Independent Financial Advisor and Co-Founder of Affari Miei

February 27, 2024

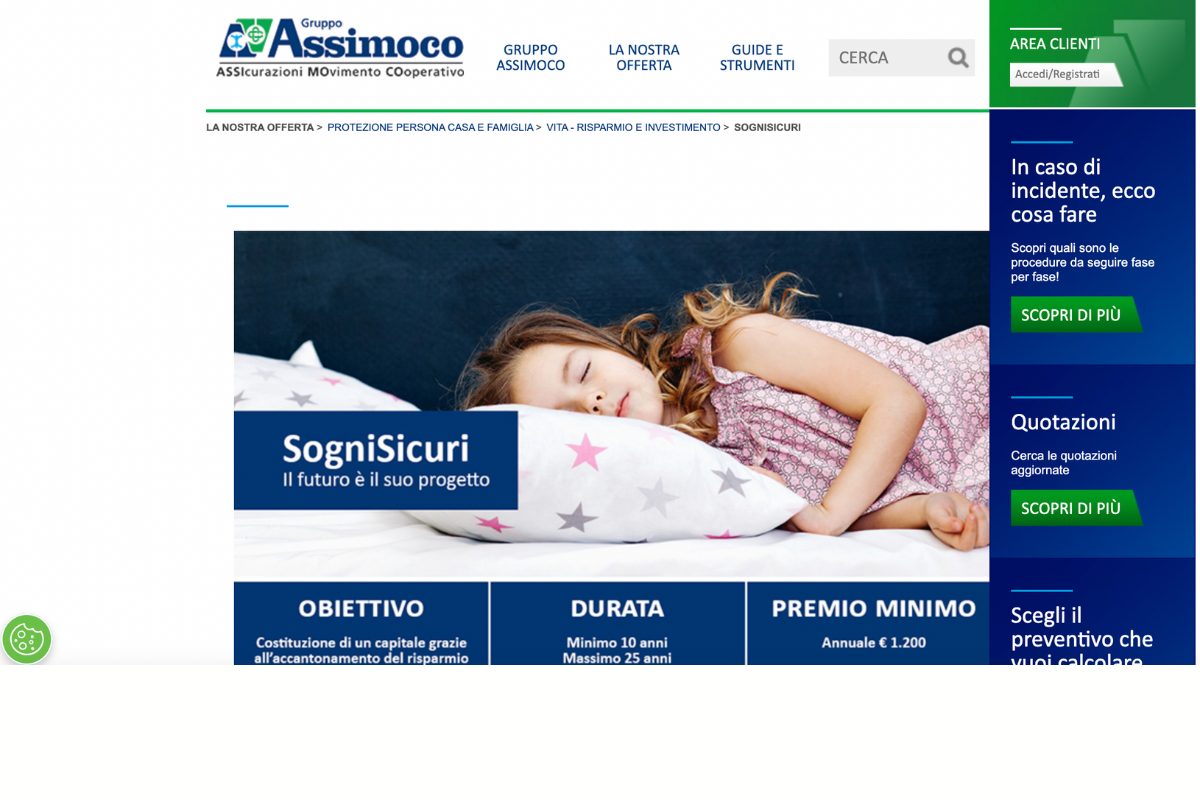

You are looking for detailed information on Assimoco Safe Dreamsthe product dedicated to family with children in order to establish a capital thanks to the accumulation of savings?

If you find yourself in this situation and want some ideas or clarification on how to set aside capital for your child or children, then you are in the right place.

Today we will analyze all of them together characteristics of this contract, focusing on the costsi advantages they disadvantages and at the end of the analysis you will find mine opinions about.

Enjoy the reading!

This article talks about:

Two words about Assimoco

Before proceeding with the analysis of the policy I like to give some information relating to the institution that places it, so as to inform those who are interested.

Assimochus was founded in 1978 and is the first Italian insurance company to have acquired the qualification of benefit company, as well as the first certified B corp.

The company carries out the insurance business in a logical way territorialin which different partners are integrated in a harmonious and cohesive way with the aim of generating fair and sustainable well-being for families, small and medium-sized businesses and third sector bodies in the area.

This is a solid company as well consolidated able to offer trust to all its customers: from this point of view you have nothing to worry about.

Separate management

I haven’t explained something very important to you yet: the investment of this policy focuses exclusively on separate management: in this case it is the separate management of a protected future, to which the product is directly connected.

Il savings that you choose to set aside will be revalued every year thanks to the performance of the separate management: the revaluation can never be negative and remains definitively acquired, consolidating the results achieved from time to time.

The separate management it is an investment suitable for those who do not feel like risking too much, for those who want to warranty of capital and to those who perhaps are not very familiar with the financial markets.

I can tell you with certainty that your savings will be invested in one safe tool.

Don’t know how to invest?

Find out what kind of investor you are. Are enough 3 minutes to discover the best strategy for you.

>> START NOW!

Features of Assimoco Sogni Sicuri

Safe Dreams aims to create a accumulation plan intended for the future needs of the family, especially for the children: we are talking about money that they will be able to use for their studies, or for a stay abroad, or even to buy their first house or to start a professional business.

In case of separation of parents, it offers the possibility of using the accumulated amount for a contribution for the maintenance of children.

