In the field of Pre-REITs that have not yet met the issuance conditions, some companies have begun to intervene in the target projects.

Viewpoint Since the expansion of publicly offered REITs in late June, there has been a wave of asset securitization in China, and C-REITs (i.e. China Real Estate Investment Trusts) have also become one of the focus areas of the capital market.

Taking affordable rental housing as an example, market sources said that during the sale period from August 16 to 17, Hongtu Shenzhen Anju REIT, Huaxia Beijing Affordable Housing REIT and CICC Xiamen Anju REIT received a total of more than 66 billion yuan in subscription funds on the first day of sale. The final offering results were announced on August 18. The offline investor subscription multiples of the three funds reached 130.21 times, 112.29 times and 106.20 times, respectively, hitting a record high.

Some other new players are ready to enter the market with great ambition: on August 12, Baowan Logistics, a subsidiary of Nanshan Holdings, plans to issue public REITs with four logistics parks as the underlying infrastructure projects; on August 15, Dongjiu Xinyi’s “Dongjiu New Economy” REIT” was accepted by the Shanghai Stock Exchange, which is regarded as the first REITs with a private enterprise as the original owner.

C-REITs have gradually expanded their infrastructure sector, allowing the market to see development opportunities. On the one hand, it provides an exit channel for operating properties, subverting the inefficiency and poor liquidity of properties; on the other hand, while attracting more companies to pay attention to existing businesses, it also guides more standardized operations and ultimately stimulates the vitality of the stock. .

At the recently held 2022 Boao Real Estate Forum, “Public offering of REITs will be a disruptive change” has become an important consensus among participating operators and financial institutions. It is an open secret to tap the stock value and build a REITs platform.

In fact, in the field of Pre-REITs that have not yet met the issuance conditions, some companies have begun to intervene in the target projects. Assets that are not included in the scope of REITs, including shopping centers, senior care institutions, and long-term rental apartments, are also considered to have a bright future.

Rental housing REITs are in demand

An important node for the expansion of public REITs occurred on June 29, 2021. The National Development and Reform Commission issued “Document No. 958”, which clearly defined transportation, energy, municipal, ecological and environmental protection, warehousing and logistics, park infrastructure, as well as new infrastructure and guaranteed leases. Housing is included in the pilot. At the same time, explore pilot projects in the fields of water conservancy facilities and tourism infrastructure.

Compared with the NDRC’s “Document No. 586” in 2020, the “Document No. 958” has expanded the pilot program from the Beijing-Tianjin-Hebei region, the Xiong’an New Area, the Yangtze River Economic Belt, the Guangdong-Hong Kong-Macao Greater Bay Area, the Yangtze River Delta, and the Hainan Free Trade Zone to the whole country. Various regions; in terms of industry scope, new energy, water conservancy, tourism infrastructure, and affordable rental housing are added.

As of May 25 this year, the State Council proposed to promote the healthy development of infrastructure REITs, focusing on revitalizing infrastructure in areas such as affordable rental housing. Two days later, the China Securities Regulatory Commission and the National Development and Reform Commission proposed that the issuance of infrastructure REITs for affordable rental housing will help revitalize existing assets, recover funds for the construction of new affordable rental housing projects, and promote the formation of a virtuous cycle of investment and financing.

Affordable rental housing REITs are also an important issue category of the third batch of publicly offered REITs since June 22.

Viewpoint New Media understands that in the past two months, Penghua Shenzhen Energy REIT and China National Railway Construction REIT have completed the issuance and listing. They belong to energy and highway infrastructure REITs respectively; and in August, laterite Shenzhen Anju REIT, China Railway Construction REIT, etc. Huaxia Beijing Affordable Housing REIT and CICC Xiamen Anju REIT are officially on sale.

Huatai Securities stated in the research report that the first three affordable rental housing REITs will take up to 60 days from declaration, acceptance to approval (Hongtu Shenzhen Anju REIT), and the shortest is only 7 days (Huaxia Beijing Affordable Housing REIT). The reason for the rapid advancement is due to the support of policies on the one hand, and the necessity of building affordable rental housing on the other hand.

