If you are looking for information about BancoPosta MIX 3, Then you’re in the right place. Up here My business I deal with the review of savings instruments and investment that might interest you, and today is the turn of this product from Poste Italiane.

Is it convenient? How much does it cost and what are the risk? How does it invest? In short, there are so many questions and in the following paragraphs I will try to help you answer every doubt, so that you will be able to decide whether investing in the BancoPosta Mix3 fund is worthwhile oppure no.

This article talks about:

Banco Posta SGR: an insight

In this regard, I want to say a few words to frame BancoPosta Fondi SpA SGR: this is the group’s asset management company Italian post.

This company has been operational since 2001 and deals with the activity of collective asset management, through the creation and management of open-end mutual investment funds under Italian law, as well as the management service of individual portfolios relating to institutional mandates referable to the Group.

BancoPosta Fondi SpA SGR:

- It is registered in the Register of savings management companies held by the Bank of Italy (UCITS Managers Section, no. 23).

- It is authorized to carry out collective asset management, portfolio management and investment consultancy activities pursuant to art. 34 of Legislative Decree February 24, 1998 n. 58 (Consolidated Law on Finance).

- Poste Italiane SpA is the distributor of mutual funds.

What is BancoPosta Mix 3

Are you undecided whether to invest in stock or bond market? A tool like this, then, might seem interesting to you, because it allows you to do both. It is in fact a balanced fund, and is presented as the solution for those who want to invest in the growth potential of the stock market, without completely renouncing the stability of the bond market.

This Fund invests at least 40% of the assets in bonds and monetary issues of government, supranational and corporate issuers. The remainder, up to a maximum of 60%, can instead be invested in equity securities.

All financial instruments are mainly denominated in Euros and up to 30% in other currencies. The Fund may invest up to a maximum of 30% in Emerging Countries.

With this fund you entrust your savings to a professional manager. Indeed, BancoPosta Mix 3 was born from the collaboration of BancoPosta Fondi SGR – the savings management company of the Poste Italiane Group – with Anima SGR, one of the major managers operating in our country.

This is because over the years, the financial markets have become increasingly complex and therefore savers appreciate the fact of entrusting their savings to expert professionals.

Risk and return profile

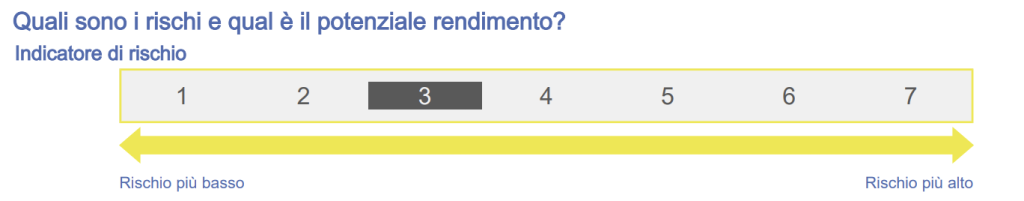

Let’s see what they are risks that you can run by choosing to invest in BancoPosta Mix3: let’s never forget that when you invest you must always be well aware of the degree of risk to which you expose your capital. The Fund is classified in the category 3on an increasing risk scale ranging from 1 to 7, so we are facing a relatively low risk.

However, let us remember that examining the fund’s historical data regarding risks and returns is useful, but cannot give you specific certainties, because the synthetic indicator does not offer a precise indication of the future risk profile of the UCITS.

Indeed, the risk/reward category indicated could change and therefore the classification of the UCI could change over time.

Belonging to a low risk category does not guarantee a risk-free investment, this should be kept in mind.

