The earnings season is approaching, and the data of the fund’s various agency sales channels are also displayed. On March 19, China Merchants Bank (600036.SH) released its 2021 annual report. The sales of non-monetary public funds were 608 billion yuan, a year-on-year decrease of 0.44%, but the agency fund business income reached 12.315 billion yuan, a year-on-year increase of 36.20%. It can be seen that among the agency sales revenue of CMB Funds, the trailing commission income corresponding to the holding scale has achieved relatively high growth.

The day before, Orient Fortune (300059.SZ) also disclosed its 2021 annual report. The sales of its subsidiary Tiantian Fund exceeded 2 trillion yuan for the first time, most of which were non-public funds, a year-on-year increase of 92%. In 2021, when the scale of public funds exceeds 25 trillion, the revenue brought by Tiantian Fund to the parent company will increase by 70% year-on-year.

China Merchants Bank’s agency fund income increased by more than 30%, and fund custody income was announced for the first time

During the reporting period of 2021, China Merchants Bank achieved operating income of 331.3 billion yuan, a year-on-year increase of 14.04%; realized a net profit attributable to shareholders of 119.9 billion yuan, a year-on-year increase of 23.20%. Among them, non-interest net income was 127.3 billion yuan, a year-on-year increase of 20.75%, accounting for 38.44% of the total income, a year-on-year increase of 2.14%. Among them, the net fee and commission income are the main ones, contributing 94.447 billion yuan to the scale.

In the retail business, in 2021, China Merchants Bank’s agency sales of non-monetary public funds will be 608 billion yuan, a year-on-year decrease of 0.44%. In the past few years, the sales of non-monetary public funds of China Merchants Bank have achieved continuous growth, and in 2020, it has increased by 177.88% year-on-year to 610.704 billion yuan.

Although the sales of non-monetary public funds have not achieved year-on-year growth, China Merchants Bank’s agency fund income in 2021 will be 12.315 billion yuan, a year-on-year increase of 36.20%. For agency sales agencies, in addition to subscription fees and redemption fees, operating income is also an important part of the trailing commission corresponding to the scale of ownership.

Regarding the growth of agency business income, China Merchants Bank said that it was mainly due to the company’s long-term layout and various allocation measures in the public fund business, which further expanded its business advantages and achieved growth in both transaction and retention revenue, thanks to the scale of the stock. The proportion of retained income has gradually increased. According to data from the China Foundation Association, in the fourth quarter of 2021, China Merchants Bank’s non-cargo funds held a scale of 870.1 billion yuan, ranking first in the market.

In this annual report, China Merchants Bank also announced the public fund custody business revenue data for the first time. In 2021, the commission income of CMB’s public fund custody business will be 2.662 billion yuan, a year-on-year increase of 84.86%, accounting for 49.33% of the bank’s custody business commission income, a year-on-year increase of 15.17%.

As of 2021, China Merchants Bank’s public fund custody scale was 1.97 trillion yuan, an increase of 44.27% over the end of the previous year, accounting for a 1.61% increase in the bank’s custody scale compared with the end of the previous year, and the industry ranking rose two places to fifth (statistics from the Banking Association). ).

China Merchants Bank pointed out that in 2021, China Merchants Bank will have 253 newly issued public funds under custody, with a custody scale of 406.8 billion yuan. Compared with 2020, there were 184 newly issued public funds under custody, a year-on-year increase of 49.59%; the total custody scale was 418.2 billion yuan, a year-on-year increase of 140.48%. However, China Merchants Bank said that the number and scale of newly issued public funds under custody ranked first in the market.

China Merchants Fund’s net profit increased by nearly 80% year-on-year

With the release of China Merchants Bank’s annual report, the performance of China Merchants Fund was first announced. In 2021, China Merchants Fund will have 253 newly issued public funds under custody, with a custody scale of 406.8 billion yuan, ranking first in the market in both the number and scale of newly issued public funds under custody. At the same time, the asset management business scale was 1.35 trillion yuan, an increase of 16.70% over the end of the previous year.

