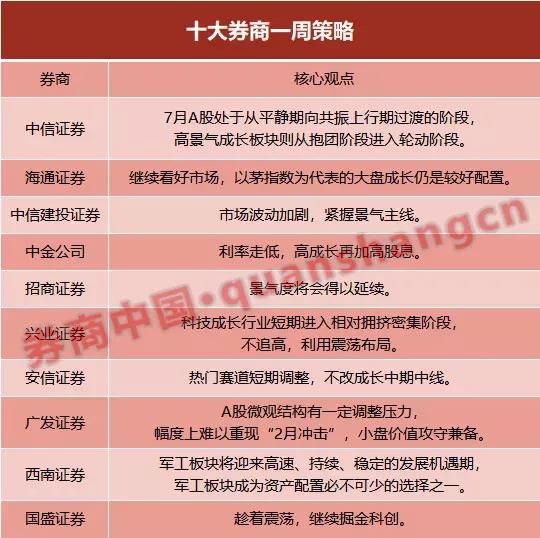

CITIC Securities: Revise anticipation, rebalance style

In July, A-shares were in a transitional phase from a quiet period to a resonant upward period. The recent fundamental expectations have been revised up, policy expectations have increased, the extreme market differentiation has gradually converged, styles have been rebalanced, value sectors have been restored in stages, and booming growth The plate enters the rotation stage from the group stage.

First of all, the fundamentals are expected to improve and policy expectations are diverging. The core of the RRR cut is to prevent financial risks and hedge the MLF expiration peak. It is expected that the July Politburo meeting will set the tone mainly for stability, and then the policy consensus will be reunited. The theme of Pudong and carbon trading catalyzed by the intensive implementation of policies deserves attention. Secondly, A-shares are still in the transition stage from a quiet period to a resonance upward period. The fundamental recovery is still uneven and unstable. It will take time to enter the resonance recovery period. At the same time, the high volatility and fast-moving market are behind the divergence and increase. The amount of funds to enter the market is still limited. Finally, under the constraints of trading and valuation, the extreme differentiation in the early stage of the market will continue to converge, and the market style will be rebalanced. On the one hand, the traditional value sector leaders whose fundamentals are expected to improve will be repaired in stages; on the other hand, the high-prosperity growth sector has changed from The group stage has entered the rotation stage, and the recent focus will be on the rotation opportunities of military industry, CXO & medical services, cloud computing, Internet of Things, cosmetics & medical beauty; in addition, for the main line of new energy and semiconductors in the third quarter, it is recommended to grasp the input brought by subsequent fluctuations. Field timing.

Haitong Securities: Continue to be optimistic about the market, the market growth represented by Mao Index is still a better configuration

Since the beginning of the 19th century, the overall market style has tended to grow. From the relative trend of style index and valuation, it can be seen that the evolution of style has not yet reached the extreme. Economic fundamentals, liquidity, and relative valuation are not the core variables that determine the style. The relative profit trend determines the continuation of the current market style. Continue to be optimistic about the market. The overall market growth represented by the Mao Index is still a better configuration, and the mid-market growth represented by intelligent manufacturing is more flexible.

China SecuritiesSecurities: Increased market volatility, grasping the main line of the economy

The current state of the economy is still running smoothly, and the central bank has maintained a loosecurrencyThe policy unifies the market’s concerns about liquidity contraction. However, valuation differentiation has reached historical highs and market volatility may intensify. It is recommended that investors grasp the main line of the industry’s prosperity. Industries such as photovoltaics and EVs, which saw a significant increase in the market in the early stage, are continuing to be booming and are the core of the market. In addition, the chemical industry,Non-ferrous metalsOther industries are also maintaining the continued prosperity and have more cost-effective advantages. Investors are advised to pay attention.

CICC:interest rateGoing low, high growth and high dividends

interest rateGoing low, high growth and high dividends. The high structural valuation may increase volatility, and at the same time, there will be more obvious differentiation within the growth style, and the relative abundance of liquidity may increase the market’s temporary tolerance for valuation. It is recommended to light index, heavy structure and partial growth,PerformanceThe period focuses on local opportunities. In addition, with the decline in market interest rates, some high-yield and stable assets may also receive attention, such as REITs and stable high-dividend stocks.

