daily economic news

2023-04-12 08:24:11

Edited by Lu Ming every time

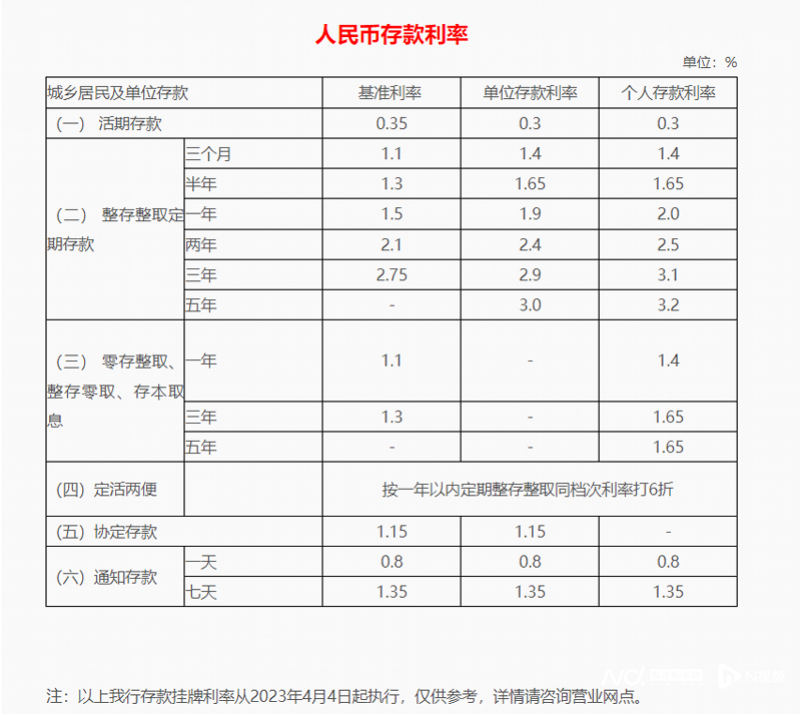

Recently, many banks in Guangdong, Henan, Hubei and other places have lowered their deposit interest rates, which has aroused concern. In this regard, GF Securities believes that,The recent reduction of deposit rates by some rural commercial banks may still be following up the reduction of deposit rates by major banks in September 2022. It is only a “small episode” and has little impact on the market.

According to the Southern Metropolis Daily on April 12, industry experts said in an interview with reporters that the reduction in some bank deposit interest rates is related to reducing the pressure on net interest margins and maintaining lower costs for bank loans.In the long run, there will still be some small and medium-sized banks that will further cut deposit rates, but this does not mean that they will be lowered across the board.

Image source: Visual China

A number of banks cut deposit listing interest rates

Since April, many small and medium-sized banks in Guangdong, Henan, Hubei and other places have announced the reduction of deposit interest rates.

according toGuangdong Nanyue BankAccording to the information on the official website, starting from April 4, among the personal deposit interest rates, the current deposit interest rate has been reduced from 0.385% to 0.3%, and the interest rate for lump sum deposits and withdrawals has been reduced by 0.02% to 0.15%. Since April 4, Guangdong Nanyue Bank has adjusted the deposit interest rate for the first time.

Screenshot of the official website of Guangdong Nanyue Bank

Guangdong Chenghai Rural Commercial BankIt also stated that since April 1st, the listed interest rate of RMB deposits will be adjusted, and the interest rates of 1-year, 2-year, 3-year, and 5-year periods have been lowered, and the maximum reduction rate for 3-year periods is 0.15%. .

According to Southern Metropolis Daily,A branch of Bank of GuangzhouThe staff told reporters that since the beginning of this year, the Bank of Guangzhou has lowered the deposit interest rate twice in March and April, successively lowering the three-year and five-year lump-sum deposit and withdrawal time deposit listing interest rates to 3.25% and 3.20%, respectively. The next reduction is 0.05%, and the listed interest rates for other terms remain unchanged.

April 8,Henan Rural Credit CooperativesThe announcement on the adjustment of the interest rate of RMB deposits shows that starting from April 8, the listed interest rate of demand deposits is 0.25%, and the listed interest rates of one-year, two-year, and three-year lump-sum deposit and withdrawal time deposits are adjusted to 1.9% respectively. , 2.4%, 2.85%.

Screenshot of the official website of Henan Rural Credit Cooperatives

On the same day,Henan Huaibin Rural Commercial Bank, Wuyang County Rural Credit CooperativeRelevant adjustment announcements have been issued. Among them, Henan Huaibin Rural Commercial Bank stated in the announcement that in accordance with the arrangement of the Henan Provincial Rural Credit Cooperative, it has decided to reduce the listed interest rates of one-year, two-year, and three-year lump-sum deposits and withdrawals from April 8. to 1.9%, 2.4%, and 2.85%, and the listed interest rates for other terms remain unchanged.

April 8,Henan Zhengyang Rural Commercial BankAnnounced that the listed interest rates of 1-year, 2-year and 3-year lump-sum deposit and withdrawal time deposits will be lowered.

