Yemenat – special

– 11 billion and 727 million dollars are the total losses of Yemen from the resources of the sector (18) during the period from 2009 to April / April 2015 AD, compared to total revenues of (1 billion and 207 million dollars) and (4 billion and 149 million dollars are recovered expenses).

$12 billion in net profits of the partners in the gas project during the period from 2009 to April 2015 with the recovery of all operating and capital expenses, according to the actual selling prices with the government’s treatment according to contract prices despite its breaches to redirect shipments from the US markets to the Asian markets.

In its session held on February 25/26, 2023 AD, the House of Representatives in Sana’a discussed the report of the Oil and Development Committee on following up the implementation of the gas project agreements and the level of the Ministry of Oil’s commitment to them, and following up on improving gas sales prices to mitigate the economic damage that was listed by Public Funds Prosecution Resolution No. 193 dated June 4. June 2014, based on the report of the results of the review of the Central Organization for Control and Accounting No. 1636 and the date of June 1, 2014 AD, where the Council reviewed the data provided by the Ministry of Oil in Sana’a on annual gas exports and the government’s share, which showed a significant improvement in the government’s share during the year 2014 AD, and was absent About the data, sales prices, total income, and how profits are shared between the government and partners. The report was returned to the Development, Oil and Mineral Resources Committee of the Council to complete the data.

In this regard, the economic editor of the “Yemenat” website asked the oil expert a question about the absence of sales price data and the occurrence of a change in gas exports provided by the Ministry of Oil compared to what was documented in the report of the Central Organization for Control and Accounting during the period from 2009 AD to 2013 AD.

