On February 22, the Beijing Stock Exchange ushered in the “100th birthday”: from the opening of the market on January 15, 2021 to today, the Beijing Stock Exchange has been running smoothly for just over 100 days.A series of reports jointly released by the Beijing Stock Exchange and the National Equities Exchange and Quotations recently showed that the Beijing Stock Exchange’s “leading leverage” role has gradually come into play. The turnover rate is 434%; the average annual growth rate of North Exchange stocks in 2021 is 99%, and the number of investors has exceeded 4.8 million at the end of January.fundActively enter the market.

The report shows that in 2022, the New Third Board and the Beijing Stock Exchange will adhere to the general principle of keeping the word at the forefront and seeking progress while maintaining stability, with the reform year and service year as the main line, to further consolidate and deepen market characteristics, enhance market functions, and optimize market ecology. Maintain the good development momentum of the market and continuously improve the market’s ability to serve the innovative development of small and medium-sized enterprises. Many experts believe thatThe Beijing Stock Exchange has sufficient late-mover advantages and needs to invest for a long time according to its own characteristics. Among them, the “little giants” specializing in specialization and new ones have the advantage of valuation.

The market ecology has undergone fundamental changes

The report jointly issued by the Beijing Stock Exchange and the New Third Board shows that under the leverage of the “leading” of the Beijing Stock Exchange, the market is operating steadily and improving, market functions are further restored, market resilience is further enhanced, market confidence is further boosted, and market ecology has emerged. Fundamental changes have been made, and the results of the reform are constantly emerging.

The data shows that the Beijing Stock Exchange has played a significant role in leading and demonstration. Since the opening of the market, the average daily turnover has increased by 3 times compared with that of the selection layer before the reform. The average daily turnover rate is 1.8%, and the overall annualized turnover rate is 434%, which is in line with small and medium-sized stocks. Liquidity characteristics; the average annual growth rate of stocks reached 99%, and the average price-earnings ratio was 47 times; the market depth increased, transaction costs were reduced, price resilience was enhanced, and transaction quality was significantly optimized. The innovation layer and the basic layer were effectively driven, and the annual transaction increased by 20% year-on-year, all 10 indexes rose, and the valuation and pricing ability was improved.

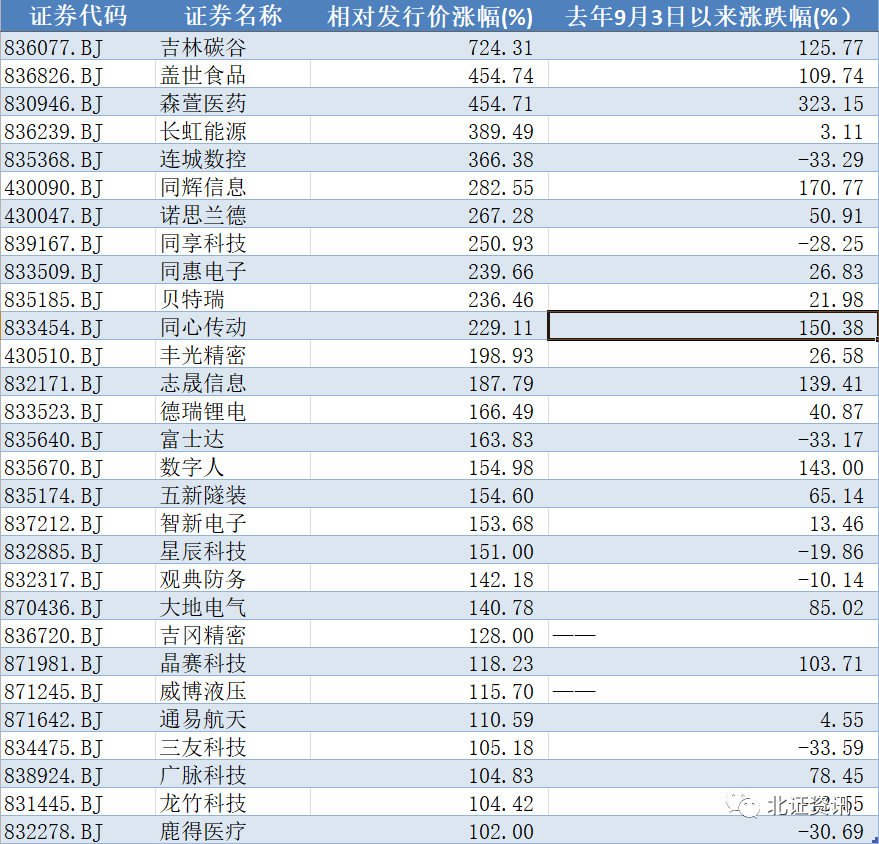

Since the high-profile official announced on September 2 last year that the North Exchange would be established, select-tier stocks have set off a wave of gains. On the basis of the large increase in the early stage of the translation of the selection layer, it is not surprising that the total market value of the North Exchange stocks has dropped after the opening of the market. Extending the time to September 3, 2021, 66 select-tier stocks rose like a rainbow at that time, and 42 have closed with positive gains today, of which 8 have increased by more than 50%. The increase of 323.15% topped the list, and the range increase of Tonghui Information, Digital Human, Jilin Carbon Valley, and Geishi Foods also exceeded 100%.