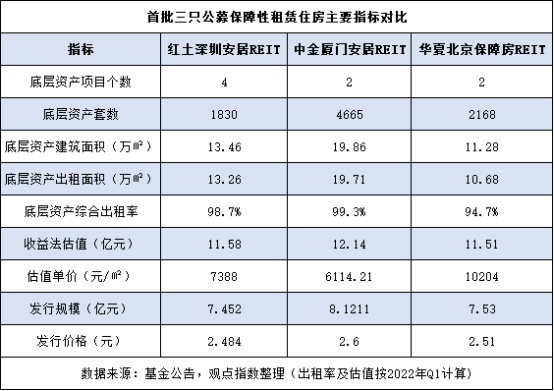

From the perspective of the underlying assets, the affordable rental housing of the above-mentioned three REITs are all located in first- and second-tier cities. At the same time, the public attributes of the project are stronger than the commodity attributes, and the rent is lower than the rent of rental housing in the same area and the same quality market. For example, the rent of Shenzhen talent housing is About 60% of the market level in the same area. This has kept project rent increases limited, which in turn has ensured high occupancy rates.

Due to the inclination of policies to obtain affordable rental housing, such public REITs also have certain barriers to entry. Hongtu Shenzhen Anju REIT mentioned that Shenzhen has a shortage of public housing land resources and barriers to entry that protect the qualifications of specialized housing institutions for talents. Subjects with specialized qualifications can acquire land through agreement.

Even in terms of investment expansion, these REITs also have the advantage of project reserve. Among them, Hongtu Shenzhen Anju REIT currently holds 4 expandable projects, with an estimated investment scale of 5.36 billion yuan, which is equivalent to 4.6 times the asset valuation of the REITs issued this time; Huaxia Beijing Affordable Housing REIT makes it clear that in the future, Beijing Affordable Housing Center will Include qualified rental housing assets in this REITs platform.

According to CITIC Securities, since August 8, Hongtu Shenzhen Anju REIT, Huaxia Beijing Affordable Housing REIT and CICC Xiamen Anju REIT have announced fund share subscription multiples (the multiples of offline offering after excluding invalid quotations) have been as high as 133.03 times and 113.37 times respectively. and 108.96 times.

The agency believes that higher occupancy rates and more stable rents make leasehold REITs have certain anti-cyclical properties, so they can be positioned as “protective” assets in real estate REITs.

Another reason may be related to the current interest rate and credit environment. Ying Hua, director and president of Shanghai Zhongcheng Alliance Investment Management, said that in the past, the issue of CMBS, ABN and other tools had the problem of insufficient yield, so developers often need to subsidize the income. Now that the market has experienced ups and downs, and everyone’s requirements for yield are not so high, it is very suitable to launch REITs at this time.

As of August 17, the above-mentioned three REITs have announced that the public investor offering will end their offering early. According to market sources, due to the active subscription by investors, the total subscription funds of this batch of REITs are expected to exceed 66 billion yuan, compared with only 446 million yuan in total for their public offerings.

players in line

On August 18, Hongtu Shenzhen Anju REIT was the first to announce the results of the fund subscription. The announcement disclosed that this time it plans to sell 300 million fund shares to Zhantou, 140 million shares to offline investors, and 60 million shares to public investors; the subscription price is 2.484 yuan per share.

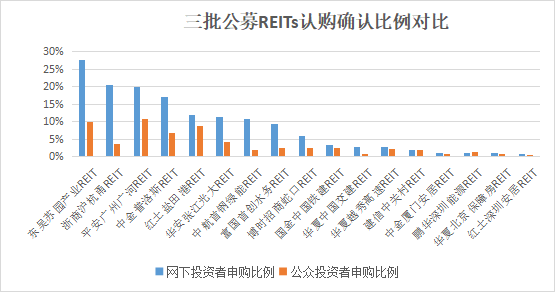

Among them, the valid subscription application confirmation ratio of offline investors of the Fund is 0.76801123%, and the actual confirmation ratio of valid subscription applications by public investors is 0.39315760%. Based on this calculation, the subscription multiples of offline investors and public investors are 130.21 times and 254.35 times respectively.

This is also the record of the highest subscription multiple in China since the first batch of REITs was issued on June 21, 2021. The previous record holder was China Communications Construction REIT, which was subscribed by about 119.50 times of public investors.

On the same day, CICC Xiamen Anju REIT disclosed that the placement ratio of offline investors was 0.94159265%, and the placement ratio of public investors was 0.69140886%, equivalent to 106.2 times and 144.63 times the subscription ratio; the subscription ratio of Huaxia Beijing affordable housing REIT was 112.29 times, 157.38 times.

According to the statistics of Viewpoint New Media, before the release of 3 affordable rental housing REITs, a total of 14 publicly offered REITs have been issued in China, raising more than 54.1 billion yuan. The underlying assets mainly include parks, highways, warehousing and logistics, ecological environmental protection and energy. infrastructure.

From the perspective of subscription, it is not difficult to find that a total of 9 public REITs were issued in the first batch, and the subscription ratio of offline investors and the average subscription ratio of public investors reached 14.94% and 5.63% respectively; the second batch of 3 REITs, these two The average proportion of subscription indicators dropped to 2.38% and 1.65% respectively. The subscription ratio is on a downward trend, reflecting the increasing popularity of the market.