At the beginning of this year, many banks in Henan had raised interest rates. The interest rate adjustments of many banks that occurred on April 8 were mostly “good start” activities, and the banks resumed their previous interest rate levels. The “Wuyang Rural Credit” public account shows that Wuyang Rural Credit Cooperatives had launched a “good start” deposit interest rate increase activity earlier this year. The staff introduced, “From January to March 2023, the deposit interest rate will increase. Taking 100,000 yuan as an example, one You can earn 2,250 yuan per year.” In addition to Wuyang Rural Credit Bank, Henan Xincai Rural Commercial Bank also issued the “Announcement of Xincai Rural Commercial Bank on Adjusting the Listed Interest Rate of Renminbi Deposits” on January 2 this year. The announcement shows that the bank has decided to adjust the listed interest rates of RMB deposits from January 1, 2023. Among them, the one-year fixed deposit interest rate is 2.25%, the two-year interest rate is 2.7%, and the three-year interest rate is 3.3%.

also,Hubei Wuxue Rural Commercial Bank, Hubei Huanghai Rural Commercial Bank, and Hubei Luotian Rural Commercial Bank in Hubei ProvinceAnd other banks also recently issued an announcement saying that since April 8, the interest rate of deposit products will be adjusted.

Screenshot of Wuxue Rural Commercial Bank’s official WeChat account

Liu Yu, an analyst at GF Fixed Income, said in the research report that in the process of small and medium-sized banks following up with big banks to lower deposit rates, some small and medium-sized banks have also raised deposit rates in stages before the Spring Festival in 2023 to attract savings. On April 8, some small and medium-sized banks lowered their deposit interest rates again, and some of them may be returning the interest rate raised by the savings bank to the original level.

A new round of “interest rate cuts” has begun?

According to the Daily Economic News report on April 10, why do small and medium-sized banks continue to adjust the deposit listing interest rate? Does this herald the start of a new round of “rate cuts”?

Zhou Maohua, a macro researcher at the Financial Market Department of Everbright Bank, said that there are three main reasons for the downgrade of some small and medium-sized banks.

First, under the background of continuous deepening of interest rate liberalization, coupled with the increasing pressure on the net interest margin of some banks in recent years, banks have become more proactive in managing liability costs.

Second, the domestic economy is currently in the recovery stage. Small and medium-sized banks, as the main force in serving small and micro enterprises and serving agriculture, rural areas and farmers, are actively managing the cost of deposit liabilities to provide banks with reasonable concessions to expand the space for the real economy.

The third is that the current domestic deposit market supply is relatively high. In recent years, the overall growth of residents’ savings deposits has been rapid, and there is a trend of regularization. “This market supply and demand has also prompted some banks to reasonably lower deposit interest rates according to their own operating conditions.”

Zhou Maohua also pointed out that the short-term big banks are unlikely to follow up. “On the one hand, judging from the domestic financial data in January and February, credit is booming in both supply and demand; on the other hand, big banks have actively increased counter-cyclical adjustments in recent years. Intensive efforts have been made to continue to make reasonable profits to the real economy, and the net interest margin has narrowed significantly. In addition, major banks have also lowered deposit interest rates last year.”

In mid-September 2022, the six major state-owned banks collectively lowered the listed interest rates of RMB deposits, and then many joint-stock banks and urban and rural commercial banks followed suit. “This is the active behavior of banks to adjust the level of deposit interest rates according to changes in market interest rates, reflecting an important step forward in the market-oriented reform of deposit interest rates.” The central bank stated in its report on China’s monetary policy implementation for the third quarter of 2022.

Against the background of the interest rate reduction channel, judging from the banks that have released their annual reports, the current net interest margin of banks is also shrinking rapidly, and the increase in the cost of deposits in the cost of liabilities is an important reason for the decline in net interest margin. In the past, small and medium-sized banks have often absorbed deposits at higher interest rates than larger banks. Under such circumstances, some small and medium-sized banks are under greater pressure to further reduce deposit interest rates, and the reduction of deposit interest rates has a certain degree of rigidity. At this time, for small and medium-sized banks, how to control the cost of liabilities?

“At present, the biggest source of bank profits is credit business, so deposits are very important to all banks. At this time, while stabilizing deposits and optimizing the liability structure, banks first need to reasonably measure and control the issuance of long-term deposit products.” Zhou Maohua He said that the domestic economy is currently recovering steadily, the capital market is gradually returning to normal, and market liquidity preferences are picking up. Therefore, residents are also motivated to gradually reduce long-term deposits, which will help ease the pressure on deposit termization.

Secondly, Zhou Maohua said that banks need to steadily promote asset management, innovate wealth management products to promote the increase of demand deposits, and actively promote the development of intermediary business to bring banks as much demand deposits as possible.

Daily Economic News ComprehensiveReported by Southern Metropolis Daily, Everyjing.com (Reporter: Zhao Jing)

Cover image source: Visual China