Allocation recommendations: focus on growth, taking into account the cycle; under the background of lower interest rates, pay attention to REITs and stable high dividend stocks. 1) Highly prosperous, China’s already competitive or growing industrial chain: electric vehicle industrial chain, photovoltaics, technological hardware and software, electronic semiconductors, some manufacturing capital goods, etc. The valuation is getting higher and the short-term volatility is increasing, but it may still be positive in the medium term; 2) Pan-consumer industry: In the pan-consumption industry, including daily necessities, light industrial home furnishings, hotel and tourism, home appliances, automobiles and parts, medicine and medical equipment, etc. Bottom-up stock selection; 3) Gradually reduce the cycle allocation but pay attention to some cycles with favorable structure or structural growth characteristics:Non-ferrous metalsSuch as lithium, chemical industry and financial leaders benefiting from the development trend of wealth and asset management. Some stable high-dividend assets or individual stocks are also worthy of attention.

China Merchants Securities: The boom will continue

The overall economic data in June was relatively positive. Under the base effect, the growth of industrial production may slow down to a certain extent in the second half of the year. Taking into account the export stimulus and the certain resilience of prices, it is expected that the demand side of some industries in industrial enterprises in the third quarter will have a strong guarantee, and the prosperity will continue. Combining the volume and price performance of industrial enterprises in the latest economic data, the performance forecast of the interim report, and the recent increase in industry profits, the sectors with high industry prosperity and good performance are concentrated in export-oriented manufacturing, new energy sectors, and the electronic industry chain. The industry is expected to maintain a relatively high degree of prosperity in the third quarter. It is recommended to arrange and adjust positions around the direction that the semi-annual report exceeds expectations and the third quarter report will continue.

Industrial Securities: Do not chase high in the short-term, and re-layout after shocks

Looking ahead, the overall market will fluctuate mainly. Focus on July and August. Domestic and foreign risk factors may cause disturbances and resonances. There will be surprises and no dangers, and there will be no systemic risks. Pay attention to cost performance, do not chase high in the short term, and re-layout after shocks. 1) In the third quarter, the domestic market may enter a critical period for resolving existing risks. The three major risks may be resolved. The taper or tightening expectations in August and September in the overseas United States may further ferment, and internal and external resonance may cause disturbances. 2) After entering the intensive period of interim reports, especially the performance period in August, this stage is often prone to shock adjustments when long-term ideals meet short-term performance reality for the science and technology market. 3) Configuration level: growth direction, short-term priority recommendation of military industry, and wait for short-term market shocks to choose opportunities to increase technology, advanced manufacturing, medicine, etc. The value direction, focusing on the performance of the interim report season and the favorable “dual-carbon” policy, and continuing to recommend individual stock opportunities in traditional industries such as chemical, nonferrous, glass, etc., are high-quality core assets with alpha attributes.

The technology growth industry has entered a relatively crowded and intensive phase in the short term. Instead of chasing the high, it uses the shock layout and pays attention to the cost-effectiveness. Currently, the Sci-tech Innovation Board and ChiNext companies have entered a relatively crowded trading stage. As of July 14,Growth Enterprise Market IndexThe 5-day turnover relative to the full A’s accounted for 23.7%, which was in the 97% quantile since 2013; the 5-day trading volume of the Science and Technology 50 Index accounted for 4.9% of the full A’s, which was in the 99% quantile since the establishment of the index number. After the intensive forecast period of the interim report on July 15, especially the performance period in August, this stage is often prone to shock adjustments when long-term ideals meet short-term performance reality for the science and technology market. In the long run, under the background of the protracted war between big powers, the science and technology innovation leader has just started. It will not catch up in the short-term and wait for the shock to re-layout. It will be a high-growth star track in the fields of technology, advanced manufacturing, biomedicine and medical beauty.

Essence Securities: Short-term adjustments to popular tracks, no change to mid-term growth

Last week, the overall RRR cut was implemented. China’s second-quarter economic data and US inflation data were released. During this week, investors’ perceptions of my country’s economic conditions and expectations of future monetary policies in China and the United States have been significantly disturbed.ReflectedNorthward capitalThe big in and big out and the callback of the popular sector. More and more investors are concerned about the allocation direction under the new economic and policy situation.

Looking to the future, continue to maintain the long-term downward trend of the economic center, and in the second half of the year AStock baseThe judgment that the actual situation is better than expected and that the monetary policy maintains a neutral and loose tone remains unchanged. On the whole, the A-share market in the second half of the year is still a volatile market, structurally tolerating high valuations, but it is not a significant valuation expansion environment. It is not suitable for any consensus direction to be extremely deduced to catch up. You can consider adjusting the structure appropriately and waiting for it. Retracement. In the short term, with the end of the July 15 interim report, the market of the high-prosperity hot sector may face adjustments, and funds may turn to chase medical services,food and drink, Military industry, automobiles, 5G communication equipment and other high-prosperity industries with low initial attention. From a long-term perspective, before the discovery of new business growth sectors, after the consolidation period, the market’s mid-term direction is likely to still be deduced around core growth tracks such as new energy, semiconductors, medical aesthetics, and medical care. At the same time, in the growth period of high-prosperity industries In the stock selection, further extend to small and medium-sized caps.

