The economic week began in the same climate in which it ended last Friday. The weekend was simply a hiatus and the currency frenzy resumed along with the opening of the markets on Monday. The news that President Alberto Fernández will no longer be a candidate was useless, nor was the wink from the International Monetary Fund (IMF) regarding a possible extraordinary disbursement.

The blue dollar jumped $20 in a single day, a 4.5% gain in a single day. It is the largest daily jump in the parallel price since July 2022. After yesterday’s session, the gap with the official exchange rate ($226 on Banco Nación’s screens) reached 104%.

The government does not have the tools to intervene in the parallel market, since it is a marginal (illegal) market. At most, it can intervene in the secondary market where financial prices are determined, operating by buying and selling bonds.

All the official efforts were put into the evolution of the Soybean Dollar III, with the objective of accumulating reserves and being able to find solidity in the official segment against the run. In this sense, The Central Bank made purchases for 100% of those settled via agricultural dollars, paying $300 per dollar and without making sales in the Single and Free Exchange Market (MULC), accumulating US$106 million in reserves.

However, in Sergio Massa’s economic team they are aware of the impact that the price of the blue dollar has on expectations and of the possible transfer to prices that price makers are beginning to carry out in a preventive manner. They fear that although the reference exchange rate for importers and exporters is the official one, the abrupt rise in the blue will end up complicating the inflation data for April.

In the economic team they fear that although the reference exchange rate for importers and exporters is the official one, the abrupt rise in the blue will end up complicating the inflation data for April.

Within this framework and given the manifest difficulties that the government exhibits in finding instruments to contain the advance of the informal contribution, the question of the majority is until when will the blue continue to rise and mainly until how much.

How the price of the blue dollar is formed

A first exercise to understand the price of the blue dollar yesterday is to observe how much the currency was trading exactly one year ago, and compare it with the inflation accumulated in the same period.

On April 24, 2022, the blue dollar was trading at $205.5, with which yesterday’s $462 implies a year-on-year increase of 124%. Even considering inflation so far in April, the rise is ostensibly higher than the inflation accumulated in the last twelve months.

In the same way, The blue dollar was trading at $346 on the first day of 2023, with which yesterday’s $462 implies a 33% rise so far this year. Accumulated inflation from January to March was 21.7%. Even if the incidence of inflation in April is considered, lThe rise in the blue so far in 2023 seems to be faster than retail prices.

The dynamics that the parallel dollar has presented in the last two weeks implies an update in real terms of the delay that the blue maintained throughout 2022.

With this first data, it seems that there are no reasons for the parallel exchange rate to continue rising. However, one must consider the fact that throughout 2022, the parallel exchange rate moved at a speed much lower than retail prices. Accumulated inflation for 2022 was 94.8%, and from end to end in 2022 the blue rose just 52.4%. First conclusion: the exchange rate jump of the last two weeks is simply an update in real terms of the 2022 lag.

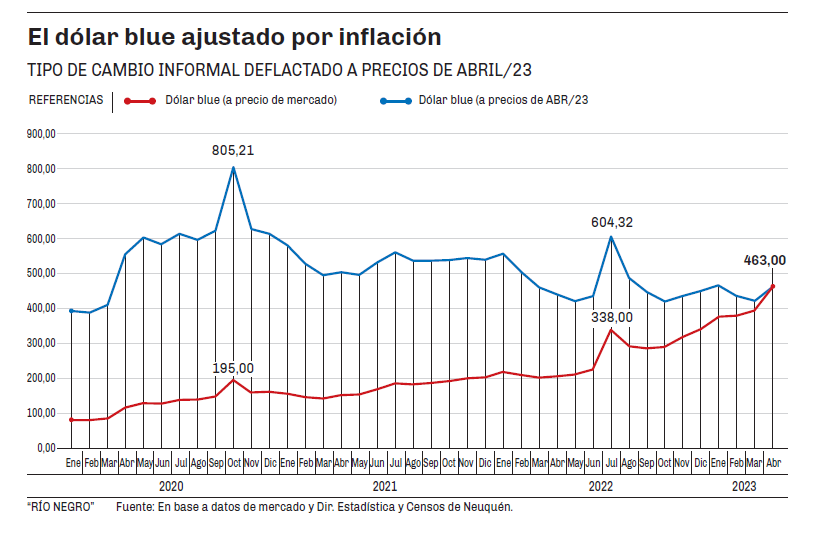

This dynamic is much clearer if the historical series of the parallel exchange rate is observed from 2020 to April 2023, deflating the price of the blue dollar to April 2023 prices.

in economics There is talk of exchange rate “overshooting” when the short-term exchange rate overacts the incidence of macroeconomic variables and “over reacts” suddenly, generating a strong exchange rate jump. The chart clearly shows the last two episodes of currency overshooting.

In the first, Argentina was going through the sixth month of quarantine due to Covid and the government of Alberto Fernández began to encounter serious difficulties in validating the initial vote of confidence in the management of the pandemic. The blue dollar reached $195 at the end of October 2020. At April 2023 prices, that exchange rate would be equivalent to $805.21.

In the second, the former economy minister Martín Guzmán had just resigned, and the management of the new minister Silvina Batakis was staggering in political terms. At the end of July 2022, the blue dollar hit a record high of $338. Translated into April 2023 prices, it is equivalent to a dollar of $604.82.

The data leaves no doubt. The $462 at which the exchange rate closed yesterday is far from matching the real level of the two most recent overshooting episodes.

However, overshooting episodes are always followed by a noticeable moderation in real terms, which can also be seen clearly in the attached graph.

In order to know if the blue dollar can continue to rise, and if said rise “makes sense”, it is much more valuable to appreciate the moment in which the historical series finds some stability in real terms. In this regard, it turns out that Between July 2021 and January 2022, the blue dollar in real terms (at April 2023 prices) averaged $560. Likewise, between August 2022 and January 2023, it averaged $460.

- 124%

- The year-on-year rise in the price of the blue dollar considering the $462 at which it closed yesterday and the $205.50 at which it traded in April 2022.

To comment on this note you must have your digital access.

Subscribe to add your opinion!

Subscribe