In fact, judging from the current stock price rise and fall compared to the issue price, it can be seen that which stocks are sought after by investors. Statistics show that among the 84 stocks on the Beijing Stock Exchange, 58 have recorded an increase in their share price from their issue price since their listing to the close of the day, accounting for nearly 90%, of which 22 have doubled their share price, accounting for about 33%. Carbon Valley’s share price rose by 7.24 times compared to the issue price; Gasgoo Foods and Senxuan Pharmaceutical both rose by more than 4.5 times; Changhong Energy, Liancheng CNC, Tonghui Information, and Northland also rose by more than 2 times.

According to reports, as of the end of 2021, the number of investors in the whole market exceeded 4.76 million, a year-on-year increase of 1.9 times; more than 100 public funds were traded in the market, and 8 newly established theme funds were all over-raised.social securityfund,QFIIAll have entered the market, and institutional investors have accelerated their deployment, laying a logical foundation for long-term investment and value investment in the market.

As of the end of January this year, the average daily turnover rate of the North Exchange market was 2.00%, and the number of investors exceeded 4.8 million. More importantly, the confidence of all parties in the market has been effectively boosted, and the market popularity has continued to increase. 96% of the companies are full of confidence in the future development of the New Third Board and the Beijing Stock Exchange.

On the other hand, in 2021, the whole market will issue 598 times, raising a total of 28.1 billion yuan. Among them, 41 companies have raised 7.5 billion yuan through public offerings, and 2 companies listed on the Beijing Stock Exchange have started refinancing, continuing to meet the large and efficient financing needs of enterprises; 532 companies have completed 557 directional issuances and raised 20.6 billion yuan, of which self-financing It has conducted 122 issuances and raised 1 billion yuan. The amount of proposed issuance and raised throughout the year increased by 55% year-on-year, and the function of small, fast and on-demand financing was further exerted. Since the announcement of the establishment of the Beijing Stock Exchange, the efficiency of public issuance has been significantly improved, and the share subscription ratio has doubled; the structure of directional issuance has been optimized, and the proportion of the subscription amount by external investors has increased by 16 percentage points.

Explore the new pattern of multi-level capital market

The report believes that the Beijing Stock Exchange and the New Third Board insist on serving innovative small and medium-sized enterprises, and the market positioning is earlier, smaller, and newer, forming a dislocation pattern with the main board, the Science and Technology Innovation Board, and the ChiNext to enhance service synergy.

The report shows that the Beijing Stock Exchange and the New Third Board jointly constitute the main carrier for serving innovative small and medium-sized enterprises. On the one hand, it adheres to the progressive level, and the listed companies of the Beijing Stock Exchange all come from the innovation layer of the New Third Board, forming a pyramid-shaped market structure; on the other hand Adhere to interconnection, establish a transfer docking mechanism with Shanghai and Shenzhen Stock Exchanges and regional equity markets, and play a role in connecting multi-level capital markets. The market characteristics of connecting up and down and connecting inside and outside make enterprises more willing to develop upwards and enhance their market attractiveness. Since the announcement of the reform, the number of listing applications has increased by 46% year-on-year; nearly 90% of the newly listed companies with new listing guidance plan to apply for the Beijing Stock Exchange. During the market stratification process in 2021, 96% of eligible basic strata companies applied to enter the innovation stratum, the highest level since the implementation of the stratification system. Throughout the year, 3 companies submitted applications for transfer to the Science and Technology Innovation Board and ChiNext, and 3 companies quickly completed the listing of the New Third Board through the green channel of the regional market.

Thus, open sourcesecuritiesthink,The transfer system with the New Third Board and the Beijing Stock Exchange as the core has been initially completed, and a transfer system covering the whole market can be gradually established. Compared with mature capital markets, the links between domestic capital markets at all levels are not close enough, and a more complete transfer system needs to be established to strengthen the links between capital markets at all levels and improve the efficiency of resource allocation in capital markets. In order to avoid the problems of overheating and regulatory arbitrage caused by the transfer of a large number of companies in a short period of time, the principle of prudence must be considered when promoting the construction of the transfer system. Realize the transfer system covering the whole market.

