Original title: Historic breakthrough! Soaring 400 billion a year, the futures market surpassed the trillion mark!Serious business differentiation in various jurisdictions

Summary

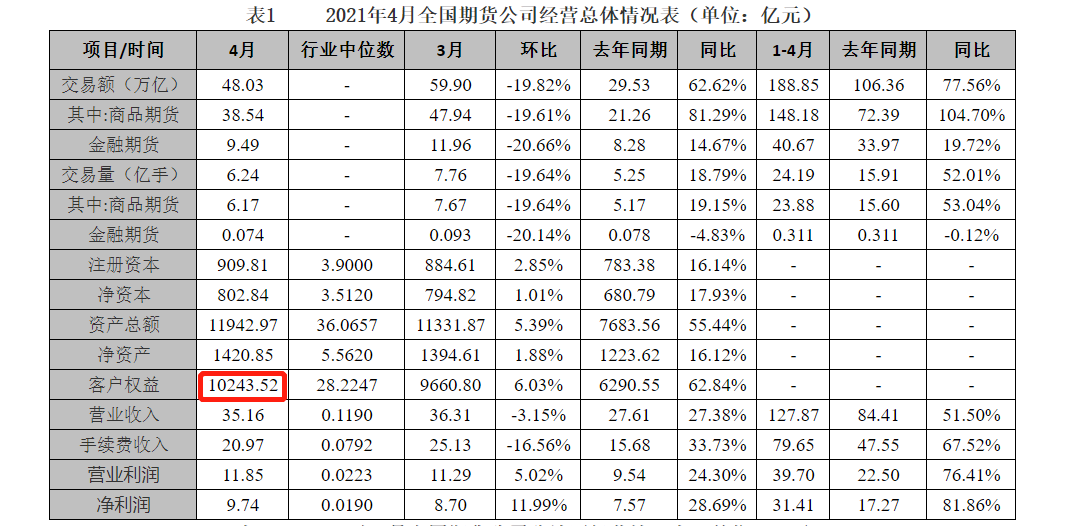

[Historic breakthrough! The futures market soared by 400 billion a year and crossed the trillion mark! Serious business differentiation in various jurisdictions]The latest data released by the China Futures Association shows that as of the end of April, customer equity in the futures market reached 1024.352 billion yuan, breaking the trillion mark for the first time in history! In the past year, customer equity in the futures market has soared by nearly 400 billion, which can be described as rapid development. (Broker China)

Entering the 31st year of China’s futures market, it is finally time for the moment to be recorded in history: the total amount of funds has exceeded the trillion mark!

The latest data released by the China Futures Association shows that as of the end of April, customer equity in the futures market reached 1024.352 billion yuan, breaking the trillion mark for the first time in history! In the past year, customer equity in the futures market has soared by nearly 400 billion, which can be described as rapid development.

The rapid increase in the size of the futures market has also brought about a substantial improvement in the operations of futures companies.From January to April this year, 149 futures companies’Operating incomeReached 12.787 billion yuan, a year-on-year increase of 51.50%;Net profitIt rose to 3.141 billion yuan, an increase of 81.86% year-on-year. The futures company finally waited for a good day.

It is worth noting that although the overall growth of futures companies has achieved substantial growth, the operations of various jurisdictions have been severely divided. From January to April this year, the net profits of Shanghai, Shenzhen, and Beijing all exceeded 300 million yuan, and Shanghai was as high as 900 million yuan. However, the net profits of seven jurisdictions including Dalian, Gansu, and Heilongjiang were negative.

With the continuous maturity of the futures market and the continuous enrichment of varieties, industrial customers, institutional funds and foreign investors have entered the market one after another, and China’s futures market has ushered in a rare period of development opportunities.

There are five reasons behind the futures market’s customer equity breaking the trillion mark

After the explosive growth of 2020, the futures market will continue to flourish in 2021!

On June 2, the China Futures Industry Association announced the overall operation of futures companies in April 2021 and the operating conditions by jurisdiction. As of the end of April this year, the customer equity of 149 futures companies nationwide was 1024.352 billion yuan, and the scale increased by nearly 200 billion yuan during the year. In the past year, it has soared by nearly 400 billion.

It is worth noting that since the establishment of the futures market in 1990, it has a history of more than 30 years, but the development of the futures market has not been easy. Once experienced severe rectification of the industry, separate operations of securities and futures, and exchange mergers, by 2015, the futures market margin was nearly 600 billion yuan, but then stock index futures were restricted, the industry fell into a downturn again, and the margin remained at around 400 billion yuan. The plateau period.

Today, the margin of the futures market has finally broken through the trillion mark, achieving a historic leap, which is undoubtedly good news for the industry.

