The growth of US inflation slowing down is it a reality or an illusion? The question comes naturally, given what has emerged today on the macroeconomic front of the United States.

Today it was published the Fed’s preferred metric for monitoring inflation trends, the PCE index, or the personal consumption expenditure index.

The figure rose in April, on a monthly basis, by 0.4%accelerating the pace compared to the previous growth, equal to +0.1%.

On a year-over-year basis, the headline inflation trend was a 4.4% increaseover the +4.2% in March.

US inflation: core PCE leaps 4.7% in April, beyond expectations

Even stronger PCE core acceleration which, on an annual basis, was equal to +4.7%, beyond the estimated 4.6% rise and more than the +4.6% seen in April.

On a monthly basis, Core PCE advanced +0.4%, more than the +0.3% expected and, again, at a faster pace than the previous +0.3%.

The numbers, needless to say, confirm that inflation continues to remain high, even in the United States, stubbornly.

No SOS returned, therefore, contrary to what emerged on May 10, when the US consumer price index for April was announced, another crucial parameter for monitoring the trend of inflationary pressures.

This is not good news for the markets, given that the PCE data is once again reinvigorating the bets on further interest rate hikes by Jerome Powell’s Fed, among other things, precisely in anticipation of a meeting that was hoped for, until before the publication of the data, a break.

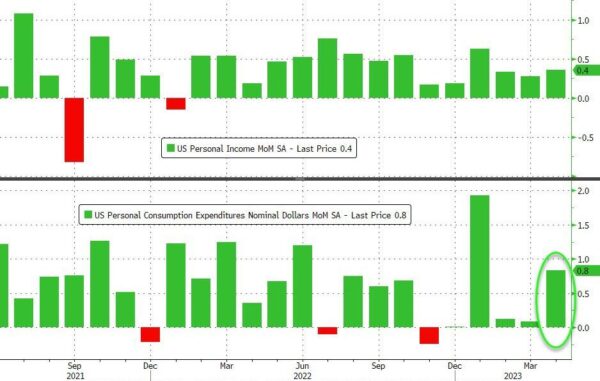

The inflation numbers were released in a report that also released them consumption expenditure and personal income.

The report revealed that personal expenses rose by 0.8% in April doubling expectations of an increase of +0.4% and well beyond the previous unchanged figure.

On an actual basis, personal spending advanced 0.5% from its previous unchanged trend.

Personal incomes were confirmed in line with expectations, up in April by 0.4%, compared to +0.3% in the previous month.

The data on incomes and expenses further confirm this the validity of the bets of new monetary tightening by the Fed, as they highlight a healthy economy, not quite a recession.

Countdown to Fed meeting. Is interest rate anxiety back?

“With today’s higher-than-expected PCE report, the Fed may need to come back from the holidays earlier, as the holidays for American consumers continue to underpin spending,” he commented on CNBC. George Mateyo, chief investment officer di Key Private Bank – Prior to today’s data, we believed the Fed was hoping to take a vacation (in the sense of taking a breather and reassessing the state of the US economy). But now, it seems that his work aimed at curbing inflation is not finished.

The next FOMC meeting is scheduled for on June 13-14.

A few days ago Minneapolis Fed Chairman Neel Kashkari spoke of a divided Fed, undecided whether to raise rates or take a break (and then start over with the monetary tightening).

Recently, despite the dovish markets bets, JPMorgan chief executive Jamie Dimon said he believes the Fed will it could raise rates even to 6-7%.

For his part, Fed Chairman Jerome Powell, in the last meeting of the FOMC on May 3, warned that it would not have been appropriate cut rates.

Powell & Co raised rates on May 3 for the tenth consecutive meeting, bringing them to new range between 5% and 5.25%, at the record since July 2006, with an increase of 25 basis points.

The Federal Reserve, in the communiqué announcing yet another monetary tightening, also hinted that the US-made restrictive monetary policy could be nearing its end. Today’s figure sinks at this point any feeble certainty.