Title: China’s Manufacturing Sector Weakens in July amid Sluggish Demand and Shrinking Output, External Factors Cited

Date: August 1, 2023

[Caixin.com] – China’s manufacturing sector experienced a decline in July as both output and demand contracted, primarily due to weak external demand, according to the latest data from the Caixin China Manufacturing Purchasing Managers Index (PMI) released on August 1.

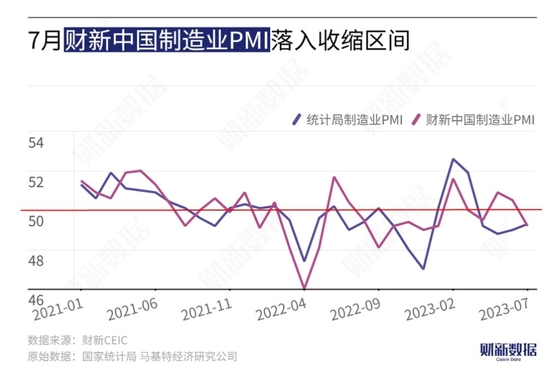

The Caixin China Manufacturing PMI for July recorded 49.2, marking a 1.3 percentage point decline compared to June and returning to levels below 50 after two months of moderate growth.

This downtrend contrasts with the data released by the National Bureau of Statistics, which showed a slight improvement in the manufacturing PMI to 49.3 in July, indicating a 0.3 percentage point increase from the previous month. However, the index recorded a contraction for the fourth consecutive month, remaining below the benchmark of 50.

An analysis of the sub-items of Caixin China’s manufacturing PMI revealed weakened demand and a contraction in supply during June. The new orders and production indexes hit new lows since January and February respectively. Surveyed companies attributed the decline in customer demand to weak market conditions and reported a decline in new orders after two consecutive months of growth. The main factor dragging down manufacturing demand is weak external demand, influenced by the rising risk of overseas economic recession and limited external market demand. As a result, the new export order index plummeted to its lowest point since October 2022.

Furthermore, manufacturing employment continued to deteriorate in July, marking the fifth consecutive month of decline, albeit at a slightly slower rate. Enterprises cited limited market demand and a need for cost reduction and efficiency increase as the primary reasons for reducing employment. The backlog of work remained stable overall, although some companies reported a negative impact on order delivery due to a tight power supply in the summer.

Manufacturing purchasing activity and production also contracted slightly for the first time since the start of the year. However, the inventory of raw materials increased at a slower rate compared to June, while the inventory index of finished goods surpassed the benchmark of prosperity and decline for the first time since October 2022, thereby exhibiting a slight increase. The increase in inventories was primarily attributed to production exceeding sales, rather than active inventory replenishment.

Moreover, the logistics of suppliers experienced some sluggishness in July, with the supply time stretching for the first time in six months. This resulted in a new low in the corresponding index since February. Companies reported that the sluggish macroeconomic situation led some suppliers to adjust their acceptable inventory levels, leading to shortages in certain raw materials.

The manufacturing purchasing price index and ex-factory price index both remained below the growth and contraction line for four and five consecutive months respectively. While the pressure of deflation persisted, the rate of decline narrowed significantly. The decline in bulk commodity prices, such as industrial metals, exerted downward pressure on costs, whereas the sluggish market and weak demand limited companies from raising ex-factory prices.

Despite the contraction in manufacturing output and demand, entrepreneurs remained generally optimistic. The manufacturing production and operation expectation index rose slightly above the expansion and contraction line in July, albeit remaining lower than the long-term average. Some respondents expressed concerns about both domestic and external economic prospects.

Senior economist Wang Zhe from Caixin Think Tank highlighted the downward pressure on the economy. The Political Bureau of the Central Committee acknowledged the challenges and complexities of the current economic operation and emphasized the importance of actively expanding domestic demand and leveraging consumption’s fundamental role in driving economic growth. To this end, ensuring employment stability, managing expectations, and boosting residents’ income are top priorities. With limited impact on the supply side, a proactive fiscal policy targeting the demand side should take precedence over monetary policy.

In conclusion, China’s manufacturing sector experienced weakening output and demand in July, primarily due to sluggish external demand. The challenging macroeconomic environment and constraints on market demand continue to pose difficulties for the industry, emphasizing the need for proactive government intervention to stimulate domestic demand and support economic growth.

Related reports:

– Caixin PMI analysis | Manufacturing boom shrinks again, business expectations improve at low levels

– 【Caixin PMI】July 2023 Caixin China Manufacturing PMI Report

– 【Caixin PMI】Analysis: Caixin China manufacturing PMI fell into the contraction zone for the first time in three months