Data sources: Fund announcements, opinion index collation

This “new” boom has also been interpreted as a good financing channel for infrastructure REITs, because public REITs expand traditional debt and debt financing to equity financing, optimize the balance sheet, and convert assets with low liquidity. for securities assets.

Publicly offered REITs also provide infrastructure operators with a project exit channel, thus building a closed-loop industrial chain of “investment, finance, construction, management, and exit”. An industrial park practitioner pointed out to Viewpoint New Media that the cost of a self-built park by a central enterprise is about 800 million yuan, and the valuation can reach 1.5-1.55 billion yuan when it exits through REITs, with a gross profit rate of about 50%.

According to the Shanghai Stock Exchange and Shenzhen Stock Exchange, since the end of May this year, 6 state-owned enterprises including Huadian International, Sinotrans, Entrepreneur Environmental Protection, and China Power Construction have successively carried out the declaration of public REITs, and 3 new enterprises have been added since August alone. On August 12, Nanshan Holdings announced that it plans to use the four Baowan logistics parks in Tianjin, Langfang, Nanjing and Jiaxing as the underlying assets to set up a public fund with an initial valuation of 1.997 billion yuan.

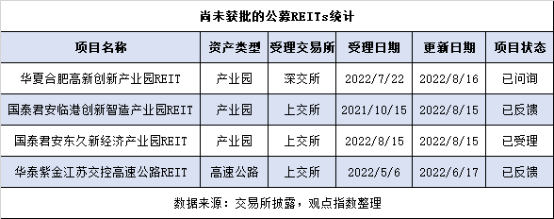

The above-mentioned publicly offered REITs are basically in the pending declaration stage, and they still need to be reviewed and approved by the relevant regulatory agencies, as well as to determine the transaction terms, time arrangement, the scope of infrastructure projects to be included in the pool, and the final establishment plan.

Among the projects that have been declared, there are still 4 public REITs in the approval process, which belong to the infrastructure categories of parks and expressways. Among them, the newly accepted Dongjiu New Economy REIT is the first REITs with a private enterprise as the original owner, and the sixth public REITs of the park type officially accepted in the market.

There have been traces to promote the pilot of privately-owned REITs. On August 1, Yi Huiman, chairman of the China Securities Regulatory Commission, issued a document stating that we should speed up the implementation of affordable rental housing and pilot projects for private enterprises to help accelerate the formation of a virtuous circle of existing assets and new investment.

On August 9, the Chinese government website published an article titled “Actively Expand Effective Investment! The article clarifies that we should promptly launch real estate investment trust fund projects for private investment; promote the healthy development of real estate investment trust funds (REITs) in the infrastructure sector; further improve the efficiency of recommendation and review, and encourage more eligible infrastructure REITs projects to be issued and listed. .

At the recently held 2022 Boao Real Estate Forum, Ge Peijian, Dean of Gemdale Weixin Industrial Research Institute, revealed that the National Development and Reform Commission also held a video conference for Gemdale Weixin. The company has declared 5 parks and has now entered the “project library”. “Public REITs will be a disruptive change in this industry.”

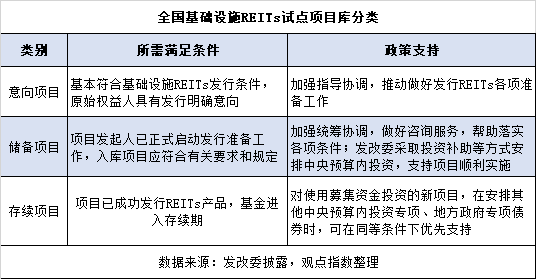

Viewpoint New Media understands that in January 2021, the National Development and Reform Commission decided to establish a national infrastructure REITs pilot project library and include eligible projects into it; among them, the infrastructure REITs pilot projects recommended to the National Development and Reform Commission should be uniformly selected from the reserve library.

The Pre-REITs market is surging

A recent research report released by Industrial Securities pointed out that China has invested heavily in infrastructure construction. At present, China’s infrastructure stock has exceeded 100 trillion yuan, mainly in the fields of transportation, energy, environmental protection, and municipal administration. The needs of revitalizing existing assets, transfusion for new investment, equity financing, and controlling debt ratios have given birth to the development of infrastructure REITs in China.

According to its calculations, even if 1% is converted into REITs, the scale of China’s infrastructure REITs is expected to reach trillions.

