|

|

Securities Times reporter Zhang Zhibo

On June 13, the A-share charging pile index rose by 2.29%, ranking at the forefront of the Wind concept index. Among the constituent stocks, Heshun Electric, Autoxun, Guodian Nanzi rose by the daily limit, and individual stocks such as Changyuan Group, Zhongneng Electric, and Gaolan Co., Ltd. followed suit, with an increase of more than 4%.

On the news side, the official account of State Grid announced that on June 12, Xin Baoan, Chairman and Party Secretary of State Grid Corporation of China, and Zhang Zhigang, General Manager and Deputy Secretary of the Party Group, held talks with Sichuan Provincial Party Secretary Wang Xiaohui at the company headquarters.

Xin Baoan said that the company will actively help green and low-carbon transformation, do a good job in the grid connection and consumption of new energy, and promote the construction of charging piles and the transformation of supporting power grids.

Intensive introduction of favorable policies

As a supporting industry for electric vehicles, since 2023, the charging pile policy has been intensively catalyzed to promote the steady progress of the industry.

On April 6, the National Energy Administration issued the “Guiding Opinions on Energy Work in 2023”, indicating that it is necessary to promote the construction of charging infrastructure and improve the service guarantee capabilities of charging facilities. On May 5, the executive meeting of the State Council reviewed and approved the deployment of accelerating the construction of charging infrastructure to better support new energy vehicles going to the countryside and rural revitalization, and proposed “moderately advanced construction of charging infrastructure”. In addition, the Ministry of Commerce will organize the “Hundred Cities Linkage” Auto Festival and the “Thousands of Counties and Ten Thousand Towns” new energy vehicle consumption season activities in the second half of this year to promote automobile consumption.

Huaxin Securities said that with the introduction of top-level design and follow-up of local measures, the policy side is expected to continue to exceed expectations; policy and demand resonate, and charging piles usher in a golden period of development. In addition, with the strong support of national policies, the construction of new energy vehicle charging facilities “sinking” into rural areas will become one of the important trends in the development of the industry.

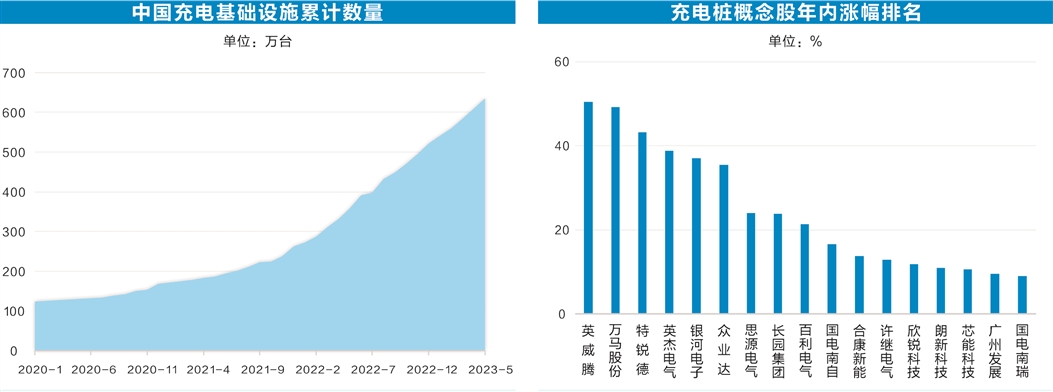

According to data from the China Electric Vehicle Charging Infrastructure Promotion Alliance, as of May 2023, the cumulative number of charging infrastructure nationwide is 6.356 million units, a year-on-year increase of 77.49%. Great Wall Securities believes that there is currently an obvious structural problem of insufficient public charging piles in my country. The ratio of vehicles to piles is 2.51:1, and the ratio of public vehicles to piles is 7.29:1. This has not yet met the large demand gap for public charging piles in my country. In the future, the construction of charging piles in my country will There is still plenty of room.

Northward funds hold 24 shares with a large amount of money

According to the statistics of the Securities Times·Databao, there are a total of 24 charging pile concept stocks with the latest holdings of more than 500,000 shares by Beishang Capital. Only Guodian NARI has a market value of more than 100 billion yuan, with a latest market value of 178.141 billion yuan. In addition, more than 10 stock markets such as Siyuan Electric, Langxin Technology, and Terad have a stock market value of more than 10 billion yuan. Guodian NARI recently stated on the interactive platform that in recent years, the company has been actively planning and developing emerging industries such as energy storage, charging piles, and IGBTs, and related products and solutions have been successfully applied to many projects.

In terms of foreign shareholding, Beishang Capital has the highest position in the leading Guodian NARI, reaching 1.158 billion shares. Beishang Capital also holds more than 10 million shares in other concept stocks with a market value of more than 10 billion. Among them, XJ Electric holds 101 million shares. The company’s charging piles are mainly high-power DC piles, and its products cover conventional AC and DC charging piles, V2G, orderly charging, high-power charging, super fast charging, wireless charging and other products.

Compared with the end of April, Beishang Capital’s holdings of most individual stocks have increased significantly. EAST, INVT, KSTAR, Changyuan Group, Dayang Electric, and XJ Electric increased their holdings by more than 25%, and their latest holdings are more than 20 million shares. The positions of Guodian NARI and Siyuan Electric dropped slightly, less than 2%.

At the beginning of 2023, the concept of charging piles ushered in a wave of rise, and the average rise of the above-mentioned 24 stocks was as high as 14.41%. Among them, INVT rose by 50.41%, Wanma shares rose by 49.21%, and Terad, Yingjie Electric, Yinhe Electronics, Zhongyeda, etc. rose by more than 35%. The performance of charging pile concept stocks is also relatively outstanding. In the first quarter of this year, the net profit of 6 stocks including INVT, KSTAR, and Wanma doubled year-on-year. Guodian NARI also increased by 38.68% year-on-year in the first quarter, and its net profit reached 526 million yuan.

(The special data for this edition is provided by the central database of the Securities Times. Peng Chunxia/Drawing)

Disclaimer: The Securities Times strives for truthful and accurate information, and the content mentioned in the article is for reference only and does not constitute substantive investment advice, so operate at your own risk

Download the “Securities Times” official APP, or follow the official WeChat public account, you can keep abreast of stock market trends, gain insight into policy information, and seize wealth opportunities.