[Beauty fund manager god operation! Gorgeously surpassed the “fire pit” of education stocks and jumped onto the strongest point of view. Fundamentalists: This product should be renamed]This week, education stocks have been “smashed”, and education theme funds have also been dragged down. An education theme ETF plummeted 33.33% a week. However, a fund called Nanfang Modern Education Stock bucked the market and even rose by nearly 8% in a single day. It can be described as a standout among similar funds of “green oil”. (China Securities Journal)

This week, education stocks have been hit by “explosive hammers”, and education-themed funds have also been dragged down. An education-themed ETF plummeted 33.33% a week. However, a fund called Nanfang Modern Education Stock bucked the market and even rose by nearly 8% in a single day. It can be described as a standout among similar funds of “green oil”.

CSI Jun Xingba Fund positions found that seven of the top ten most heavily held stocks in this fund are all new energy concept stocks.

Data show that the Southern Modern Education Stock Fund has risen by 2.30% in the past week, and the increase in the past three months is as high as 33.19%. According to data from Tiantian Fund, it ranks 48 out of 621 funds, with outstanding returns since the beginning of this year, the past two years, and the past three years.

In contrast, similar funds have fallen by 2.73% in the past week, and an education-themed ETF has fallen by 33.33% in a week.

Why did education stocks plummet, but this education-themed fund ran out of positive returns? The answer lies in the position. The second quarterly report of the Southern Modern Education Stock Fund shows that seven of its top ten heavyweight stocks are new energy stocks.

As of the end of the second quarter, the fund’s largest holding stock was the Ningde era, the “one brother” of lithium batteries, accounting for 9.20%. There are also new energy concept stocks such as Yiwei Lithium Energy, Longji, Nordisk, and Sungrow. . In addition, the medical beauty concept stocks Amic, the consumer electronics industry Big White Horse Goer shares are the sixth largest and tenth largest stocks, respectively. The only education stock-Zhong Gong Education, ranked its ninth largest stock, accounting for only 3.32% of the fund’s total assets.

Source: Southern Fund Website

According to the Southern Fund’s website, at the end of the first quarter, among the top ten most heavily held stocks of this fund, there were 4 education and cultural media stocks, namely Phoenix Media, Zhong Gong Education, Zhongnan Media, and Zi Guang Da. They are 4.56%, 4.36%, 4.25%, 3.51%. But in the second quarter, the education industry only accounted for 5.38% of the fund’s assets, and the manufacturing industry accounted for 80.63%.

Jimin: Thanks to the fund manager

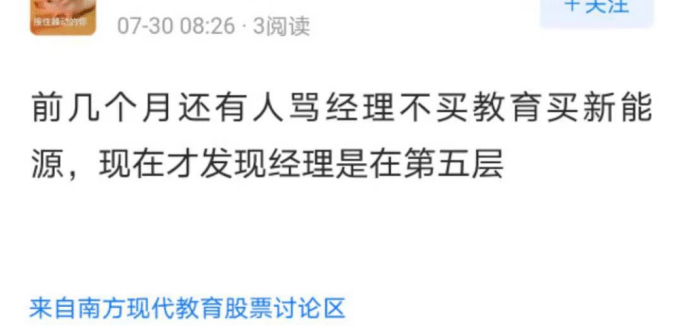

It is called the Education Stock Fund, but it is actually “Stud” new energy. In this regard, some Christians said that they had misunderstood the fund manager before:

Some Christians said that it is “really fragrant”: I am really grateful to the fund managers to avoid the crash of education stocks this time. Some people commented: In this way, it is still active fund managers “walking coquettishly”, and found that there is a problem with the education stocks, and immediately jumped out of the car.

Regarding the controversy that the fund’s name does not match the holdings, some netizens believe that it is clear that all education stocks are arranged in short, and they cannot jump into the fire pit.

However, some netizens said that the fund belongs to “selling dog meat” and the name should be changed to “Southern New Energy”.

According to the Southern Modern Education Stock Fund contract, the fund’s stocks (including depositary receipts) investment account for 80-95% of the fund’s assets. Among them, the stocks invested in modern education themes account for no less than the proportion of non-cash fund assets. 80%.

The stock investment strategy part of the fund contract shows that the scope of stock investment of the “modern education” theme fund includes but is not limited to: early childhood education, K12 education, higher education, vocational education and training, foreign education and training, exam-oriented training and further education, and cultural and sports education And education publishing, online education, education informatization and education asset securitization, etc. Based on the above-mentioned “modern education”, the fund’s investment stocks include: CSI Education Industry Index and other education-themed industry indexes constituent stocks, and the main business is not the above-mentioned industry, but has business and “modern education”. “Relevant, listed companies that are in the cultivation or development period and have the potential to grow as their main business in the future.

Fund manager reveals the reason

In the second quarterly report, the fund manager explained the reason for the “big turn”. Xiao Jiaqian said that in the first half of 2021, the operation of the education and training company was affected to a certain extent, and the fund’s performance in the first quarter also experienced a certain degree of correction. In addition, the fund performance benchmark “China Securities Education Index” was changed to “China Securities 800 Index” in 2020 due to the cancellation of the adjustment by the China Securities Index Company. In contrast, the industry benchmark has also changed, and the corresponding configuration needs to be carried out. A certain degree of consideration and adjustment.

Therefore, the fund adjusted its holdings significantly in the second quarter and reduced its position in the education sector. After the market correction in the first quarter, the fund’s valuation level entered a stage of reasonable allocation and the boom is expected to continue to rise, such as medical beauty, new energy vehicles, Photovoltaic, semiconductor, VR, etc.

The fund manager also said that in order to keep the fund’s investment in education-related industries, efforts are being made to modify the fund contract to broaden the scope of investment.

(Source: China Securities Journal)

Editor: Liao WeiyiReturn to Sohu to see more

.