Before the US stock market on August 20 (Friday), the three major US stock index futures all fell. As of press time, Dow futures fell 0.51%, S&P 500 futures fell 0.39%, and Nasdaq futures fell 0.14%.

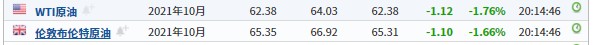

As of press time, WTI crude oil fell 1.76% to $62.38 per barrel. Brent crude oil fell 1.66% to $65.35 per barrel.

Market news

MidlandPresident Powell will deliver a speech on the economic outlook at the Jackson Hole Annual Conference at 10 am local time (10 pm Beijing time) on August 27.In addition, the latest letter shows that U.S. Republican Senator Daynes urged Biden to re-nominate Powell asMidlandChairman Chu.

At 23:00 this evening, Dallas Fed President Kaplan will participate in the “Economic Development and Its Impact”currencyThe “Impact of Policy” is the Q&A session of the online dialogue.

The US Centers for Disease Control and Prevention (CDC) postponed the meeting to review the new crown vaccine booster injection until next week, originally scheduled for August 24, because of the growing debate about whether a third injection is needed.

NYMEX New York crude oil September futures are affected by the shift of positions. The last trading on the floor will be completed at 2:30 am on August 21 and the last trading on the electronic disk will be completed at 5:00 am. In addition, the expiry time of some US oil contracts on some trading platforms is usually one day earlier than the official NYMEX, so please pay more attention.

US Department of Labor and Treasury officials said on Thursday that states can use the funds previously allocated by Congress to state and local governments to fight the epidemic, and continue to pay the unemployed after the epidemic unemployment benefit expires on September 6.

On Thursday, Cathie Wood, the founder of ARK Invest and “Sister Mu”, said that she did not believe that the stock market was in a bubble. She also defended her investment strategy, saying that her macro argument focuses on the currency brought about by innovation. Crunch.

The UK retail sales data in July unexpectedly showed the largest drop since the British economic blockade in January, which indicates that the momentum of the UK’s rapid economic recovery may be weakening.

President of the New Zealand Federal Reserveinterest rateNormalize. New Zealand Prime Minister Ardern: Will extend the nationwide new crown blockade measures for 4 days.

The world‘s second largest lithium producerChile Mining and Chemical Industry(SQM.US) predicts that global lithium demand may increase by more than 40% this year, and sales will exceed 95,000 tons, which is higher than the 85,000 tons predicted three months ago.Global supply tightening should helpChile Mining and Chemical IndustryThe average selling price in the second half of the year rose further.

IHS Markit released a report saying that the global shortage of semiconductors will reduce global automobile production by up to 7.1 million vehicles this year, and the supply interruption related to the epidemic will put the industry in trouble. IHS said in the report that the shortage of chips will not stabilize until the second quarter of next year, and will not recover until the second half of next year.

Important economic data: At 17:30 Beijing time, the annual rate of gold production in South Africa in June (%). At 20:30 Beijing time, the monthly rate of retail sales in Canada in June (%).

Individual stocks

In terms of technology stocks,Apple(AAPL.US) fell 0.12% before the market, Facebook (FB.US) fell 0.25% before the market,Amazon(AMZN.US) fell 0.04% before the market,Microsoft(MSFT.US) fell 0.04% before the market.

Tesla(TSLA.US) rose 1.59% before the market, on AI DAYTeslaEmphasis is placed on the field of artificial intelligence, especially in the training and predictive reasoning of neural networks.

Other new energy auto stocks were mixed,Xiaopeng Motors(XPEV.US) fell 0.37%;Wei Lai(NIO.US) rose 0.14%;Ideal car(LI.US) fell 1.13%;Faraday Future(FFIE.US) rose 2.33%.

Blockchain concept stocks are strong before the market,Bit number(BTBT.US) rose 4.06% to $12.57;Bit Mining(BTCM.US) rose 4.20% to US$6.95; Marathon Digital (MARA.US) rose 1.23% to US$32.20; Riot Blockchain (RIOT.US) rose 1.62% to US$32.60.

Sonoma Pharmaceuticals (SNOA.US) US stocks fell 8.34% before the market and closed up more than 50% yesterday after launching dental hygiene products in the US and Switzerland.

In terms of popular Chinese concept stocks,Alibaba(BABA.US) rose 0.34% before the market,Pinduoduo(PDD.US) fell 0.78% before the market,Jingdong(JD.US) fell 0.32% before the market,Bilibili(BILI.US) fell 1.31% before the market,Baidu(BIDU.US) US stocks fell 0.15% before the market.

The ninth city(NCTY.US) announced today that its wholly-owned subsidiary will be LGHSTR Ltd. Establish a joint venture company in Kazakhstan, and plan to invest and build a digital currency mine with a total capacity of 200MW within two years. The stock rose 5.82% pre-market to $13.53.

360 math department(QFIN.US) rose 4.08% pre-market to $17.59. After the US stock market on Thursday, Eastern Time,360 math departmentAnnounced the second quarter of 2021Performance. The financial report showed that the company’s revenue in the second quarter was 4.002 billion yuan, a year-on-year increase of 19.8%;Net profitIt was 1.548 billion yuan, a year-on-year increase of 76.6%; the diluted income per ADS was 9.62 yuan, compared with 5.76 yuan in the same period last year.

Porch Pet(BQ.US) announced the unaudited financial performance report for the first quarter of fiscal year 2022 ending June 30, 2021 before the market.This quarterPorch PetAchieved a year-on-year growth of 35% in total revenue, and both gross profit and the number of active buyers increased significantly.

Fogcore Technology(RLX.US) announced the second quarter of 2021 financial results. The financial report shows thatFogcore TechnologyNet revenue for the second quarter of 2021 was RMB 2.54 billion (US$390 million), an increase of 6.0% from RMB 2.40 billion in the first quarter of 2021. Under non-US GAAP, adjusted net profit was RMB 650 million (US$100 million), an increase of 6.8% from RMB 610 million in the first quarter of 2021.

Kadani(CANG.US) announced its unaudited financial results for the second quarter of 2021. In the second quarter, the company’s total revenue was RMB 947 million (US$147 million), an increase of 245.5% from RMB 274 million in the same period last year, meeting management’s previous expectations. The increase in revenue was mainly due to the growth in the business volume of auto transaction services and auto loans.

(Source: Zhitong Finance Network)

.