When attending the 2022 Boao Real Estate Forum, Goldman Sachs Asia Managing Director Wei Jie mentioned that since the new crown epidemic, funds have been actively flowing into the logistics industry, and C-REITs are gradually opening up to this infrastructure field, which is believed to lead to the development of the industry. New opportunities come. “In the next five years, C-REITs will become an important part of the capital cycle that supports the development of the logistics industry.”

However, public REITs also impose stricter requirements on assets and promoters. According to Document No. 586 of the National Development and Reform Commission, the pilot infrastructure projects need to have clear ownership and clear asset scope, and the project operation time should not be less than 3 years in principle; the overall profitability or operating cash flow will be positive in the past 3 years, and the net cash in the next 3 years will be Stream distribution rate of not less than 4% and so on.

Document No. 586 also clarifies that real estate projects such as hotels, shopping malls, office buildings, apartments, and residences are not within the scope of the pilot program.

Li Wenzheng, general manager of the credit insurance fund REITs platform, has previously used “brand, compliance, and value” to summarize the basic requirements for issuing public REITs. On the one hand, public REITs value the issuer’s own branding ability. On the other hand, many projects are difficult to pass for approval due to non-compliance problems in construction procedures and land use rights.

It further mentioned that public REITs are required to have a scale of at least 1 billion and 2 times the reserve assets at the time of their initial offering, which poses a scale challenge to enterprises. Therefore, to achieve exit through this channel, it is necessary to mine value, operate until the project is mature, and seize the opportunity to form a REITs platform as soon as possible.

Because of the coexistence of opportunities and challenges in the development of public REITs, more and more participants choose to intervene in the front end of the REITs value chain, seeking to invest in projects with the potential to issue fund products in the Pre-REITs segment. Ying Hua, director and president of Shanghai Zhongcheng Alliance Investment Management, said frankly that the future investment opportunities will be in Pre-REITs, and it is necessary to spend energy to find targets in the early stage, otherwise it will be difficult to participate in the later stage.

One of the typical cases involved through Pre-REITs is: In 2017, the Everbright Fund established by Zhangjiang Hi-Tech and Everbright Anshi acquired Shanghai Xingfeng Science and Technology Park, and then changed its name to “Zhangjiang Guangda Park”; Huaan Zhangjiang Everbright REIT, the underlying asset, was listed, becoming one of the first pilot projects of public REITs.

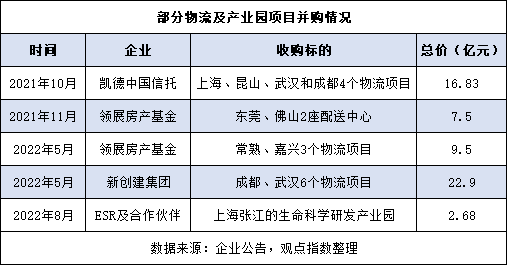

Under this trend, companies that are good at asset management have expanded their investment layout. Since last year, CapitaLand China Trust and Link have successively announced their entry into the Chinese logistics market. ESR has also extended its tentacles to life science-type industrial parks.

In this regard, Zhu Haiqun, Managing Director of Link Asset Management in Mainland China, explained that the development of warehousing and logistics in the Mainland has broad prospects. Link currently has 5 logistics projects and is still very optimistic about the trend of the industry. He also believes that the public REITs policy has the opportunity to be further liberalized, expanding investment categories to shopping malls, office buildings, hotels, pension institutions, etc.

Coincidentally, SVP Yu Hongyin, co-founder of Lehu Group, also believes that once the affordable rental housing REITs are opened, the marketization of (long-term rental apartments) should also open in the foreseeable future. Under this promotion, it may be able to truly enter the first year of leasing development.

Huatai Securities pointed out that many real estate companies are currently accelerating the development of the long-term rental apartment sector, and it is expected to issue REITs through two channels in the future. One is the inclusion of long-term rental apartments into the affordable rental housing system, expanding the scale of the underlying assets of subsidized rental REITs; the other is the second expansion of publicly offered REITs, and a separate long-term rental apartment REITs, which means that the Shanghai and Shenzhen REITs market is developing towards mature REITs The market is one step closer.

According to the development experience of the United States and other countries, public REITs started from the real estate industry and gradually developed into retail, office, residential, hotel, industry, healthcare, warehousing and logistics, infrastructure, data centers and other fields.

Chen Hongfei, President of Everbright Jiabao and Chairman and CEO of Everbright Anshi, mentioned earlier that if REITs are liberalized, the main body of a listed company is actually a typical Pre-REITs.

“For those assets that do not meet the REITs standard, we will put them in the incubation of listed companies, so the potential returns of listed companies will be higher than those of mature REITs. This is the overall business opportunity in the future.”