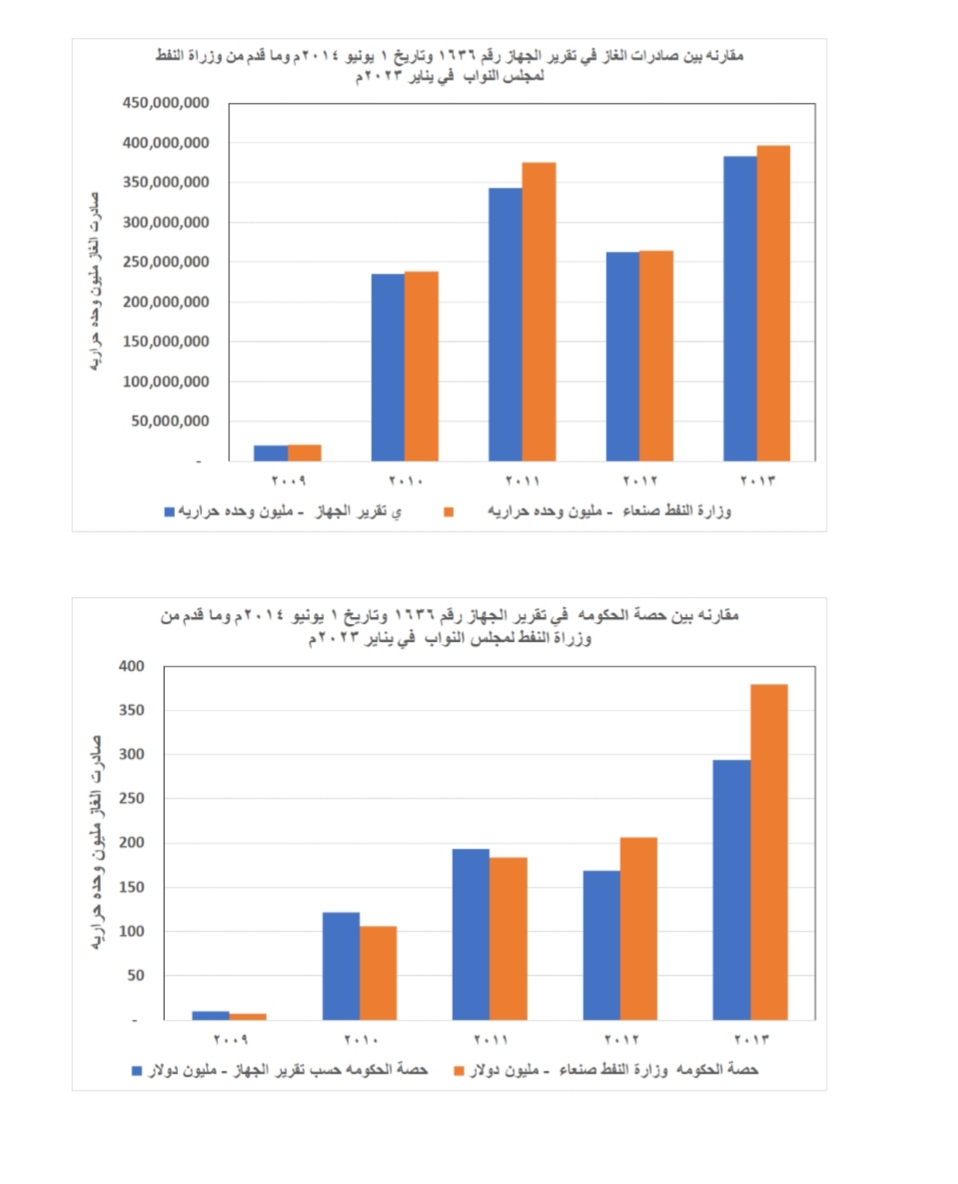

The oil expert stated that the data provided by the Ministry of Oil reflected an increase in each year from 2009 AD to 2013 AD by a total of (52 trillion BTUs), resulting in an increase in government revenues by $882 million compared to what was calculated in the agency’s report ($787 million). The source of information for the agency’s report was the oil accounts at the Ministry of Oil, Sana’a Information Center. However, such amendments aimed to challenge the work of the agency as a supervisory authority to invalidate the decisions of the Public Funds Prosecution and revive Clyde’s fatwa on February 12, 2014, granting the project additional gas reserves of (2 trillion cubic feet). ) Outside the quantities allocated for the project in the agreements and gas sales contracts in effect. (A chart of comparisons of the data of the agency’s report with what was received by the Ministry of Oil in the appendix of this journalistic investigation, quoting the report of the oil expert)

The oil expert at the Public Funds Prosecution pointed out that he was summoned by some members of the Council and the Director of the Office of the Oil and Development Committee to review and specify the data required to be completed by the Ministry of Oil.

The expert noted that he had recalculated the quotas and assessed the damage to the government, and submitted a report to the director of the Office of the Development, Oil and Mineral Resources Committee in the Council, from which we quote the following analyses:

1- Recalculate the government’s share according to gas exports delivered from the Ministry of Oil.

