Optimism prevails on European markets in the first session of the week, following the sentiment of the Asian markets. After the initial reversal of last week, due to fears about the regulation of the tech giants by China, the markets have recovered the positivity. In Europe, the positive data on Italian GDP brought some strength, signaling growth equal to double that of France and Germany. This week the attention of traders will be focused on the outgoing job market report, as usual on the first Friday of the month. Before Friday important data such as the ISM, durable goods orders and PMI for the Chinese economy which is currently under special surveillance globally.

Ftsemib closes the week above 25,000

The Ftsemib is the index that has recovered the most since the mid-July reversal. After retesting the bearish trendline, now the first target is represented by the highs recorded at the beginning of June close to 26,000 points. With the closing above 25,000 points, the technical picture has strengthened but for any entrances it is advisable to wait for the breaking of the highs or the involvement of the supports, one of which, of quite important importance, is positioned at 24,500 points. Below that level we see no major supports up to 23,800 points.

For those who want operate Long with leverage, could consider the Turbo Open End Long UniCredit ISIN DE000HV4L2F3 with 10.7 times leverage and strike at 23300.641466 points, or ISIN DE000HV4L2E6 with 9.7 times leverage and strike 23046.288511 points.

For those who want operate Short leveraged, might consider the Turbo Open End Short UniCredit ISIN DE000HV4LSX8 with 10.4 times leverage and strike at 27599.541994 points.

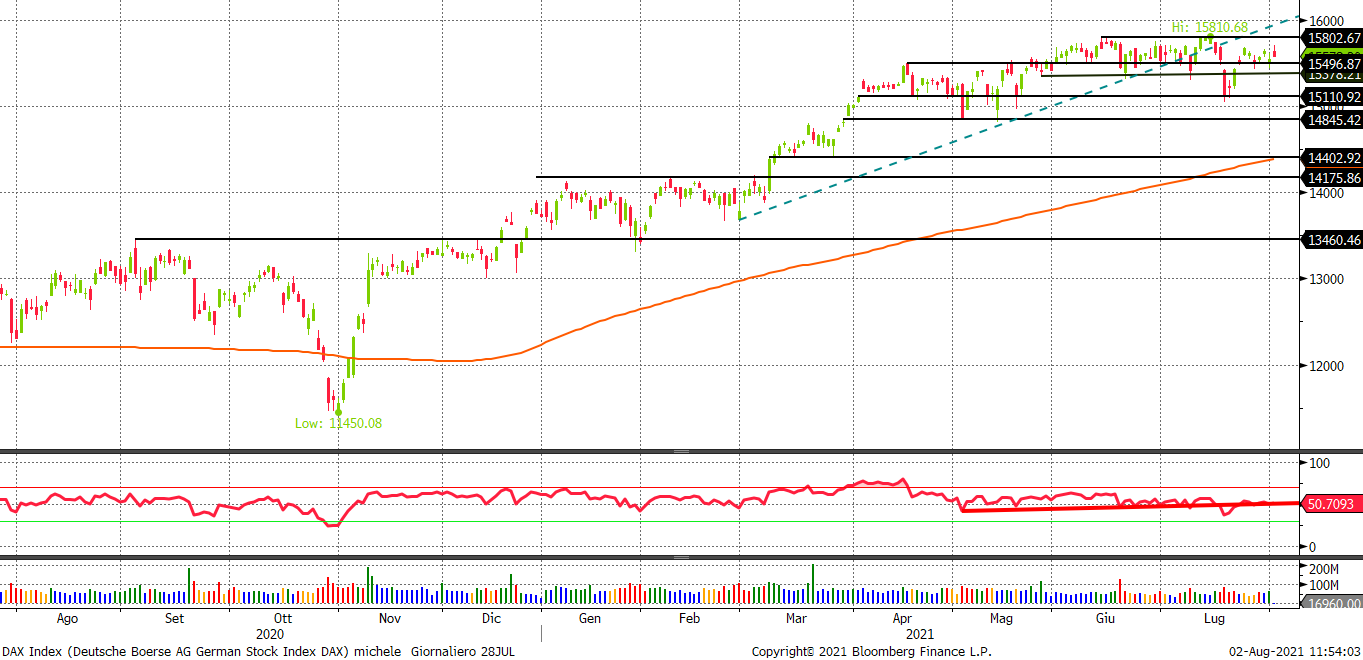

Dax, after a retest of the new lows

The German index continues to rise. The 15425 area test, now an important support, provides the ideas for a restart and the closing of the week above the key level. Long with turbo open end instruments to be tested on hourly closings above 15680 with a target of 15800 or at the retest of the important 15425 area. other times previously the volatility of the summer months can play tricks so it is better to remain vigilant with the utmost caution.

For those who want operate Long with leverage, could consider the Turbo Open End Long UniCredit ISIN DE000HV4L261 with 11 times leverage and strike at 14188.433758 points, or ISIN DE000HV4L253 with 9.3 times leverage and strike 13935.068844 points.

For those who want operate Short leveraged, might consider the Turbo Open End Short UniCredit ISIN DE000HV4LSN9 with 10.5 times leverage and strike at 17005.568724 points.