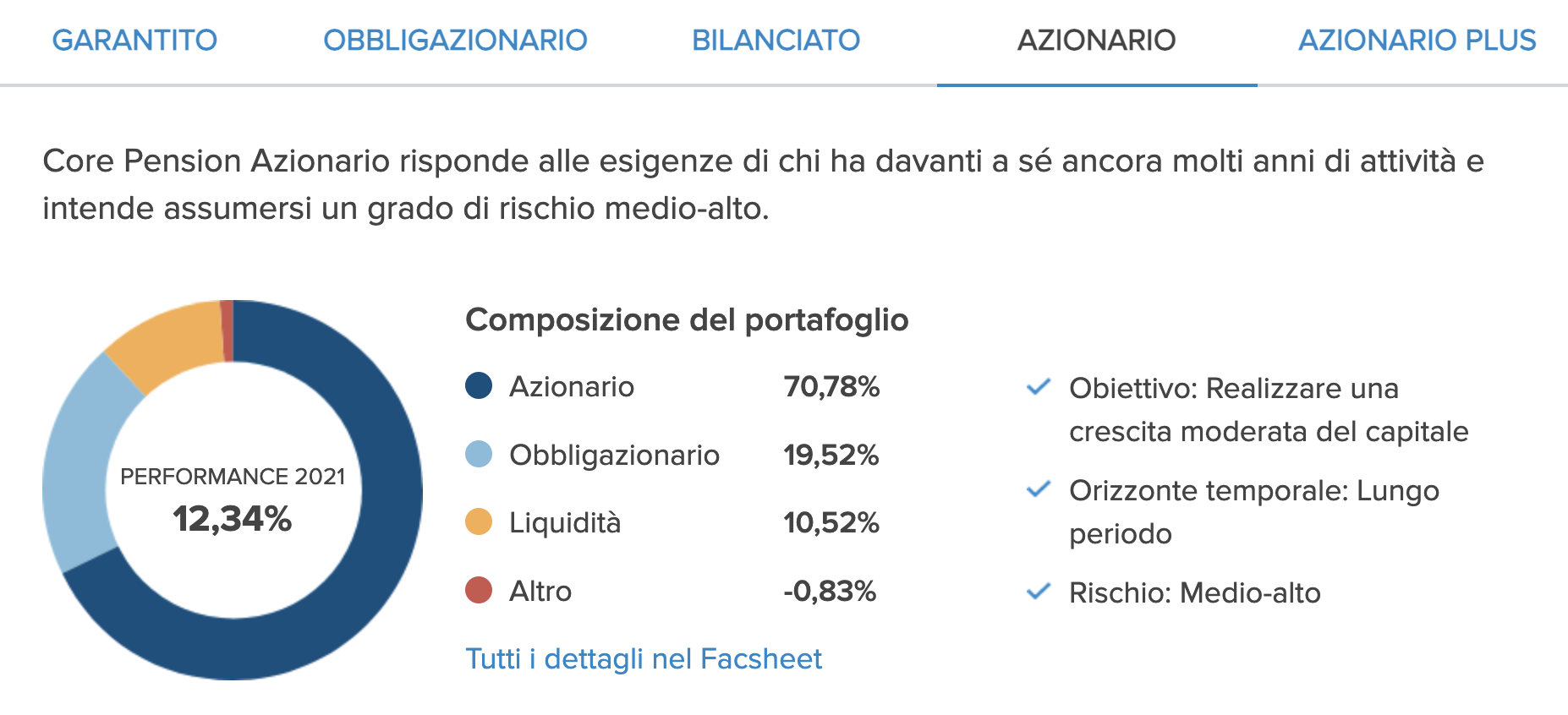

Core Pension Equity

Core Pension Equity 75% it is a product designed for a basically long-term time horizon and moderate growth of invested capital.