The investment, as we have seen, takes place in separate management, so the capital is protected and safe.

It is also an investment accessible since you can start with just €100 a month: just choose the payment frequency and the split.

It’s an investment flexiblegiven that you will be able to choose the amount of the plan, make additional payments and decide when to suspend and reactivate the plan.

The product is also able to accompany the family’s life cycle, as it has time horizons between 10 and 25 years.

The performances

Let’s see what the performance is:

In case of life: when the policy expires, if the insured (who will be one of the two parents) is alive, then the revalued insured capital will be paid to the designated beneficiaries (the parents in equal shares);

In case of death: if the insured dies during the term of the policy, then the company pays the insured and revalued capital to the designated beneficiary (non-contracting partner/accepting beneficiary). The beneficiary must be the non-contracting parent/partner.

The prize

You can activate a scheduled payment plan by choosing theamount and the frequency of the payment plan, based on your needs. You will obviously have to take these limits into account:

Monthly payment frequency: minimum 100 euros, maximum 1,000 euros; Quarterly payment frequency: minimum 300 euros, maximum 3,000 euros; Six-monthly payment frequency: minimum 600 euros, maximum 6,000 euros; Annual payment frequency: minimum 1,200 euros, maximum 12,000 euros.

You can suspend and reactivate the payment whenever you want and change the amount and frequency of payments at any time.

Everything is fine additional payment then it must be at least 1,000 euros and must not exceed double the last agreed recurring premium calculated on an annual basis, with a maximum limit of 12,000 euros.

Who is the contract addressed to?

As we have seen, the policy is designed for families with children who want to set aside and set aside money for their children’s future and to achieve certain goals.

The duration of the contract

The contract ranges from a minimum of 10 years to a maximum of 25 years.

When you sign up for the policy you must be between 18 and 65 years old, and at most 90 years old at maturity.

The risk

Il risk level for this policy it is equal to 2 on a scale ranging from 1 to 7: we are in the low risk level.

What does it mean? It means that it is very unlikely that poor market conditions will affect Assimoco’s ability to pay you what you owe.

I remind you that the risk indicator assumes that the product is maintained for at least 10 years.

The costs of Assimoco Sogni Sicuri

Let’s now analyze the part of costswhich is one of the most important parts to consider.

I advise you to read the carefully KID to find out what costs you will have to bear if you disinvest early or even to better understand the costs that will impact your returns.

Here, however, I will give you an overview and list the commissions that refer to this policy.

I entry costs are equal to €30, and must be paid at the time of signing up for the premium, while €1 will be the amount for subsequent premiums. 2% of the premiums paid net of fixed costs are also added.

I exit costs they refer to redemption costs and we will see this later in the dedicated paragraph.

The management fees amount to 1.20%, and this sum is withheld annually from the return of the separate management.

Revocation and withdrawal

For this policy the revocation is not foreseen, so you will not be able to revoke the contract.

As regards the withdrawalyou can withdraw from the contract within 30 days from the moment it is concluded by sending a communication via registered mail.

When the company receives your request, within 30 days it will refund you the premium paid net of issuing costs.

The ransom

When at least 12 months have passed from the effective date, you will be able to redeem the policy totally or partially.

The value of total redemption is equal to the insured capital revalued up to the date of the redemption request, while instead the partial redemption it can be exercised as long as the amount redeemed is not less than €1,000 and as long as there is a residual amount of not less than €1,200 on the contract.

Il special redemption however, it is only possible following the personal separation of the parents, upon presentation of a written request to which the necessary documentation for the settlement will be attached.

I costs of redemption are equal to 3.50% for ordinary redemption requested in the second year, 3% for redemption in the third year, 2% in the fourth year and 1% in the fifth year.

Don’t know how to invest?

Find out what kind of investor you are. Are enough 3 minutes to discover the best strategy for you.

>> START NOW!

Opinions of Affari Miei on Assimoco Sogni Sicuri

Now that we have seen all the characteristics of the contract we can move on to conclusions.

I’ll give you mine opinions general and I will help you think.

What I will tell you is a general discussion because I cannot tell you specifically whether this product is worth it or not; I don’t know your personal and financial situation.

But since this is a policy designed for the family, allow me to speak to you as parents.

If you are really looking for a product that can be used to set aside and revalue capital to then leave to your children for their dream or an important project, allow me to make you think.

Are you sure that a policy of this type, which invests in a separate management, is the best solution?

Yes, of course, by investing in a separate management you will have the safety of capital and a safe investment, but if you really want to aim for a good revaluation, have you thought about the possibility of making a PAC?

A PAC is a capital accumulation plan which, in essence, operates more or less like this policy: you will choose the frequency of payment, the duration, and the amount of the installments, only that you will be able to count on lower costs and you will have much less constraints.

Personally, I’m not a big fan of insurance: this product, like others, invests in separate management and is therefore classified in the world of safe investments.

Given that it is a safe investment, it is obvious that you cannot aim for exciting returns.

This is why I can show you due alternative:

Before I let you go I also want to leave you some guide which could be useful to start your investment journey in the best possible way:

Happy reading and good investments!

Find out what kind of investor you are

I have created a short questionnaire to help you understand what type of investor you are. At the end, I will guide you towards the best contents selected based on your starting situation:

>> Get Started Now