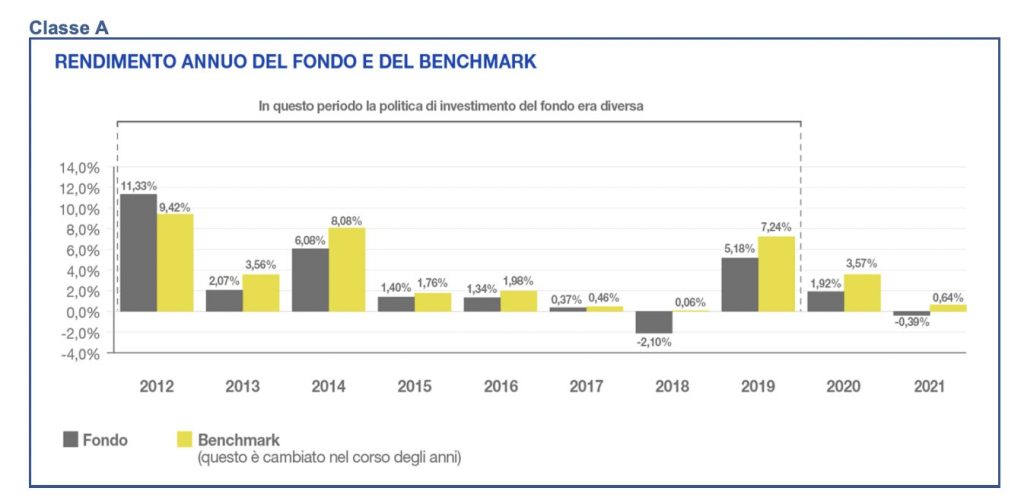

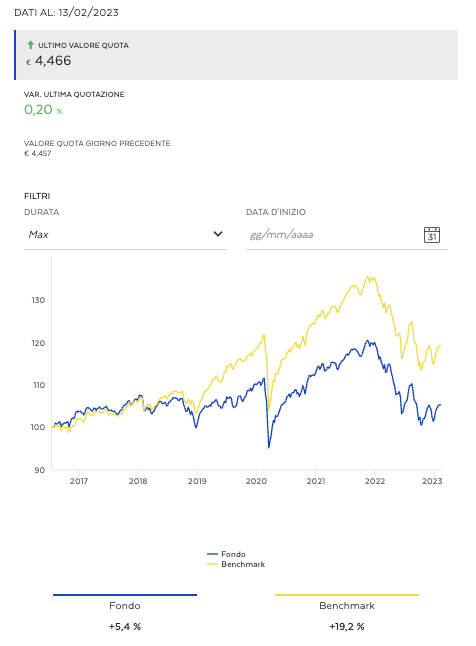

Let’s now see the results of the Fund, starting from the screen relating to the Class A.

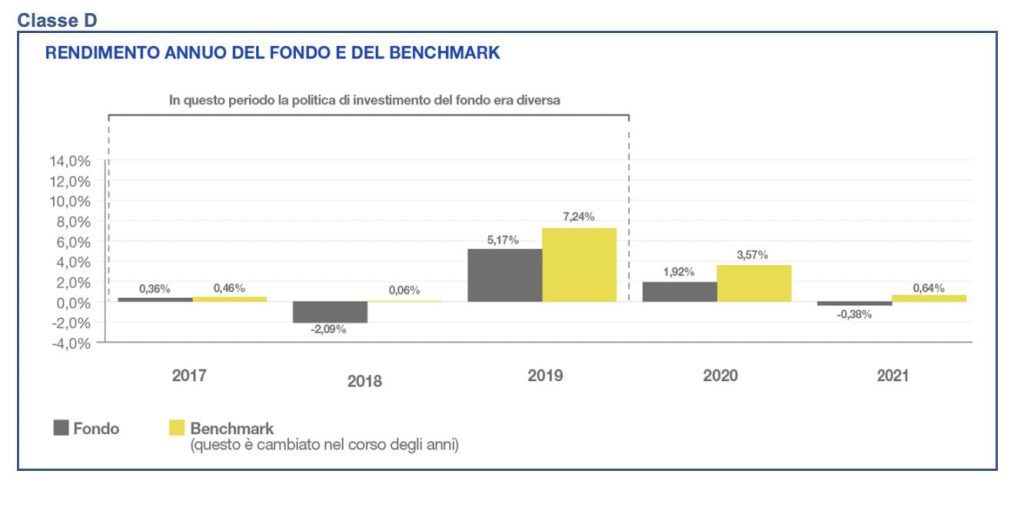

And now let’s see the one relating to the class D.