I limits imposed are as follows:

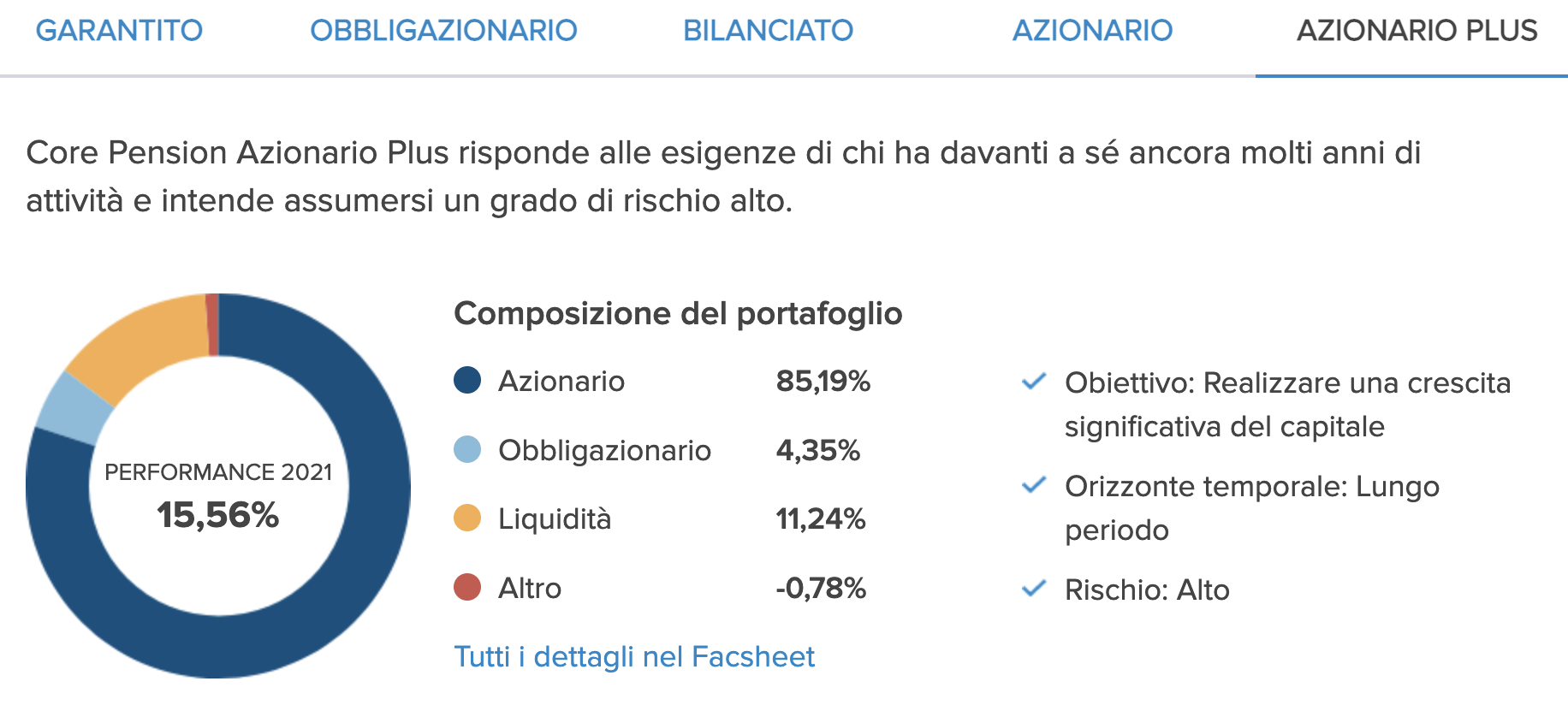

Core Pension Equity Plus

Core Pension Equity Plus 90% has the purpose of covering, over a basically long time horizon, a significant growth of the invested capital.

The product also features the following limits:

The compartment can use OICR until the 100% of his heritage.

Not sure how to invest?

Find out which investor you are. Are enough 3 minutes to discover the best strategy for you.

>> START NOW! <

Is Fineco’s supplementary pension a safe tool?

As far as the safety parameter is concerned, however, it is a product of Fineco Bank. A solid banking institution from this point of view. His Cet1 ratio (transitional) is placed at 20,39%.

We are facing a considerable guarantee, far higher than the average of Italian banks and the minimum threshold imposed by BCE. In the case of deposits of less than 100,000 euros you are secured since Interbank Fund for the Protection of Deposits.

So, what you have to evaluate is not the security of the instrument and the body that issues it, but the level of risks running, i stringent constraints to which you are related and the abundant presence of bureaucratic quibbles typical of this type of product.

