(Original title: It’s sold out! Gold jewelry is almost 600 yuan per gram, sales: “Sometimes it goes up to 7 yuan a day”! The repurchase income of 100 grams of gold bars is nearly 10,000, can you still buy it now?)

The “surge” of gold prices can’t stop consumers’ enthusiasm for buying, and the jewelry in gold stores is sold out.

Recently, the international gold price has risen significantly. Last Thursday, that is, May 4, under the influence of multiple factors such as the Federal Reserve’s announcement of interest rate hikes, the international spot price of gold once stood above $2,080 an ounce in the intraday session, hitting a record high.

COMEX gold hit a record high not long ago, and the picture shows the price trend in 2023

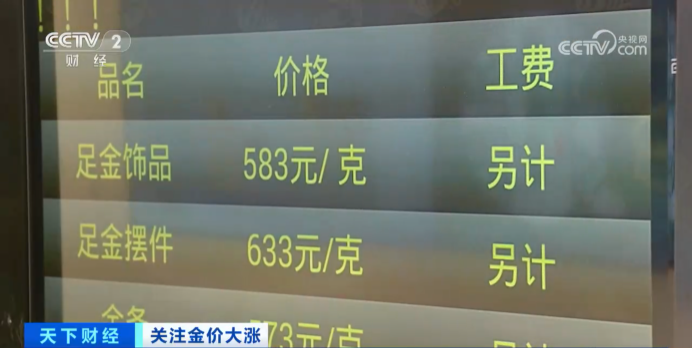

According to a CCTV Finance report on May 8, the reporter found after visiting that the prices of gold jewelry in many stores in Beijing have been raised rapidly in the near future, approaching 600 yuan/gram.

A number of staff told reporters that the price has risen rapidly recently, and many consumers feel caught off guard and regret not buying in time. Luckier consumers have already bought gold when the price is slightly lower. In just five months, the price of single-gram gold jewelry has risen a lot. Some clerks even said that sometimes it increased by 7 yuan per gram in one day.

Industry insiders believe that the recent rise in gold prices is mainly affected by multiple factors.

Sales are booming, approaching 600 yuan per gram

According to a report by CCTV Finance and Economics on May 8, in a gold jewelry sales store in Xicheng District, Beijing, there are all kinds of gold jewelry on display at the counter, and there are crowds of people in front of the counter, and many consumers are buying gold jewelry.

The staff told reporters that the price of gold has been rising recently, and the price of pure gold jewelry in stores has risen to 572 yuan per gram. Although the price has risen, the enthusiasm of consumers to buy has not been greatly affected, and some consumers are worried that the price will continue to rise, so they rush to buy gold at this time.

The pricing of gold jewelry is equal to the basic price of spot gold plus processing fees. After visiting, the reporter found that the prices of gold jewelry in many stores in Beijing have been raised rapidly in the near future, approaching 600 yuan/gram. The data shows that the spot gold price has risen significantly since November last year. Although there was a correction in February this year, the latest price today is still 25% higher than that in early November last year.

A clerk at China Gold’s Beijing Oriental Xintiandi store said: The price of gold has risen very fast in the two or three months since it broke through 550 yuan/gram. Now it has broken through 580 yuan/gram, and sometimes it has risen by 7 yuan/gram in a day.

Some consumers in Beijing expressed that they thought about buying some gold to prepare for appreciation, but at that time they felt that the price of gold was quite high, so they never bought it, but they did not expect that the price of gold has been rising recently.

A number of staff members told reporters that the price of gold jewelry has risen rapidly recently, and many consumers feel caught off guard and regret not buying it in time. Luckier consumers have already bought gold when the price is slightly lower. In just five months, the price of single-gram gold jewelry has risen a lot.

In this regard, Zhang Yingying, deputy director of COFCO Qidefeng Commercial Derivatives Department, analyzed that: the speedup is mainly due to the acceleration of the rise in the basic gold price of the international gold price, and not only the speed of rise is accelerated, but the extent of the rise is in the short term It is also very large, prompting gold shops selling jewelry to raise prices rapidly.