GF Securities: Small cap value both offensive and defensive

The A-share microstructure is under pressure to adjust, and it is difficult to reproduce the “February shock” in magnitude. Investors are mainly concerned about two issues recently: 1) The tightening of overseas liquidity is gradually approaching.judgmentMidlandChu Taper will be more moderate and there will be no systemic risks. 2) The microstructure is crowded. The A-share microstructure is under pressure to adjust, and it is difficult to reproduce the “February shock” in magnitude.

The configuration continues to increase the value of small caps with high winning rates and high odds. With comprehensive supply policy constraints, upward adjustments in earnings expectations, and low valuation quantiles, industries with high winning rates and high odds in small-cap value are mainly concentrated in steel, rare earth/aluminum, glass, chemical fiber, etc. In addition, it was previously proposed that the “market value sinking” of some popular growth tracks has already been over half, so small-cap growth needs to combine the two conditions of high prosperity (winning rate) and still market value sinking (odds), mainly including optical optoelectronics /medical instruments.

Southwest Securities: Military industry ushered in the deployment period

After the US military transport plane landed in Taiwan, China in June, there were media reports on July 15 that the US military transport plane landed in Taiwan. In the face of this kind of military provocation by the United States, China cannot act blindly or just let it go. The most reasonable countermeasure is to quickly improve its own military strength and equipment capabilities, and form an overall balanced and partially dominant military strength state for the US military as soon as possible, so as to achieve the goal of establishing the military in 2027. In this situation, in the next few years, the military industry sector will usher in a period of high-speed, sustained and stable development opportunities. The military sector has become one of the indispensable choices for asset allocation.

In the “14th Five-Year Plan” and Proposals for Long-Term Goals in 2035, the central government has set a new tone for the construction of the national defense and military industry, requiring that the goal of building a military in a century be achieved by 2027 and the modernization of national defense and the military should be basically achieved by 2035. The “14th Five-Year Plan” period is an important window period for the construction of my country’s national defense industry. The main battle equipment will transition from “development” to “mass construction”. The national defense policy will move from “strengthening the target steadily” to “building the ability to prepare for war.” Transform to form a military work combat capability system. With the implementation of the target, orders for aerospace, military equipment and other sectors are expected to increase in volume. Related companies will fully enjoy the dividends driven by industry demand and obtain considerable performance. The military industry chain has ushered in a dividend period, and the industry’s prosperity continues to rise.

Guosheng Securities: Taking advantage of the turbulence, continue to nuggets science and technology innovation

Recently, the market, especially the Sci-tech Innovation Board, has experienced volatility, but the overall style will not change: 1) First, the RRR cut does not mean a systematic relaxation, nor will it bring about overall changes in the market style. The logical clue of “quasi-currency relaxation-style switching” is difficult to occur. 2) Secondly, overseas inflation continues to rise, and market turbulence has intensified, bringing in and out of foreign capital. 3) The current round of growth stocks has accumulated relatively generous returns, and there is also pressure to adjust spontaneously in the short term. It is recommended to take advantage of the shock and continue to select the Nuggets. Since “breaking the box” was proposed in May and a systematic optimism on the Sci-tech Innovation Board was proposed in June, the market for growth stocks represented by the Sci-Tech 50 and ChiNext Index has started. Today, the market is also under pressure to adjust spontaneously in the short term. However, the market for growth and entrepreneurship is far from over, and we continue to recommend taking advantage of the shock to lay out and select.

Focus on the future, grasp the present, and deploy scientific innovation. Three clues to the “Nuggets” Sci-tech Innovation Board: 1) The retracement has been deep since the listing, and has fallen below the issue price; 2) The performance growth rate has been leading the “high growth” of Sci-tech Innovation; 3) The new direction of A-share development is right. Mark the scarce subdivision track “unicorn”. Subdivision tracks such as new energy vehicles, semiconductors & consumer electronics, AI, CXO services & medical aesthetics, and sub-high-end liquors with strong certainty of the economy and high growth potential. The petroleum and petrochemical, chemical, non-ferrous, and photovoltaic sectors driven by overseas demand.

(Article Source:BrokerageChina)

.