How to open a Fineco Bank supplementary pension?

They can open Core Pension both employees and self-employed workers. You can join this pension fund even if you do not receive work or business income or are a person who is tax dependent on other subjects.

Who can join?

Let’s see immediately who has the opportunity to enter into one of these contracts.

Core Pension for the self-employed

Self-employed workers are those who do not receive work or business income. These can access the Core Pension supplementary pension through individual membership.

Anyone interested as a private or self-employed person can carefully read the information note before joining and the pension fund regulation. The example project which can help you to know and understand all the specific conditions is available at i Fineco center and within the bank site.

After having obtained the contact of a Fineco Bank financial advisor, you can make an appointment or go directly to a Fineco Center. If you make the decision to join, you must complete and sign the membership form to the pension fund.

Core Pension for employees

Core Pensionas already mentioned, is intended for employees who have the right to decide whether or not to allocate their own TFR to the pension fund. If you do not want to transfer the TFR to the fund, you must follow the same procedure as for self-employed workers or private individuals.

If, on the other hand, you want to pay the severance indemnity, you can do it through the employer: you must give him the modulo TFR2together with a copy of the membership form Core Pension Fund signed and the document containing the operating instructions for making payments to the pension fund.

The company you work for, on the other hand, will have to accept your indications, carefully read the operating instructions for payments to Core Pension and finally make payments to the pension fund on behalf of the employees.

My Business Opinions

Now that you know the Fineco pension fund offer in detail, to be truly exhaustive, I’ll also provide you with my expert opinion which I have already mentioned from the beginning.

As you could guess, I’m not particularly enthusiastic about this type of product except for some specific cases that involve a comfortable situation, i.e. the presence of a high income and the need to reduce the tax burdenhaving already made other investments.

If not, I advise against it because the conditions are not at all advantageous: expenses of a high bureaucratic nature, constraints and interests too low can make supplementary pensions a real trap for your savings.

Consider this product only and exclusively if you are in the situation I outlined a moment ago and if it gives you relief not to take an active interest in your capital and want someone to take care of it for you.

If you really don’t want to think about it anymore and you want to keep them bound for long periods of time that are around 10-20 years, then you can delve into the matter and think of tools of this kind that would prove to be – only in similar circumstances – suitable for your situation.

But let’s take a step back and recap the advantages and disadvantages of the Fineco pension fund.

When Fineco Supplementary Pension is right for you

Suits you:

- If you want to rely on one of the most solid and secure banking institutions in Europe;

- whether the limits and characteristics of the Fund can benefit your situation;

- if you have a high income and want to deduct a certain amount;

- if you don’t want to be actively and constantly interested in how your savings are invested;

- if you want to block your capital for a medium-long term, equal to at least 10-20 years without worrying about it;

- if you need to reduce your tax burden.

When Fineco Supplementary Pension is NOT for you

On the contrary, it’s not for you:

- if you belong to a category of workers that has pension funds reserved for the sector from which to take advantage;

- if you find the risks excessive compared to the effective possibility of growth of the invested capital;

- if you don’t want your capital to be subject to numerous temporal and bureaucratic constraints and quibbles of various kinds.

I advise you, if you belong to this category, to investigate and evaluate tools that include more active management on your part. To help you, I have prepared a series of itineraries for you, divided according to your age:

Conclusions

Now that you have all the tools for a fair assessment of a supplementary pension and you know my position, you can decide to stop and think about making the your considerations about.

Remember that if you don’t want to immobilize your savings for decades without worrying about costs and premiums, a supplementary pension is not what you need either to obtain benefits from an investment or to secure your future.

Given the high levels of criticality of this kind of product, if you don’t want to leave your money at the mercy of a bank or insurance company, you should continue to inform yourself on this blog.

Apart from some rare cases in which this tool can respond to personal needs, there are many products on the market that offer the same things with lower costs, fewer constraints and fewer bureaucratic quibbles.

Additional helpful resources

The one addressed today is a complex issue that deserves further reading:

Find on My business a way to invest your savings in a more profitable and smarter way: here you can read a lot of targeted guides. Happy surfing!

Find out which Investor You are

I have created a short questionnaire to help you understand what kind of investor you are. At the end, I will guide you towards the best contents selected according to your starting situation:

>> Start Now <