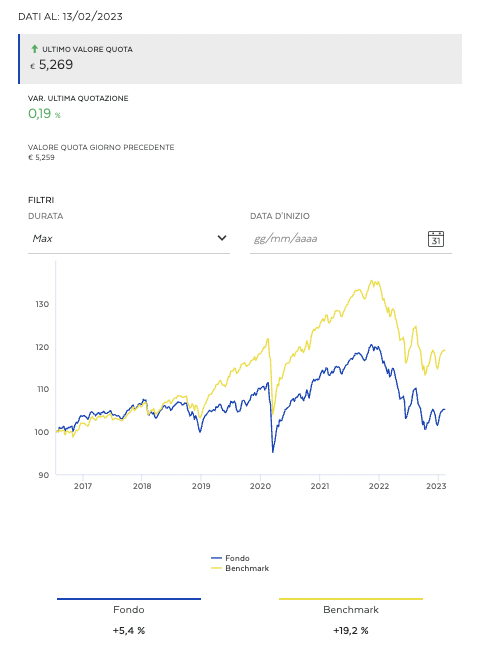

Let’s see now performancebased on the official documentation: later you will also find what data about the benchmark.

Again I will make the distinction between class A and class D.

Performance Classe A

Class D Performance

The composition

The BancoPosta Mix3 Fund is made up as follows:

- 60% bond component: this component represents at least 40% of the Fund’s portfolio and is made up of bonds and monetary securities of government, supranational and corporate issuers;

- 40% equity component: this cannot exceed 60% of the Fund’s portfolio.

To discover other instruments with different composition I suggest you read this guide.

Costs

For what concern cost of the product we are analyzing, I am attaching the image of the product itself, taken from KIDi.e. the official leaflet.

The one-off entry and exit costs are equal to 2 euros, while the management commissions are equal to 1.44% of the value of the investment in the year.

The recommended holding period of the investment is 5 years.

Its benchmark

This Fund compares its management choices and results with a benchmark index or basket (benchmark):

- 5% short-term European government bonds (ICE BofAML Euro Treasury Bill Index);

- 25% Euro Area Government Securities (ICE BofAML Euro Government Index);

- 10% Bonds of large cap European companies (ICE BofAML Euro Large Cap Corporate Index);

- 15% Global Government Bonds (ICE BofAML Global Government Index);

- 5% Emerging Countries Government Bonds hedged against exchange rate risk (ICE BofAML Diversified Emerging Markets External Debt Sovereign Bond Index);

- 20% Global Equities Hedged (MSCI World All Country Hedged);

- 20% Global Equities unhedged (MSCI World All Country unhedged).

The Fund does not intend to replicate the composition of the benchmark; the degree of deviation from the benchmark is limited.

How to subscribe it?

If you have decided to participate in this fund, you have two ways to choose to subscribe to it:

- Single Payments (PIC): through single payments with an initial (minimum) amount of 500 euros and subsequent payments (minimum) of 100 euros;

- Accumulation Plan (PAC): through an initial payment of 50 euros and a periodic installment (monthly, bimonthly, quarterly or half-yearly) of 50 euros or multiples for a minimum period of 2 years up to a maximum of 12 years.

My Business Opinions

If you’ve read my guides before, you know that I don’t have a very good opinion about mutual fundsBecause I am managed products which mainly bring advantages to the management company, and hardly to the investor.

In fact, we are faced with instruments that present very high costs for management, prices that consume the earnings that we manage to achieve through the fund itself.

We are dealing with a fund that has a risk that is starting to be high (I remind you, 4 out of 7), but in any case the advantage associated with the risk will hardly be able to keep up with the costs.

In short, it seems clear to me that it is not worth subscribing to this type of product, which have little or nothing to offer us investors and savers.

It is not just a problem of postal funds, but more generally of this type of instrument. If you want to invest in equity and bond instruments, there are certainly other ways, which in my opinion are more advantageous.

I advise you to watch the video below, where I explain my approach to investments and why I have come to say these things:

Resources to learn how to invest

If this is your first time on Affari Miei, I suggest you start with the following free resources:

Good continuation and good luck!

Find out which Investor You are

I have created a short questionnaire to help you understand what kind of investor you are. At the end, I will guide you towards the best contents selected according to your starting situation:

>> Start Now <