Original title: Moutai is fragrant again!The world‘s largest Chinese equity fund has increased its holdings in JPMorgan Chase’s funds for two consecutive months

Summary

[Moutai is fragrant again! The world’s largest Chinese equity fund has increased its holdings by JP Morgan Chase’s funds by more than 7 times for two consecutive months]Morningstar’s latest data shows that the world’s largest Chinese equity fund-UBS (Luxembourg) China Select Equity Fund (USD) increased its holdings in April Kweichow Moutai. Another asset management giant JP Morgan Chase’s fund increased its position in Kweichow Moutai in April, and its shareholding increased by 741% from the previous month. (China Securities Journal)

Kweichow MoutaiIt smells again!

Morning StarThe latest data shows that the world’s largest ChinaStock fund—— UBS (Luxembourg) China Selected Stocksfund(USD) Increased positions in AprilKweichow Moutai。

Another asset management giantJPMorganIts funds have increased their positions in AprilKweichow Moutai, The number of shares held increased by 741% from the previous month.

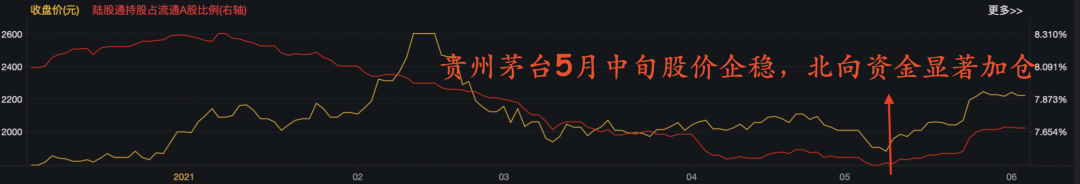

In addition, the northbound funds have recently “snap-up” Kweichow Moutai again, and the share of northbound funds has bottomed out.

Proportion of Kweichow Maotai’s shareholding in capital

The world‘s largest Chinese equity fund will increase its position in April

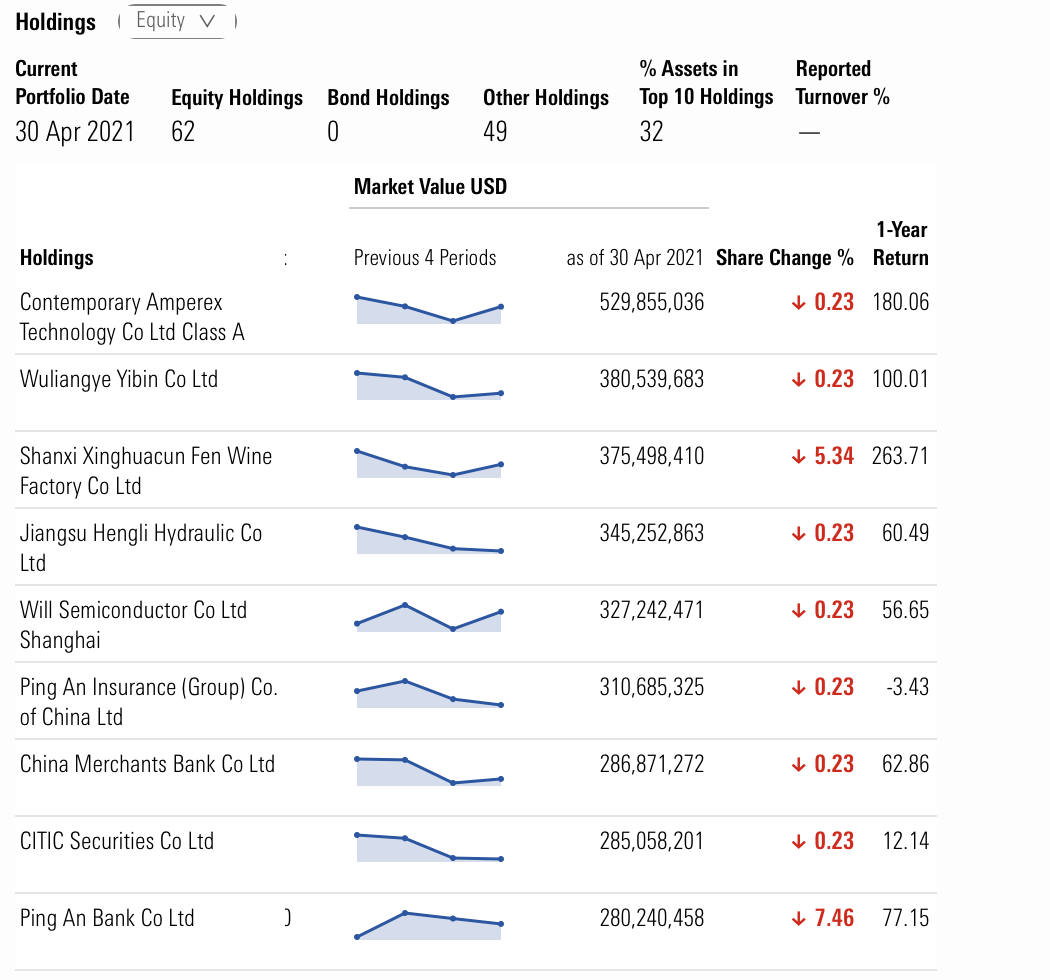

Morning StarData show that the number of Kweichow Moutai shares held by UBS (Luxembourg) China Select Equity Fund (USD) at the end of April increased by 3.39% from the end of March.This fund has also increased its position in the same periodGood future、Tencent Holdings, Hong Kong Stock Exchange andPing An Bank, ReducedAlibabawithPing An of China。

In fact, in March UBS (Luxembourg) China Selected Equity Fund (USD) has increased its position in Moutai, Kweichow.

