Back to year zero

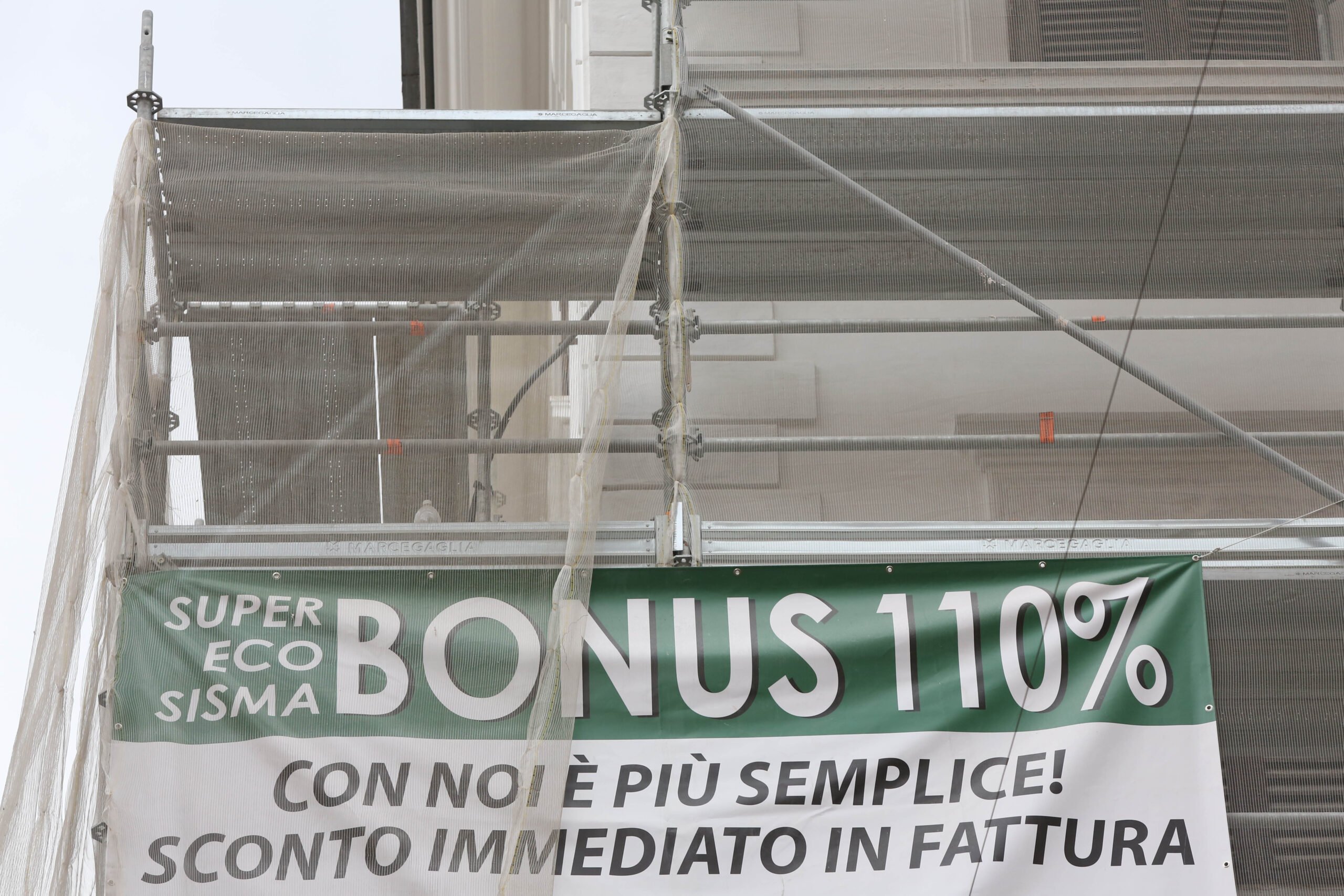

February 17 marks the watershed for building bonuses. On that date, the latest decree on the subject of Superbonus came into force, putting an end to the transfer of credit and the discount on the invoice. “The bonuses all remain exactly as they were before this decree, but in the version used in the tax return”, as he explains Salvatore Regalbuto, treasurer and member of the national council of accountants with responsibility for taxation. Back to before May 2020. An example? The Ecobonus will have a deduction of 50 or 65%, depending on the type of intervention, and the tax payer will be able to benefit from the relief over ten years.

However, the end of the credit transfer and the invoice discount clearly makes the incentives much less powerful. “The reason lies in the fact that all the incompetent have difficulty in carrying out the interventions especially when it comes to very large amounts. In fact, by paying a low tax or sometimes not paying it at all, they have nothing from which to deduct” continues the expert.

“What changes with this decree is the watershed date between those who have the previously issued qualification, therefore having presented the Cilas, the Scia or the Cila, will be able to continue to transfer the credits and those who have not presented the qualification will no longer be able to opt for the transfer of credit” he adds.

The rules for free construction work are unclear

As Regalbuto explains, for works for which it is not necessary to present the permit, it will then be necessary to demonstrate that the works started before February 17th. How will this be proved? And here’s where the problem lies: the rules of engagement aren’t clear.

“At the moment, the only thing that can be done is prove the start date of the works with all the necessary paperwork, such as the preliminary notification for safety regulations. Alternatively, there could also be a self-certification in which the beneficiary of the deduction will assume civil and criminal liability for indicating the start date of the works ”he adds. However, this last option is currently only a working hypothesis. The methods by which to provide proof of the start date will in all likelihood be defined by the Revenue Agency.

Without assignment of credits, uninteresting bonuses for those with no income

“The real bazooka of decree 34/2020 was the possibility of opting instead for the deduction, for the transfer of the credit and for the discount on the invoice. This meant that the taxpayer who did not have the capacity to file his tax return could still count on someone who would have bought his credit” the expert specifies.

“By eliminating the transfer of the credit and the discount on the invoice, not paying tax, a very frequent case among pensioners with little income, or paying very little, it is difficult to make large-scale interventions because there are no taxes that can be deducted from the deduction at the tax return,” he adds. “And above all maybe even if I have the tax capacity, I must have the money to finance the intervention, while with the discount on the invoice, the financing was effectively done by giving the credit to the supplier who did the work” he underlines.

What could happen at this point?

“In perspective, what could happen, if there is political will, is to try to reintroduce the transfer of credit at least for those who have less income because otherwise they would be cut off from the bonuses” he explains. “With the bowls still, having closed this season, where the transfer of credit has been overused, it will be necessary to understand if and how it will be possible to reintroduce the transfer of credit and the discount on the invoice” specifies Regalbuto.

“At the gates there is an important intervention to improve the energy efficiency of our buildings, built between the 50s and 90s and therefore underperforming or even historic buildings. So if you want to keep up with this promulgated provision of the European Union, you will necessarily have to politically find a way over time to accompany this path. And to accompany it for the incompetent there is no other solution than a mechanism like the one that was there ”he concludes. Perhaps with corrections such as, for example, an annual ceiling. As for fraud, on the other hand, they have now been curbed by the 2021 decree, issued by the Draghi government thanks to the controls of technicians, accountants and also of the banks that buy tax credits.