August 29, 2022 ATFX “Ming Tian Guan Hui”

Market risk, the investment need to be cautious! Happy trading!

Powell’s hawk slumps U.S. stocks, markets focus on this week’s non-farm payrolls report

【Market Review】

Federal Reserve Chairman Powell beat market expectations and said that he would still raise interest rates “strongly” to fight inflation, which dashed some investors’ hopes for a slowdown in the path of interest rate hikes, and also indicated the possibility of continuing to raise interest rates by 75 basis points at the September meeting. .

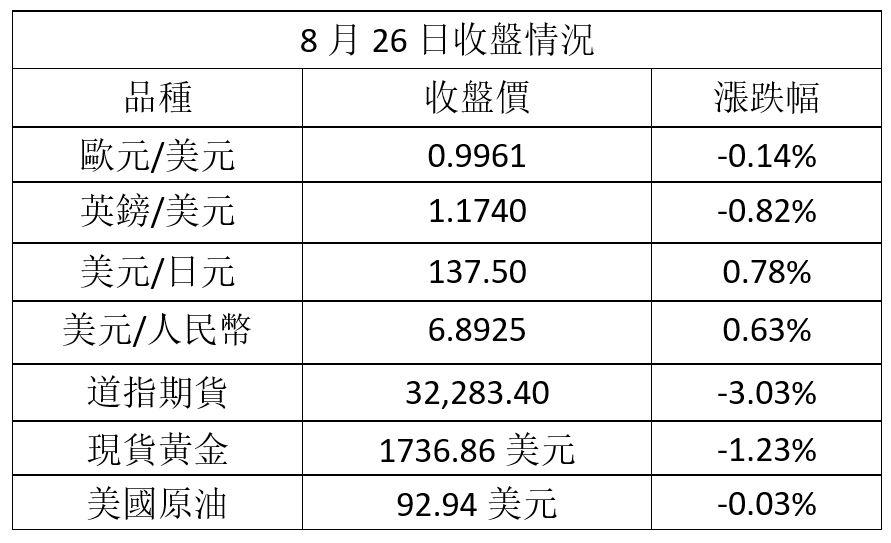

Last Friday, U.S. stocks collectively suffered a slump of more than 3%. The Dow fell more than 1,000 points in one day for the first time in three months. Both the S&P and the Nasdaq recorded their largest daily declines in more than two months. For the week, the Nasdaq fell 4.4%, the Dow fell 4.2% and the S&P 500 fell 4%.

The U.S. dollar index rose above the 109 mark at one point, with two-year yields briefly hitting their highest since October 2007. EUR/USD continued to close below 1.0, while GBP recorded its biggest drop in a week and returned to below 1.18.

Gold fell more than 1% to close below $1,740, closing lower for the second week in a row. Oil prices ended slightly lower, with a weekly gain of 2.5%, helped by Saudi Arabia’s signal that OPEC may cut production, but also by beauty hawks.

【Key Prospects】

This morning, the Asian market continued to digest last Friday’s market, coupled with limited important data guidance during the day, so it is expected that the market will continue in the previous trading day, and gradually wait for the latest US job market report later this week.

【Important Economic Calendar】

UK closed for holidays

09:30 Australia July seasonally adjusted retail sales**

13:00 Japan June synchronization and leading indicators**

22:30 US August Dallas Fed Business Activity Index**

Note: * is the degree of importance

【Market Analysis】

EURUSD

0.9970/1.0013 resistance

0.9903/0.9853 support

The euro rose against the dollar last Friday, but after the dollar received Powell’s speech to stimulate the rise, the exchange rate still closed lower. This morning, it continued to expand and fell close to the low set last week, so pay attention to the possibility of looking for support near the 0.99 mark first.

GBP to USD

1.1734/1.1795 resistance

1.1641/1.1593 support

GBP/USD extended the previous session’s pressure this morning, hitting its lowest level since March 2020 this morning. The 4-hour chart fell below the previous low level, and the exchange rate continued to approach the 1.1600 mark. If it cannot hold this level, it will attract more selling to follow.

USD/JPY

139.12/140.15 resistance

137.45/136.41 support

After the USD/JPY closed at the highest level in a week last Friday, it continued to expand upwards this morning. The Asian market is approaching 138.50, and it intends to challenge the high level in mid-July. Therefore, if it breaks the 139 mark, it should pay attention to the resistance of the high level range.

USD/CNY

6.9292/6.9549 resistance

6.8876/6.8461 support

USD/RMB followed the strength of the USD last Friday and then reached a high level. This morning, it continued to break above 6.90. Technically, the upward momentum on the 4-hour chart is strong, but pay attention to short-term adjustments before testing 6.93. During the period, pay attention to the support near 6.89, but Target 6.95 if there is a chance for a breakout to the upside.

