As of press time, Dow futures rose 1.2%, S&P 500 futures rose 1.88%, and Nasdaq futures rose 1.34%.

European stocks rose collectively, with Germany’s DAX30 up 443.39 points, the UK’s FTSE 100 up 97.4 points and France’s CAC40 up 225.71 points.

The Financial Stability and Development Committee of the State Council held a special meeting to study related issues. Regarding real estate enterprises, it is necessary to timely study and propose effective and effective response plans to prevent and defuse risks, and propose supporting measures for the transition to a new development model. Regarding China Concept Stock, the regulatory agencies of China and the United States have maintained good communication and have made positive progress, and are working on forming a specific cooperation plan. The Chinese government continues to support various types of companies to list overseas.

The meeting emphasized that the relevant departments should earnestly undertake their own responsibilities, actively introduce policies that are favorable to the market, and prudently introduce contractionary policies. Respond in a timely manner to hot issues that the market is concerned about. Any policy that has a significant impact on the capital market should be coordinated with the financial management department in advance to maintain the stability and consistency of policy expectations. The Finance Committee of the State Council will, in accordance with the requirements of the CPC Central Committee and the State Council, increase coordination and communication, and conduct accountability when necessary.

After the special meeting of the Financial Committee of the State Council on March 16, the CSRC Party Committee quickly held an enlarged meeting to convey the spirit of the study meeting, and made research and deployment on the implementation. Continue to strengthen communication with U.S. regulatory agencies, and strive to reach an agreement on China-U.S. audit supervision cooperation as soon as possible. We will promptly promote the implementation of the new regulations on the supervision of overseas listing of enterprises, support all kinds of qualified enterprises to go public overseas, and keep the channels for overseas listing unimpeded. Continue to support the rational financing of the real economy, actively cooperate with relevant departments to effectively and effectively resolve the risks of real estate enterprises, promote the standardized and healthy development of the platform economy, and improve international competitiveness. In the next step, the China Securities Regulatory Commission will, in accordance with the deployment requirements of the State Council’s Finance Committee, effectively improve its political position, closely follow the theme of promoting high-quality development, and further deepen and refine various work measures, in order to achieve results, and make every effort to maintain the smooth operation of the capital market.