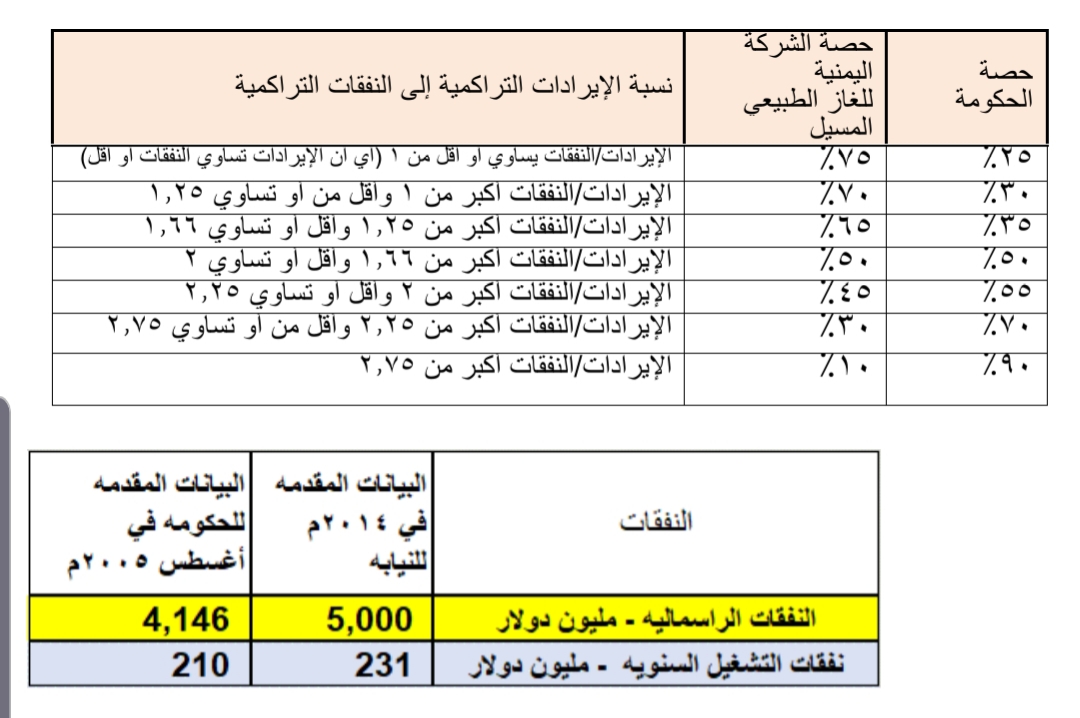

* The formula for sharing profits and expenses is attached in the appendices of this journalistic investigation, quoting the report of the oil expert.)

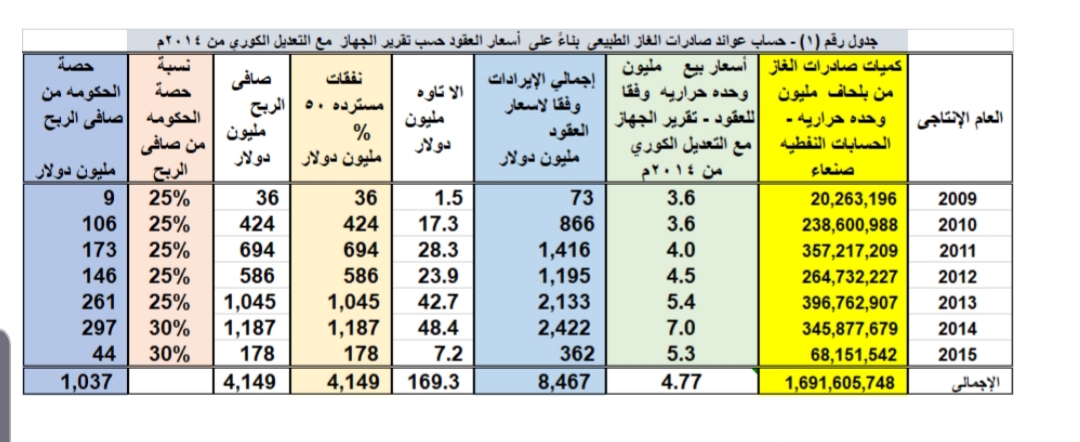

First: According to the prices recorded in contracts for the sale prices recorded in the report of the Central Organization for Control and Accounting for the period 2009 AD to 2013 AD with the Korean adjustment of prices from January 2014 AD, where we summarize the results of the review of profit re-sharing between the government and the company in the following table (1) ..

The expert noted that the government’s share of net profit remained 25% during the period from 2009 to 2013.

Second: According to the equivalent prices, the selling prices (the price of m and h = 12.6%* the price of a barrel of oil), which is the modified equation in December 2013 AD by Ko Gas, which calculates the selling prices of gas in an amount of 73% of what is calculated according to the gas pricing formula The globally applicable (M and HB price = 17.2% * price of a barrel), where we summarize the results of profit re-sharing between the government and the company in the following table (2).