South China FuturesChairman Luo Xufeng believes that there are five main reasons for the large-scale increase in customer equity in the futures market:

The first is that the global central bank release of water has led to the circulation areacurrencyThe total amount of funds has rapidly doubled, and the corresponding total amount of margin to enter the futures market is also rising;

Secondly, in the past two years, the new crown epidemic and geopolitical changes have had a huge impact on the economy, resulting in increased volatility in commodity prices, and the inherent demand for physical enterprises and financial institutions to hedge risks has increased rapidly;

Third, with the positive and positive publicity and guidance of the China Securities Regulatory Commission and the Chinese government in recent years on the futures market, the positive effect of investors, especially real enterprises, on the futures market has begun to be effective, and more and more industrial customers and Listed companies realized that the use of the futures market for price risk control is an inherent need for business operations, and began to use the futures market for hedging;

Fourth, with the rapid development of China’s economy in recent years,Common peopleWith more and more money on hand, the demand for wealth management has begun to rise. Various financial institutions are actively using futures and derivatives to design their products, and hedge risks in the futures and derivatives markets, which has further expanded the scale of the market.

Fifth, due to the outstanding performance of the Chinese economy in this round of the new crown epidemic, overseas funds are rapidly pouring into the Chinese market. To a certain extent, China’s opening to the outside world also makes them optimistic about the Chinese market, but overseas investment after entering China People are accustomed to carrying out risk hedging and hedging operations, so a group of overseas risk hedging investors has been added to our investor group, and this part of investors will increase in the future.

Li Qingsong, head of Jinrui Futures Marketing Management Headquarters, also said that the strong stock market, active trading of stock index futures, and strong overall commodity prices have promoted the rise of margin on the one hand, and on the other hand, the profitability effect has been highlighted, and the attractiveness of funds has been further enhanced.

The net profit of futures companies has increased significantly, but the operation of different jurisdictions is severely divided

In the context of industrial customers, institutional funds and foreign investors running into the market, the trading scale of the futures market has also increased significantly.

In the first five months of this year, the cumulative trading volume of my country’s futures market was about 3.125 billion lots, and the cumulative trading volume was about 239.34 trillion yuan, an increase of 51.49% and 77.80% year-on-year, significantly exceeding the level of the same period last year.

The rapid increase in the size of the futures market has also brought about a substantial improvement in the operations of futures companies. From January to April this year, the operating income of 149 futures companies reached 12.787 billion yuan, a year-on-year increase of 51.50%; net profit rose to 3.141 billion yuan, a year-on-year increase of 81.86%. The futures companies finally waited for a good day.

Judging from the net profit indicators of jurisdictions, from January to April, there were 6 jurisdictions with a total net profit of more than 100 million yuan, namely Shanghai, Shenzhen, Beijing, Guangdong, Xiamen, and Chongqing. The total net profit was about 916 million yuan. 390 million yuan, 378 million yuan, 247 million yuan, 195 million yuan, 147 million yuan;

However, there are 7 jurisdictions with negative net profits, namely Dalian, Gansu, Heilongjiang, Hunan, Jilin, Xinjiang, and Yunnan. Net profits are -3,134,100 yuan, -831,800 yuan, -946,800 yuan, and -739,500 yuan. , -3.4318 million yuan, -13,408 million yuan, -2.6961 million yuan.

Obviously, the operation of futures companies in various jurisdictions is severely divided, and the effect of industry agglomeration is obvious. For example, the net profits of Shanghai, Shenzhen, and Beijing all exceed 300 million yuan, and Shanghai is as high as 900 million yuan, and the total of the three jurisdictions is as high as 1.684 billion yuan, accounting for 53.61% of the total net profit.

Some people in the industry said that the influx of capital and the substantial increase in the scale of transactions are undoubtedly a major benefit for futures companies. However, if the operations of futures companies are to continue to improve, they must proceed from specialization and institutionalization, vigorously develop innovative businesses, rely on professional services to meet customer needs, and at the same time establish and increase investment in a talent system.

The sustainability of the commodity market is also an important indicator of the operation of futures companies, which has attracted the attention of the industry.

Luo Xufeng pointed out that at present, it seems that the epidemic is still in the process of continuous development, but with the emergence of vaccines, it is believed that from the second half of this year to next year, the global new crown virus will be gradually contained, and production and economic activities will gradually return to normal. The supply will gradually return to the normal range.

“From the second half of this year to the first half of next year, the volatility of the entire commodity market will still maintain a relatively large range. The problem of the over-issue of the US currency also needs a gradual digestion process on a global scale, and it will not disappear in the short term. The contradiction between supply and demand is still prominent, and the commodity market will still fluctuate greatly. In the future, as the global production and operation and financial markets return to normal, I believe that in the next two years or so, prices will gradually return to calm.” Luo Xufeng said.

(Article Source:BrokerageChina)

(Editor in charge: DF358)

Solemnly declare: The purpose of this information is to spread more information, and it has nothing to do with this stand.

.