On Thursday, gold fluctuated and fell. After a short period of sharp rise, the price of gold launched a callback correction and stabilized above this week’s low of $1,753; silver fluctuated and fell, and silver prices fell for the third consecutive trading day, setting a new one-week low of $20.7. After opening on Thursday, gold and silver rebounded upwards, recovering nearly half of Thursday’s decline. Currently, gold is trading at $1,763 and silver is trading at $21.1.

Huang Lichen, a star analyst at Wolfinance, believes that after a short period of sharp rise, gold and silver have started to correct this week, US inflation has shown signs of peaking, and market expectations for the Fed to slow down interest rate hikes have been strengthened. , but the performance is still very weak. These factors continue to support gold and silver, limiting the short-term drop in gold and silver prices. However, everyone still needs to be vigilant. The next Fed officials will speak. If the Fed continues to reiterate its confidence in raising interest rates, it will be detrimental to gold prices. .

In terms of news, Fed officials made hawkish speeches for two consecutive days, putting some pressure on gold prices. Daly said on Wednesday that the Fed’s terminal interest rate range may be between 4.75% and 5.25%, which is high enough to curb inflation, but not high enough to trigger a serious economic recession; Smaller rate hikes in the future are more reassuring, but one report is not indicative of a trend and it is too early to say how high rates will go.

Bullard said on Thursday that even based on a dovish analysis of monetary policy, the Fed would need to continue raising interest rates to around 5%; Kashkari said it was difficult to predict how high the Fed would need to raise interest rates, Rate hikes should not be stopped before peaking. Federal Reserve officials took turns to rise and reiterated their determination to raise interest rates, making the market worry that the Fed’s terminal interest rate will be higher than market expectations, and the rate hike cycle will be extended, putting pressure on gold prices.

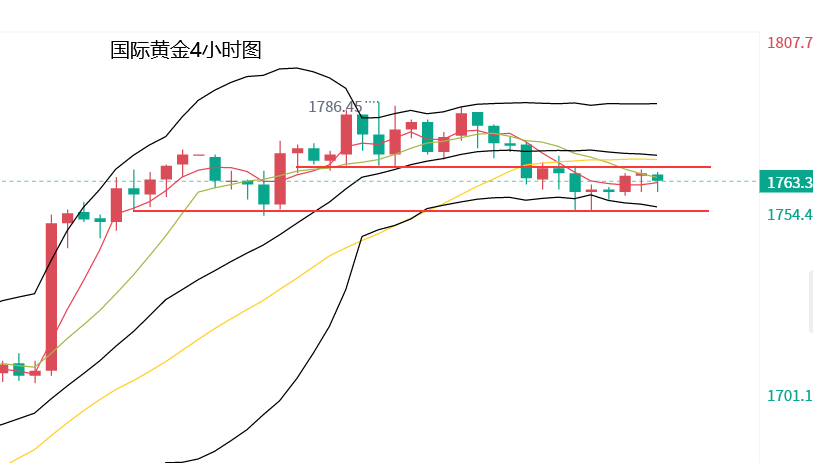

On the daily chart, after a unilateral rise in gold, the trend has corrected. The price of gold fell below the 5-day moving average of $1,770, and the 5-day moving average began to turn downward. On the attached indicators, the MACD indicator golden cross slowed down, and the RSI indicator golden cross Turning downwards, the KDJ indicator forms a dead cross, indicating that there is a need for a short-term callback in the gold price.

Gold intraday reference: gold price range adjustment, focus on the support of $1,753 at the bottom, and the resistance of $1,770 at the top.

Compared with gold, the callback trend of silver is more obvious. On Thursday, the price of silver once fell below 21 US dollars, falling for three consecutive days. At present, silver has temporarily stabilized at the integer mark of 21 US dollars. In terms of indicators, the MACD indicator has a tendency to form a dead cross, and the KDJ and RSI indicators are dead cross, indicating that the silver price tends to fall back in the short term.

Silver intraday reference: Be wary of rising and falling, pay attention to the support of $21 at the bottom, and the resistance of $21.4 at the top.