UBS (Luxembourg) China Select Equity Fund (USD) Top Ten Positions at the End of April

source:Morning Star

In the past two years, there have been many explosive funds in China’s fund industry. UBS Asset Management China Equity Director Shi Bin and the UBS (Luxembourg) China Select Equity Fund (USD) managed by the team are hot Chinese funds issued overseas. This fund was established in 1996. After Shi Bin took over in 2010, the fund has achieved substantial growth. Unlike many hot funds, this fund is not created by “distribution”, but has gradually grown in size over time.

The fund manager Shi Bin has multiple backgrounds in domestic and foreign asset management institutions. He not only adheres to the fundamentals-based stock selection method, but also has a good grasp of capturing high-quality companies in the new economy. He is more appealing among overseas investors.

Some of the largest Chinese equity funds in the world

Source: Morningstar Scale Unit: US$100 million

Liquor faucet is a favorite of foreign giants.

Not only UBS, the European financial giant Allianz Group’s Allianz Investment Fund “Allianz Shenzhou AStock baseGold”, although holdings were slightly reduced in AprilWuliangye, butWuliangyeIt still ranks as the fund’s second largest holding stock, and the largest holding stock isNingde era, The third largest stock isShanxi Fenjiu。

Allianz China A-Share Fund Top Ten Positions at the End of April

Source: Morningstar

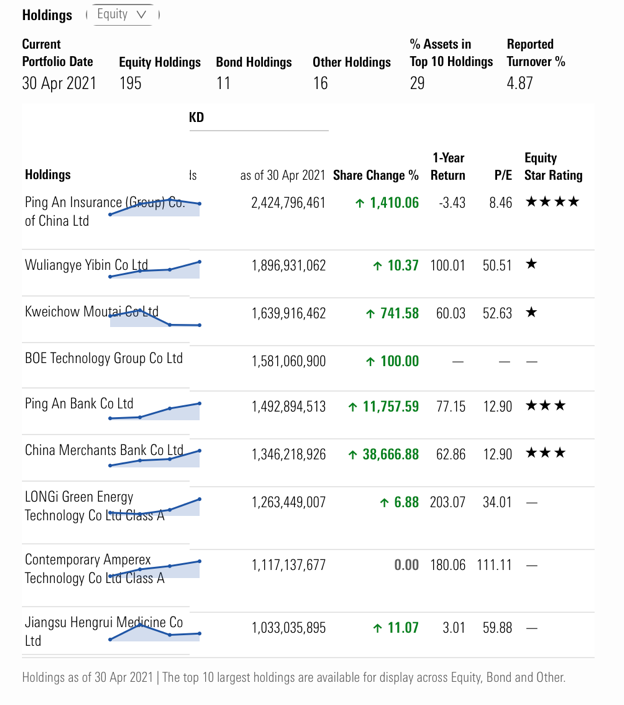

It is worth noting that the fourth largest Chinese equity fund in the world-fromJPMorgan“JPMorgan China A-Share Opportunity Fund” in AprilWuliangye. At the end of April, the number of shares in Kweichow Moutai held by the Fund increased by approximately 742% from the previous month, and the number of shares held by Wuliangye increased by 10%.No. 1 Awkward StockPing An of ChinaThe number of shares increased by 1410.06% from the previous month. Morningstar data shows that the latest scale of the fund exceeds RMB 50 billion.

As of the end of April, the market value of Wuliangye held by “JPMorgan China A-Share Opportunity Fund” was approximately HK$1.897 billion (approximately equivalent to RMB 1.565 billion), and the market value of its holdings in Kweichow Moutai was approximately HK$1.64 billion (approximately RMB 1.353 billion). .

Top ten positions of JPMorgan China A-share Opportunity Fund at the end of April

Source: Morningstar

UBS is optimistic about the A-share market outlook

At the end of May, Liu Mingdi, head of strategy at UBS China, expressed a view that a large amount of funds existed off the market as commodity prices and cryptocurrency corrections, and concerns about profit margin pressures eased. She believes that in the upcoming quarter, the onshore stock market may provide more room for upside than the onshore bond market.

UBS Securities A Share StrategyAnalystMeng Lei published a report on China’s stock strategy in early June, stating that entrepreneurs are optimistic about sales revenue and profit margins.profit predictionProvide strong support.

According to Meng Lei, the UBS Evidence Lab conducted the eighth round of the survey of Chinese entrepreneurs on 531 Chinese companies from March 30 to April 12, 2021. Respondents’ expectations for sales revenue have further improved. 72% of respondents expect sales to increase in the second half of 2021, which is higher than the 59% in the previous survey. From a weighted average point of view, the interviewed companies expect revenue growth in the second half of this year to be about 30%. He expects MSCI China,CSI 300Earnings per share of the Hang Seng Index and the Hang Seng Index will increase by 17%, 17% and 16% respectively in 2021.

Related reports:

Facing 2.8 trillion Moutai’s large overseas funds, there are “disagreements”!The world‘s largest Chinese equity fund increases its position vs. the foreign fund holding the most Moutai but it is reducing its holdings

(Source: China Securities Journal)

(Editor in charge: DF070)

Solemnly declare: The purpose of this information is to spread more information, and it has nothing to do with this stand.

.