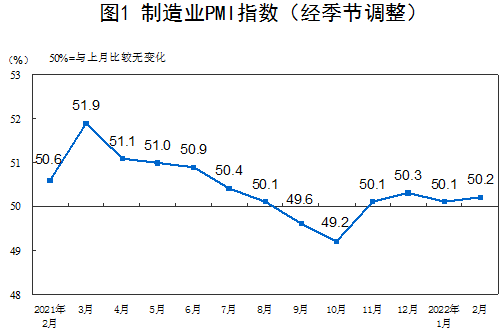

On March 1, the National Bureau of Statistics announced that in February, China’s manufacturing purchasing managers’ index (PMI) was 50.2%, an increase of 0.1 percentage points from the previous month, and continued to be higher than the threshold. The level of manufacturing prosperity rose slightly.

Image source: National Bureau of Statistics

The data also showed that the non-manufacturing business activity index and composite PMI output index for the month were 51.6% and 51.2%, respectively, which continued to be in the expansion range, 0.5 and 0.2 percentage points higher than the previous month.

Image source: National Bureau of Statistics

The “Daily Economic News” reporter noted that this is the fourth consecutive month that the PMI has been on the 50% line of growth and decline.

Zhao Qinghe, Senior Statistician, Service Industry Survey Center, National Bureau of StatisticsIt is pointed out that the relevant data shows that my country’s economy continues to maintain the momentum of recovery and development as a whole, and the prosperity level is stable and rising.

New orders index picks up

The “Daily Economic News” reporter noticed that the PMI in February rose slightly compared with January. Experts believe that February includes the Spring Festival holiday, but the data still rises. This phenomenon is relatively rare, and the reason behind it is the rebound in demand.

Li Qilin, Chief Economist of Hongta SecuritiesIt was pointed out to reporters that in previous years, the PMI in the month of the Spring Festival was often downward, and only slightly increased in 2015. This month’s manufacturing PMI was able to recover by 0.1 percentage points, mainly due to the recovery in demand. Sub-item data show that the new orders index in February was 50.7%, up 1.4 percentage points from the previous month, returning to the expansion range.

Zhao Wei, Chief Economist of Sinolink SecuritiesAccording to the analysis of the “Daily Economic News” reporter, the data showed that new export orders in February rebounded by 0.6 percentage points to 49%; new orders improved, some of which came from upstream black chains, non-ferrous chains, midstream general and special equipment manufacturing, and downstream textiles Clothing and other prosperity rebounded.

Zhang Liqun, special analyst of China Federation of Logistics and PurchasingIt is also emphasized that, considering the impact of the Spring Festival holiday factor on the production and operation activities of the manufacturing industry, comprehensive research and judgment shows that the economic recovery is relatively strong, which is mainly due to the accelerated implementation of policies related to stabilizing growth.The new orders index rebounded, indicating that market demand has picked up.

The cost of raw materials for enterprises is rising rapidly

The itemized data also shows that current companies are expected to continue to pick up. Zhao Qinghe combined data analysis and said that after the Spring Festival, manufacturing production activities have gradually returned to normal. Recently, relevant departments have introduced a series of policies and measures to promote the steady growth of the industrial economy. The market expectations of enterprises have been further improved. The production and operation activity expectation index is 58.7%, higher than the previous Monthly 1.2 percentage points, rising to a recent high.

From the perspective of the industry, the production and operation activity expectations index of the 21 industries surveyed are all in the boom range, among which the non-ferrous metal smelting and rolling processing, automobile, electrical machinery and equipment and other industries have been in the high boom range of more than 60.0% for two consecutive months. Enterprises in related industries Strong confidence in the recent market development.

However, at the same time, the “Daily Economic News” reporter also noticed that the current PMI sub-item data reflects that companies are under relatively obvious price pressure.

Wen Tao, China Logistics Information CenterThe analysis said,Since the beginning of this year, the prices of basic energy such as coal have shown an upward trend. Coupled with the price fluctuations in the international bulk commodity market, the cost of raw materials for enterprises has risen rapidly, driving the prices of the middle and lower reaches of the industrial chain to rise across the board.In February, the purchase price index of high energy-consuming industries increased by 5.6 percentage points from the previous month to 62.8%, and the ex-factory price index increased by 9.1 percentage points from the previous month to 58.6%, driving the overall purchase price index and ex-factory price index of the manufacturing industry to rise. Monthly increase of more than 3 percentage points. Enterprise surveys show that the proportion of enterprises that reflect high raw material costs exceeds 60%, which is at a relatively high level.

The reporter also noticed that recently, the “Notice on Further Improving the Coal Market Price Formation Mechanism” was released to the public. .

Cover image source: Photo by Xinhua News Agency reporter Mou Yu