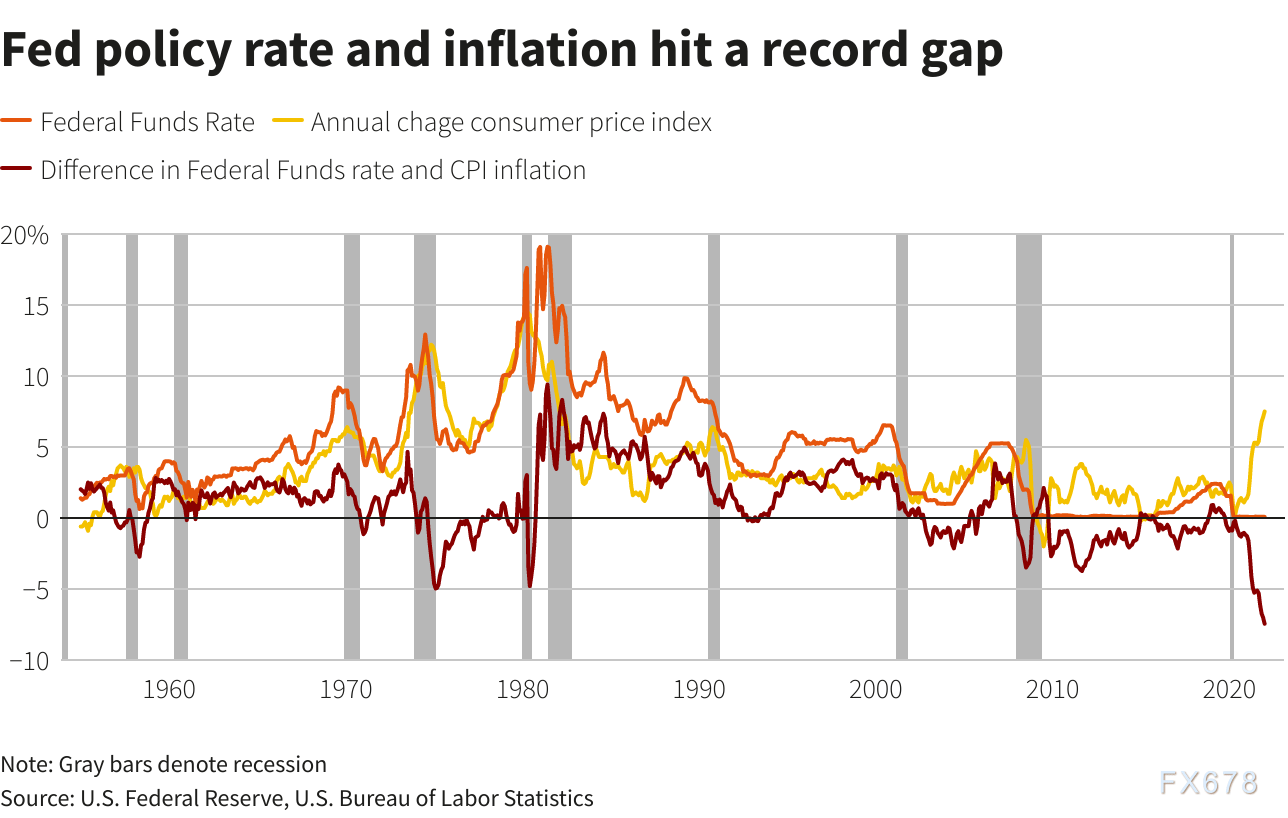

The Federal Reserve is expected to raise interest rates by 0.25 percentage points on Wednesday (March 16), ending the ultra-loose monetary policy during the epidemic and stepping up efforts to deal with stubbornly high inflation; and the Fed is likely to implement multiple interest rate hikes this year.

- 30-year U.S. Treasury yields rise to highest since mid-2019 ahead of Fed rate decision

Ahead of the Fed’s interest rate decision, the 30-year U.S. Treasury note fell on Wednesday, with yields rising as much as 4 basis points to 2.5172%, surpassing the March 2021 high and the highest level since August 2019, as concerns over heightened inflation risks Concerns about investors’ demand for fixed-income securities have been dampened.

- ANZ: Fed is expected to raise rates by 25 basis points

ANZ expects the Fed to raise interest rates by 25 basis points at this meeting and raise the trajectory of the planned tightening path. Fed Chairman Jerome Powell is expected to remain open to the possibility of raising interest rates by 50 basis points if the data is supported, and Powell may also give some guidance on how the Fed will respond to the Russia-Ukraine conflict. The meeting is expected to provide an update on the balance sheet.

- Russian Foreign Minister: Russia-Ukraine talks are not going well, but the two sides are expected to reach a compromise

On March 16, local time, Russian Foreign Minister Sergei Lavrov said that the talks between the Russian and Ukrainian foreign ministers in Turkey will not replace the Russian-Ukrainian negotiations that started in Belarus. Ukrainian Foreign Minister Kuleba did not put forward any new proposals during the meeting. The Russian-Ukrainian negotiations are not going well, but there is hope for the two sides to reach a compromise. Lavrov said that Russian and Ukrainian negotiators should be given time to sit down and discuss issues and avoid actions that would exacerbate tensions. Russia intends to continue its engagement with Ukraine in the future, but will consider the added value of the dialogue. In addition, Lavrov said that Russia is ready to seek any way to ensure the security of its own country, Ukraine and Europe, but the eastward expansion of NATO will be excluded.