China Merchants Bank said that it has further strengthened the cooperation in fund agency sales with China Merchants Fund. As of the end of the reporting period, China Merchants Fund’s non-monetary public fund management scale industry ranking jumped to seventh (WIND data). The stock of public funds accounted for the highest proportion.

In 2021, China Merchants Fund will have total assets of 10.149 billion yuan and net assets of 6.991 billion yuan; during the reporting period, it will realize a net profit of 1.603 billion yuan. Nandu reporters combed and saw that in 2021, the net profit of China Merchants Fund will increase by 77.32% year-on-year. Looking back at the net profit performance of the past five years, China Merchants Fund will achieve better operations in 2021.

The main financial performance of China Merchants Fund in the past five years

The sales of Tiantian Fund exceeded 2 trillion under the ant

The day before, Oriental Fortune released its 2021 annual report, which also revealed the 2021 performance data of its subsidiary Tiantian Fund.

In the fourth quarter of 2021, Tiantian Fund surpassed ICBC with a public fund holding scale of 637.9 billion yuan, becoming the second independent third-party sales agency to rank among the top three.

The annual report shows that in 2021, Tiantian Fund will launch 12,780 fund products from 150 public fund managers, with fund sales of 2.239 trillion yuan, a year-on-year increase of 72.48%. After the sales exceeded 1 trillion yuan in 2020, Tiantian Fund once again achieved high growth.

The reporter combed and saw that in 2020, the sales of Tiantian Fund achieved a high growth rate of 96.96%. At the same time, the sales scale of non-monetary funds was also announced, which achieved 699.1 billion yuan that year. Among the sales volume of Tiantian Fund exceeding 2 trillion yuan in 2021, the sales of non-monetary funds will be 1.34 trillion yuan, a year-on-year increase of 91%.

The main indicators of Tiantian Fund’s fund agency sales in the past 5 years

Orient Fortune said that in 2021, the sales and retention scale of Tiantian Fund will increase significantly, the market share will continue to increase, and the Internet fund sales business will achieve rapid growth.

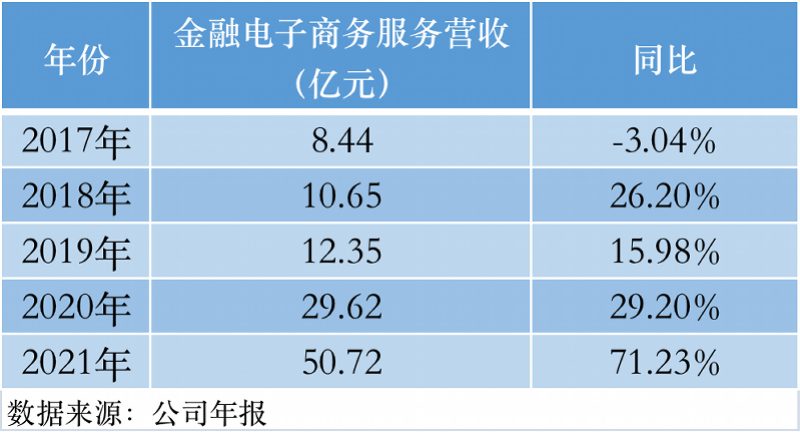

With the growth of sales scale, the operating income of Tiantian Fund also increased by 71.23% year-on-year. According to the annual report of Oriental Fortune, the financial e-commerce service business, which provides users with third-party fund sales services mainly through Tiantian Fund, will achieve an operating income of 5.072 billion yuan in 2021.

Tiantian Fund’s revenue in the past 5 years

Written by: Southern Metropolis reporter Ye LinfangReturn to Sohu, see more

Editor:

Statement: The opinions of this article only represent the author himself, Sohu is an information publishing platform, and Sohu only provides information storage space services.