“The Italian banks are becoming more and more financial shops: they seem less and less oriented towards traditional activity, that linked to loans, and increasingly aimed at selling savings and even insurance products”. Thus begins the long analysis of Autonomous Italian Banking Federation (Fabi) son the 2020 financial statements of Italian banks, in which he highlights how the banking sector of our country is evolving.

Less loans and more product sales: historic overtaking for bank revenues

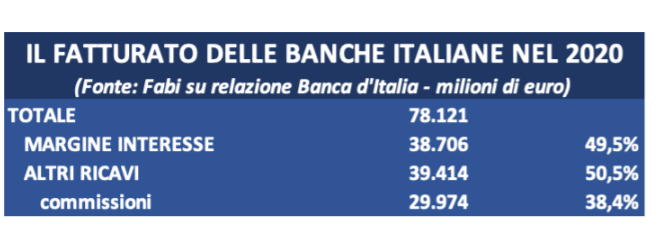

From the photograph taken by the federation led by Lando Sileoni it emerges that commissions are growing (50.5% of the total), but net interest income is decreasing (49.5%). Out of 78.1 billion euros of total revenues, in fact, over half, that is 39.4 billion, comes from commissions while credit guarantees revenues of 38.7 billion: “The distance between the percentages, 50.5% against 49.5%, seems irrelevant, but in reality it is a historically important ‘overtaking’ which is also reflected in the clientele“, Underline from Fabi. On the other hand, the portion defined as “other revenues other than commissions” remains residual, which includes, among other things, trading activities on financial securities (for example the purchase and sale of shares).

Fabi points out that the sector is losing profitability, however: the ROE (return on equity, i.e. the index that measures the profitability of a bank) after reaching a peak in 2018 of around 6%, was further reduced in 2020. , down to 1.9% from 5% the previous year.

Why are banks turning in this direction?

But why do banks prefer to focus more on selling products and less on loans? “Banks – explains Fabi – focus on low-risk activities (the sale of financial products, in fact) and somehow overshadow loans, an area made increasingly complex also due to the stringent rules, perhaps too much, written in Europe. Banks argue that particularly low interest rates make lending unprofitable. An issue on which the union focuses, which writes: “Where banks complain of low profits with the interest margin, however, it should be noted that the costs of ‘provision’ of money are very low: direct deposits from customers are in fact not remunerated and the liquidity provided by the European Central Bank with the long-term refinancing operations is even purchased at negative rates ”.

Consequently, the trade union adds, “loans to businesses and households, even if disbursed at almost irrelevant interest rates, that is, of a very few percentage points, would still ensure the banks a decent profit margin, albeit slight and more contained than that a few years ago “.

Sileoni warns: with the aggregation phase possible “unbridled competition”

“The reduction in loans, and therefore in the revenues deriving from these activities, is also linked to the growing attention of the European Central Bank to the quality of credit, with stringent rules that lead to a reduction in loans: however, there is room for more banks far-sighted who, for example, could finance the ideas and projects of companies “, says Secretary Fabi, Lando Sileoni, according to which this phase of aggregation must be closely monitored, which will produce unbridled competition in the banking sector. “As far as revenues are concerned, it should be remembered that foreign investment funds, among the main shareholders of Italian banks, are exclusively interested in dividends and the higher they are, the more the CEOs of the same banks preserve their top positions – underlines again. Sileoni -. This whole situation could cause damage to banking customers, both households and businesses, who, in any case, in the context of a free market and in full competition, will always be able to choose the solutions that best meet their needs “.