hot news

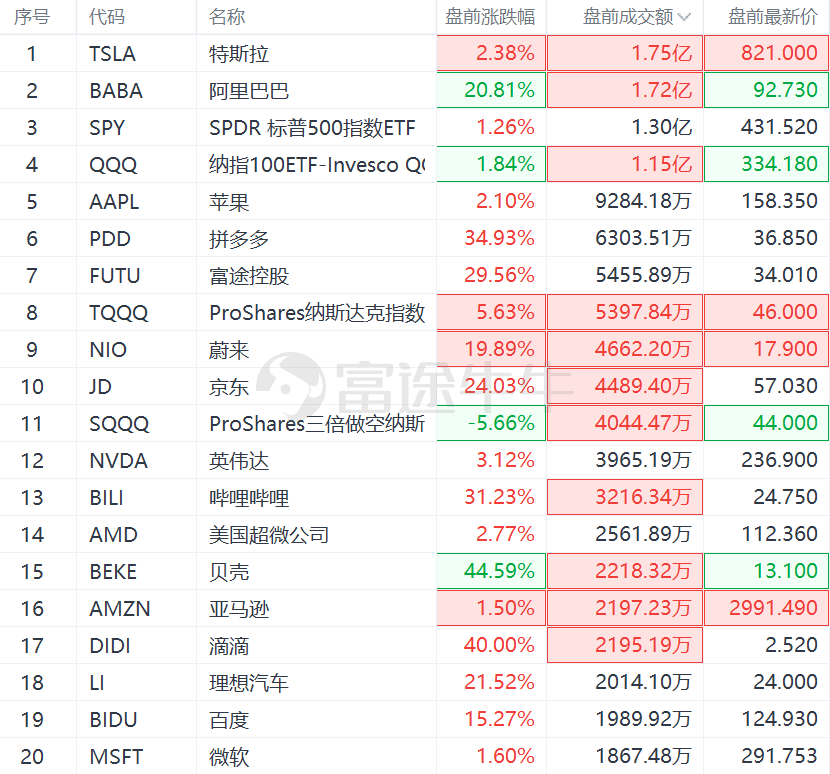

Popular Chinese concept stocks soared before the market, up more than 30%, Zhang Chao 20%.

- Bilibili will voluntarily seek dual listing on HKEx

According to the HKEx filing, Bilibili will voluntarily seek a dual listing on the HKEx. Dual listing means that both capital markets are the primary listing places. Bilibili is now a secondary listing on the Hong Kong Stock Exchange.

- Intel plans to invest $89 billion in Europe to build a complete chip supply chain

$Intel (INTC.US) $ announced that it plans to invest as much as $89 billion in the next 10 years to build a complete chip supply chain in Europe. Intel said it will spend about $19 billion up front to build two new chip factories in Germany. The factory is located in Magdeburg, a city in northeastern Germany, and is expected to start construction next year and start operations in 2027. The new factory will use Intel’s most advanced transistor technology to supply itself and its foundry customers.

- Tesla’s Shanghai plant has been shut down for two days from today, sources say

Tesla’s Shanghai plant will suspend production for two days on Wednesday and Thursday, according to an internal communication and a notice to suppliers. It is unclear whether the two-day shutdown will apply to operations at other plants.

- Sea rose 8% before the market, its Garena provided Revel Games with a $4.5 million seed round of financing

$Sea (SE.US) $ rose 8% premarket, the company recently released some early game financing news, its Garena subsidiary provided Revel Games with a $4.5 million seed round of financing. Revel Games is a newly established Turkish startup.

- Meta fined nearly 17 million euros by EU for breaching privacy regulations

According to market sources, $Meta Platforms (FB.US)$ has been fined 17 million euros for failing to prevent a series of data leaks on Facebook’s platform in 2018, violating EU privacy regulations. The EU’s privacy watchdog found Facebook had failed to take appropriate technical and organisational measures over the incident, according to Ireland’s Data Protection Commission.

- Micron Technology rose more than 5% before the market, and was upgraded by investment bank to outperform the market

$Micron Technology (MU.US) $ rose more than 5% in premarket trading. Bernstein upgraded Micron Technology to outperform with a price target of $94, or 29%.

- Huanju surged 25% before the market, achieving full-year profit for the first time

$ JOY (YY.US) $ rose 25% before the market, and the company released its fourth quarter and full-year financial results for fiscal 2021 today. For the full year of 2021, the revenue of Huanju Group was US$2.619 billion, a year-on-year increase of 36.5%; the net loss was US$116 million, compared with a net loss of US$18.7 million in the same period last year; not in accordance with the US GAAP, in 2021, Huanju Group realized the adjusted full-year for the first time Net profit was US$109 million with a net profit margin of 4.2%.

- Faraday Future rose more than 12% before the market, re-complying with Nasdaq listing rules

$Faraday Future Intelligent Electric Inc. (FFIE.US) was up 12% premarket. On March 15, local time, Faraday Future Intelligent Electric Inc., a new car manufacturer founded by Jia Yueting. The announcement stated that the company received a letter from Nasdaq on March 9, allowing FF common stock and warrants to continue to be listed on the Nasdaq Global Select Market, but the company must submit by May 6, 2022 Failure to file the Quarterly Report on Form 10-Q for the quarter ended September 30, 2021 and the Annual Report on Form 10-K for the period ended December 31, 2021, will result in the company being delisted.

Top 20 U.S. stocks by pre-market turnover

US Macro Calendar Reminder

20:30 US February retail sales monthly rate

22:00 US March NAHB housing market index

22:30 EIA crude oil inventories in the week from the United States to March 11 (10,000 barrels)

02:00 Federal Reserve announces interest rate decision

02:30 Federal Reserve Chairman Powell holds a monetary policy press conference

edit/lydia

Risk warning: The opinions of the authors or guests shown above have their own specific positions, and investment decisions need to be based on independent thinking. Futu will endeavour but cannot guarantee the accuracy and reliability of the above content, and will not be liable for any loss or damage arising from any inaccuracies or omissions.Return to Sohu, see more