USD/CAD

1.3074/1.3131 resistance

1.3028/1.2982 support

USD/CAD recorded its biggest one-day rebound since mid-August last Friday. It continued its upward trend this morning, refreshing the intraday high since mid-July. Whether the current level can hold above 1.30 is the key to determining whether the rebound can expand, and Push the target above 1.31.

US Crude Oil Futures (Oct)

94.23/95.86 resistance

92.62/90.57 support

Oil prices closed at around $93 in late last Friday, trying to rebound during the session, but the Fed’s hawkish stance also weakened the rebound in oil prices. Still trading between the moving averages on the 4-hour chart, it tends to consolidate before breaking out, and a break above the 20 SMA would mean a move above $94.

spot gold

1736/1748 Resistance

1711/1700 support

Spot gold was directly pressured by Powell’s remarks last Friday and recorded the biggest drop in nearly two weeks. It continued to decline this morning, recording the lowest level since the end of July. If it can’t hold $1725, pay attention to the low of 1711 in the 4-hour chart. The dollar comes into view. Spot silver pay attention to 18.95/19.21 resistance and 18.44/18.18 support.

US Dow Jones Industrial Average futures US30

32703/33304 Resistance

31731/31245 support

Powell said that “another unusually large increase may be appropriate”, which directly scared the US stocks away, and the Dow plunged thousands of points. After the current adjustment, the Dow has fallen to a one-month low, and the market continues to digest the market during the day, which may ease some of the downward pressure, but it is still necessary to pay attention that the price may continue to approach 32,000.

US S&P 500 SPX500

4098/4178 resistance

4035/3972 support

The Fed raising interest rates by 75 basis points in September was once again reflected. Last Friday, the S&P 500 index fell 141.46 points, or 3.37%. The current initial support looks at 4035, just to see if the lower 4000-point mark can be held.

US NASDAQ index NAS100

12898/13115 resistance

12407/12187 support

Last Friday, the Nasdaq fell 497.56 points, or 3.94%. It is also at a one-month low. As market sentiment is still weak, there is still room for short-term adjustment. Therefore, we should look at the initial support near 12,400. In terms of resistance, we mainly look at 4 Hourly chart 10 moving average and Fibonacci set at 12898.

Japan’s Nikkei 225 Index JP225

27944/28120 resistance

27595/27373 support

The Nikkei 225 suffered a sharp drop last Friday, recording the biggest drop since June. This morning, it followed the US stock market to open lower and lower, hitting the lowest level in nearly three weeks. Before entering the previous low range, technically pay attention to the vicinity of 27600. support.

China A50 Index CHI50

13620/13724 resistance

13386/13284 support

The A50 index opened lower this morning, and the trend has been repeated. The intraday low is around 13500, and the resistance is below the 4-hour moving average. Therefore, 13600 is the current resistance. Before it fails to break through, it may re-test the last week’s low of 13386.

Hong Kong Hang Seng Index HK50

20073/20215 Resistance

19783/19639 support

The Hang Seng Index finally closed lower after hitting a high last Friday. It also opened lower this morning in line with the external sentiment. The 4-hour chart continued to decline from the top. For the time being, we will focus on the trading between the moving averages, so we may repeatedly test the 20,000-point mark, which is the main support. around 19800.

The content is for reference only: there are risks in the market, and investment should be cautious. Happy trading!

–AT Global Markets LLC is a limited liability company located in Saint Vincent and the Grenadines with company number 333 LLC 2020. The registered address is: 1st Floor, First St. Vincent Bank Bldg, James Street, Kingstown, St. Vincent and the Grenadines.

–AT Global Markets (UK) Ltd. is authorised and regulated by the UK Financial Conduct Authority (FCA) with FCA license number 760555. The registered address is: 1st Floor, 32 Cornhill, London EC3V 3SG, United Kingdom.

–ATFX Global Markets (CY) Ltd. is authorized and regulated by the Cyprus Securities and Exchange Commission (CySEC) with license number 285/15. The registered address is: 159 Leontiou A’ Street, Maryvonne Building Office 204, 3022, Limassol, Cyprus.

–AT Global Markets Intl. Ltd. is authorised and regulated by the Financial Services Commission (FSC) of the Republic of Mauritius with license number C118023331. The registered address is: Suite 207, 2nd Floor, The Catalyst, Silicon Avenue, 40 Cybercity, 72201 Ebène, Republic of Mauritius.