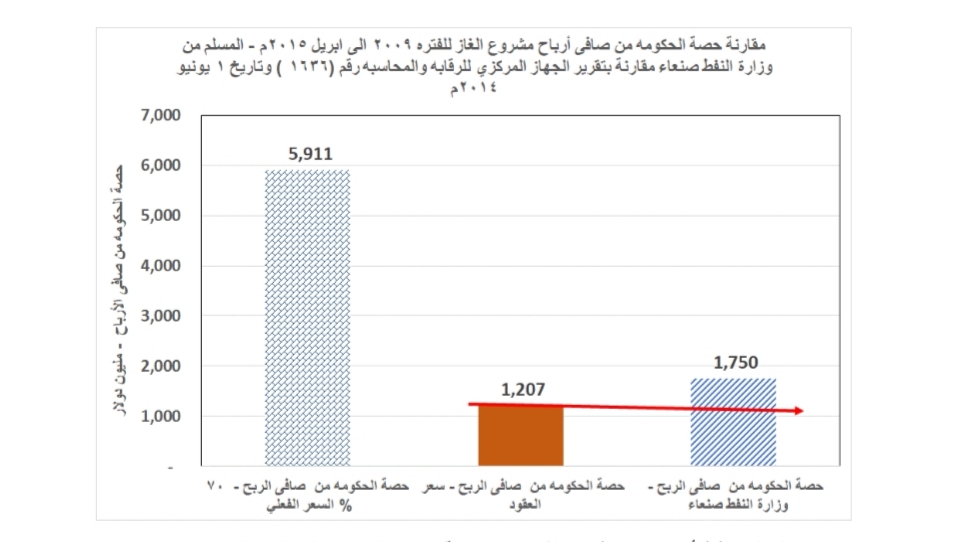

It is noted from the above table that the actual selling price ranged between 9 to 11.5 dollars per million BTUs, while calculating the selling prices according to the internationally applied formula, prices ranged from 12 to 16 dollars per million BTUs, with an average selling price during the period of 14 dollars per million BTUs.

It is noted from table (2) above that the government share rate jumped to 70% of the net profit in 2014, and this reflects the major defect in the profit sharing equation that the partners in the gas project separated according to the restricted prices, and for this reason Total refuses to adjust prices now. The proportion of the government’s share of profits depends on the value of the total (revenue over expenditure).

Second: Comparing the calculated share for the government provided by the Ministry of Oil with the recalculation

Through the above chart, it is noted that the difference between what was submitted by the Ministry to the House of Representatives and what was recalculated according to the Korean adjustment of prices from 20014 AD, with the maximum selling price of the quantities sold to Total and Suez companies about ($ 543 million), and according to the Ministry’s explanation for this increase, the government gets 20% of Profits of shipments transferred from the US markets for sale in Asia, where the HAZS report indicated that an agreement was concluded between the Yemeni Liquefied Natural Gas Company (Total) and the Swiss and Total Energy companies (a subsidiary of the Total Group) to re-transfer shipments from the US markets due to the low prices of Henry Hub and transfer them to the Asian markets and share them Profits of the price difference between the Yemeni Company for Liquefied Natural Gas (Total) 50%, Total Company 30%, and 20% for the government in a vague way. You do not know what the basis for this division is. The disastrous prices of Henry Hebb markets and the concealment behind the alleged increase in the temporary revenues of the government, and this issue must be discussed by the House of Representatives and the government for the two parties to the conflict in Yemen as it is an overarching issue for all Yemenis and undermine their rights.

Through the above chart, it is noted that the difference between what was submitted by the Ministry to the House of Representatives and what was recalculated according to the Korean adjustment of prices from 20014 AD, with the maximum selling price of the quantities sold to Total and Suez companies about ($ 543 million), and according to the Ministry’s explanation for this increase, the government gets 20% of Profits of shipments transferred from the US markets for sale in Asia, where the HAZS report indicated that an agreement was concluded between the Yemeni Liquefied Natural Gas Company (Total) and the Swiss and Total Energy companies (a subsidiary of the Total Group) to re-transfer shipments from the US markets due to the low prices of Henry Hub and transfer them to the Asian markets and share them Profits of the price difference between the Yemeni Company for Liquefied Natural Gas (Total) 50%, Total Company 30%, and 20% for the government in a vague way. You do not know what the basis for this division is. The disastrous prices of Henry Hebb markets and the concealment behind the alleged increase in the temporary revenues of the government, and this issue must be discussed by the House of Representatives and the government for the two parties to the conflict in Yemen as it is an overarching issue for all Yemenis and undermine their rights.

According to the actual prices at 73% of their level, the government’s share of net profits is about ($5911 million).