Zhang Aoping, a well-known economist and dean of the Incremental Research Institute, believes that due to the issuance and listing system, continuous financing system,M&AreorganizationA number of key institutional innovations, such as system, trading system, member management system, investor access system, continuous supervision system, delisting system, and board transfer system, have sufficient late-mover advantages compared to the Shanghai and Shenzhen Stock Exchanges. For entrepreneurs and investors, only by understanding the institutional innovation of the Beijing Stock Exchange and seizing the current critical opportunity period of the Beijing Stock Exchange can they share the long-term development dividends brought by the Beijing Stock Exchange.

Zhang Aoping suggested thinking about the value of the Beijing Stock Exchange through longer-term thinking. It said,NasdaqSimilar to the current Beijing Stock Exchange transfer system, inNasdaqListed companies can choose to transfer to the New York Stock Exchange.but withNasdaqThe follow-up development of the market, as well as the layered system (the Nasdaq market is currently divided into: Nasdaq Global Select Market, Nasdaq Global Market, Nasdaq Capital Market), market maker system, etc. System Innovation,Apple、Microsoft, Google and many other world technology giants did not choose to transfer to the New York Stock Exchange. The essential reason behind it is the “gene” (serving innovative SMEs) of Nasdaq at the beginning of its establishment, the continuous innovation of the system, and the stable and effective development of the market assets and capital. He said that although the Nasdaq cannot be simply compared to the North Exchange, the innovative development of the North Exchange is an inevitable requirement for the high-quality development of China’s economy. Adequate late mover advantage.

Specialized special new “little giant” has a valuation advantage

Zhou Yunnan, a senior New Third Board commentator and founder of Beijing Nanshan Investment, believes that 2021 will be a milestone year for the Beijing Stock Exchange, the New Third Board and even my country’s multi-level capital market. The report is an official report on the Beijing Stock Exchange in the past year. , A comprehensive summary of the comprehensive deepening of reforms and the pursuit of high-quality development on the New Third Board is a clarion call for a new journey in the new year.

Zhou Yunnan said,“Carrying out the reform to the end” will continue to be the next core work of the New Third Board. It is hoped that the “six continuous” will be strengthened, that is, the continuous improvement of the basic system, the continuous growth of the financing amount of listed companies, the continuous enlargement of market transactions, and the continuous expansion of qualified investors. The continuous increase of IPOs, the continuous entry of OTC funds, and the continuous increase of intermediary service agencies have comprehensively enhanced the overall activity of the NEEQ market.

According to Zhang Aoping,Since the official opening of the Beijing Stock Exchange, the comprehensive registration system reform has once again taken a substantial and critical step, making up for the difficulty in the Chinese capital market to help “earlier, smaller and newer” companies achieve financing and development, and allow investors to The function of investing in sharing the growth dividends of early-stage high-growth companies is missing.

Reports from the Beijing Stock Exchange and the National Equities Exchange and Quotations show that the Beijing Stock Exchange and the New Third Board insist on serving innovative small and medium-sized enterprises, and their market positioning is highlighted earlier, smaller, and newer. Service together. By the end of 2021, there are 6,932 companies listed on the New Third Board, and more than 1,000 companies that meet the financial conditions for listing on the Beijing Stock Exchange. A total of 783 companies in the whole market have been awarded the “Little Giants”, 59 companies have grown into “Single Champions”, and 65 companies have won the National Science and Technology Award since 2017. The functions of national strategies such as service innovation-driven development and economic transformation and upgrading have become more prominent.

Wanliansecuritiesthink,Combined with financial data and valuation levels, the value of the Beijing Stock Exchange’s corporate allocation is prominent, especially the Beijing Stock Exchange’s “little giants” that have the advantage in valuation. As of February 16, among the three batches of specialized and special new “little giants” announced by the Ministry of Industry and Information Technology, 17 companies from the Beijing Stock Exchange were listed. The average PE-TTM of these 17 companies is 31.22 times, and the average PE-TTM of non-specialized, new and small giant companies is 27.94 times. At present, the valuations of specialized, specialized and new companies and non-specialized new companies on the Beijing Stock Exchange are not obvious. difference. For the Beijing Stock Exchange’s “little giant” companies with high growth potential, high market share and policy support, the current valuation advantage is significant and deserves special attention.WanliansecuritiesIt is suggested to focus on two tracks in the industry configuration: First, the transformation and upgrading of the manufacturing industry continues to accelerate, and highlights in the high-end manufacturing segment are emerging; the second is innovation leading the construction of a powerful country in science and technology, and the information technology track will improve in the long run.

(Article source: Securities Times)