(CCTV Finance “Punctual Finance”)In the past, the performance of listed companies was mostly disclosed in the form of quarterly and annual reports, but this week, dozens of listed companies disclosed their monthly operating data for the first time at this time. This phenomenon is very rare in the history of A-shares.

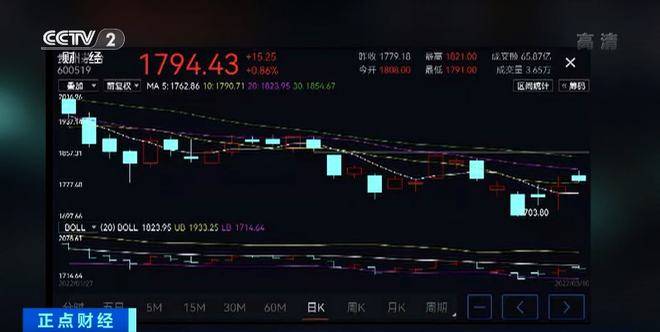

On March 8, Kweichow Moutai disclosed the main operating data announcement from January to February 2022. This is also the first time that Moutai has released monthly operating data since its listing. The announcement shows that from January to February, the company achieved a total operating income of about 20.2 billion yuan, a year-on-year increase of about 20%; the net profit attributable to shareholders of the listed company was 10.2 billion yuan. around 20% year-on-year. After the announcement, Kweichow Moutai rose for three consecutive days, and once regained the 1,800 yuan mark during the session.

Following Kweichow Moutai, as of the close on March 10, there are dozens of listed companies including Shanxi Fenjiu, Tongwei Co., Ltd., Yonghui Supermarket, Pien Tze Huang, WuXi AppTec, Tianci Materials, Shanghai Silicon Industry, etc. Intensive disclosure of their first monthly operating data announcements in their history, the revenue and net profit growth rates disclosed by these companies are both positive. After the data was released, the stock prices of related companies generally showed performance. Among them, Yonghui Supermarket, Yangnong Chemical, and Tianci Materials all closed at the daily limit on the day after the monthly report was disclosed, and the share price of Midian New Materials closed up more than 10% on the day after the monthly report was disclosed. .

Financial commentator: Many A-share companies “spoiler” the warm spring signal

Regarding the phenomenon that many companies are releasing operating data at this time for the first time, Liang Jing, a financial commentator, believes that the current A-share capital market can be said to be in a cold spring. Warm Spring” signal. Is the business good? Is there a future? Speak with facts and speak with data.

It is the first time in history that this group of leading companies has released monthly operating data and key financial indicators. This is different from the “you have to say” stipulated in the previous policy, but it is actively released to indicate “I want to say”. why?

It may be because the current A-share capital market is “green”, which makes people panic, and this kind of “red” rising data, on the one hand, releases a positive “protection signal”, on the other hand, it is also guiding investors to gradually continue their perspective. Back to fundamentals and value investing.

The “Deep V” market this time is actually due to the superposition of multiple negative factors at home and abroad. Therefore, in the current market, some sectors and individual stocks are indeed deviating from the fundamentals, resulting in wrong kills and oversolds. But now, these leading companies have posted very excellent data in the first two months, or even two or three times the year-on-year increase. In fact, they are showing the attitude of “I am very good and will be better”. At the same time, some companies also released shareholding and repurchase plans incidentally, indicating that companies are also using their own real money to release their confidence in the future to the market.

These companies release monthly data, on the one hand, they are “showing off their abdominal muscles”, and more importantly, they are “showing off” their core strength. Whether it is liquor, medicine, new energy or semiconductors, the release of these beautiful growth data for the first two months is just a point. More importantly, they hope to show the market and investors their “future strength” at the current time node. Card”. For example, a chip company listed a capital expenditure budget, indicating that they are still confident in expanding production under the current huge uncertainty. Is this just the loneliness of the company? No, in fact, they have light in their hearts, so they will not panic. Because behind the company is China, which is growing steadily.

Behind the growth data of these leading companies is not only the core strength of the company itself, but more importantly, China’s huge consumer market, the seamless connection of the entire industry chain, and the just-released “Government Work Report” mentioned in All aspects of policies to stabilize growth, these are the confidence that companies are willing and willing to “bet tomorrow”.

Finally, from the perspective of ordinary individual investors, the “spoiler” of such high-quality data can stabilize the military’s morale and boost confidence, so the more the better.

Reprint please indicate CCTV Finance

(Edited by Sun Yonghui)Return to Sohu, see more

Editor:

Statement: The opinions of this article only represent the author himself, Sohu is an information publishing platform, and Sohu only provides information storage space services.