Nearly 10,000 yuan in repurchase of 100g gold bars

According to a report by CCTV Finance and Economics on May 8, in many gold retail stores in Shuibei, Shenzhen, the reporter found that, in addition to consumers who came to choose gold jewelry, those who came to the repurchase window to cash in with their previously purchased investment gold bars and gold jewelry There are also many consumers.

Consumer Mr. Zhang: Around March 2021, I bought a 100-gram gold bar. At that time, the price of gold was a little over 350 yuan per gram. Now the price of gold has increased by about 100 yuan per gram, so I thought about selling it. , the income is about 9800 yuan, which is quite satisfactory.

A person in charge of a gold recycling company told reporters that since March this year, affected by the continuous rise in gold prices, their company’s recycling business has grown significantly, especially the recycling volume of investment gold bars has doubled.

An Dixu, general manager of a gold recycling company in Shenzhen, Guangdong: In April, our orders increased by 600% compared with the previous year, which is a relatively large increase. According to the number of orders in the first week of May, it is estimated to be the same as that in April. The gold recycling category mainly includes precious metal wealth management gold bars sold by banks and gold jewelry sold by various brands.

In addition to recycling and cashing out, many consumers are optimistic about the follow-up performance of gold prices and choose to trade in old gold for new gold and continue to hold it. Affected by this, the trade-in business of many gold stores has seen a substantial increase.

China’s central bank increases gold holdings for sixth straight month

On May 7, the central bank released data showing that China’s gold reserves at the end of April were 66.76 million ounces, an increase of 260,000 ounces from the previous month, marking the sixth consecutive month of increase. Since the People’s Bank of China started this round of additional gold purchases in November last year, the central bank’s gold reserves have increased from 62.64 million ounces to 66.76 million ounces at the end of April this year, with a cumulative increase of 4.12 million ounces.

According to data from the World Gold Council on May 5, central banks and other institutions purchased 228 tons of gold in the first quarter, a year-on-year increase of 176%. Looking forward to 2023, the investment demand for gold will become the protagonist. The association believes that gold investment demand will continue to grow healthily this year, while gold manufacturing demand (including gold jewelry and technology gold) will remain relatively stable. Central banks around the world are likely to continue to buy gold aggressively in 2023, although the volume of purchases may be lower than the record set in 2022. In addition, there is likely to be modest growth in both global gold mine production and gold recycling.

According to a report by the Economic Daily on May 9, Wang Lixin, CEO of the World Gold Council in China, said that investment demand for gold bars and coins in China has increased significantly. In the first quarter, the sales volume of gold bars and gold coins totaled 66 tons, a year-on-year increase of 34% and a month-on-month increase of 7%.

“The next second quarter is the traditional off-season for gold demand, but the performance of gold physical investment demand in the second quarter of this year may exceed that of the same period in previous years.” Wang Lixin believes that on the one hand, the continued recovery of China’s economy may be conducive to the overall growth of gold consumption; On the other hand, global geopolitical and financial market risks remain high. Against the backdrop of historically high household savings propensity and central banks of various countries continuing to buy gold, investors may pay more attention to safe-haven assets such as gold.

“On the whole, we will continue to be bullish on the trend of gold in the medium and long term.” Zhao Xiangbin, chief strategist at BRICS, believes that there are three main factors supporting the price of gold in the future: First, the U.S. dollar index will continue to fall as the Fed’s interest rate cut cycle is approaching. , which is positive for gold prices; second, the complex international geopolitical situation will lead to an increase in long-term safe-haven purchase demand; third, the process of “de-dollarization” in many countries around the world is accelerating, and the value of gold will become more prominent in the process.

Disclaimer: The Securities Times strives for truthful and accurate information, and the content mentioned in the article is for reference only and does not constitute substantive investment advice, so operate at your own risk

Download the official app of “Securities Times”, or follow the official WeChat public account, you can keep abreast of stock market trends, gain insight into policy information, and seize wealth opportunities.