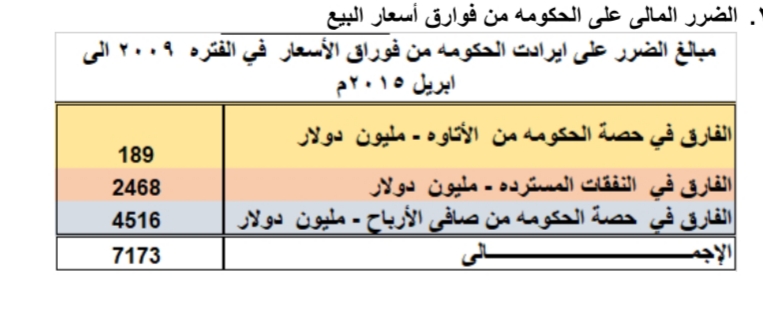

2- Financial damage to the government from the difference in selling prices

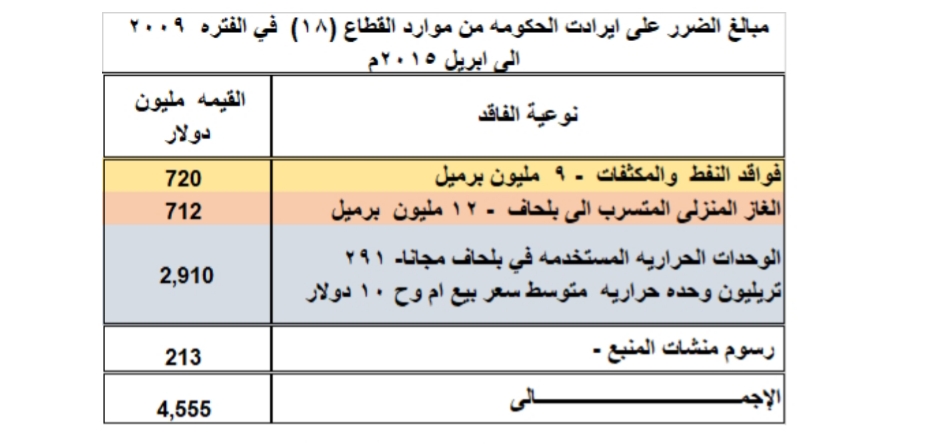

3- Financial damage to the government from the resources of Sector (18) due to the provision of incorrect information by the partners to the government and the detailing of the texts of the agreements in a way that achieves the supreme interests of the partners.

The following table summarizes these losses.

That is, the government’s total losses from the sector’s resources (18) and the price differences during the period from 2009 to April / April 2015 AD are about (11 billion and 727 million dollars), with the government’s share according to prices reaching (one billion and 207 million dollars) with the recovery of 63% of Expenses 4149 million dollars.

The main reason for the losses incurred by the government is the practices of the partners in the gas project through the absence of correct information from the government about oil and gas reserves and the efficiency of gas plants and unilaterally preparing the texts of some articles of the agreements to ensure that they give priority to the supreme interests of the partners and seize very large quantities of natural gas and liquefied petroleum gas. And harnessing the upstream facilities to serve the Balhaf project according to the continuation of oil production, and thus the government lost huge oil reserves, taking into account that the Hunt Company as a partner in the project – and operator of Sector 18 from 1986 to November 14, 2005 AD – was in control of all the sector’s information (18) The Ministry of Oil is absent along with the absence of the honest and qualified national cadre when preparing these agreements and following up the sale of gas at reasonable prices, especially the delay in implementing the agreements for a period of 12 years.

The oil expert appealed to members of Parliament and the government on both sides of the conflict to carry out their legal and national responsibility to protect this wealth owned by all members of the people.

The oil expert confirmed that what is published are not media stories of partisan bidding, but rather reports based on real data that were delivered by the ministry to the House of Representatives and the Central Agency for Control and Accounting, and were analyzed according to the provisions of the agreements, and based on them, the economic damage to Yemen was assessed.

We should not fail to draw the attention of all concerned to the fact that Article (20) stipulates that the gas development agreement granted the right to the injured party, after the start of implementation of the agreement, to demand an amendment to eliminate the damage.