[The Epoch Times, September 23, 2022](The Epoch Times reporter Cheng Jing reported) Recently, Cai Songsong, the pillar manager of the “Nuo An Fund”, was reported to have lost contact. The highs plummeted 72%. Although Cai Songsong refuted rumors on WeChat that he was “on vacation”, investors were uneasy.

Gold manager “lost contact”?market jitters

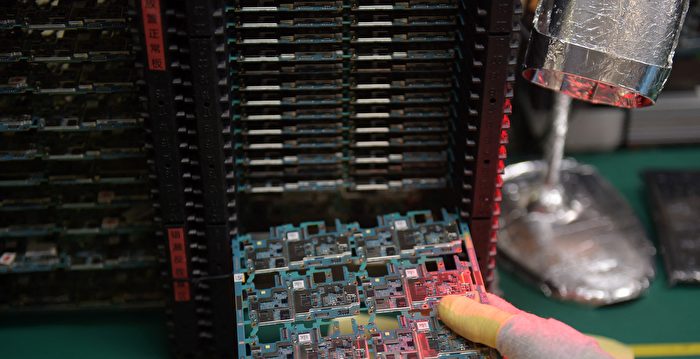

Chinese tech investors, who have already suffered heavy losses buying up troubled semiconductor stocks in Shanghai and Shenzhen, have had a particularly rough week after a top fund manager was briefly isolated from the outside world, the South China Morning Post reported today.

Recently, Cai Songsong, the gold-medal manager of China’s “Nuo An Fund”, famous for its large investment in listed chip stocks, has lost contact.

At this time, China’s economy is slowing down, the United States has continuously attacked China’s chip industry, the CCP has launched a chip anti-corruption campaign, and the authorities’ anti-corruption investigation into the industry’s largest fund is underway. During Cai Songsong’s brief absence, Chinese semiconductor stocks plummeted.

Among them, the share price of Jiangsu Zhuosheng Microelectronics, one of Cai Songsong’s heavy investments, has plummeted 72% from its high point in July 2021. Another gear, Sanan Optoelectronics, fell 21% in 5 days, making investors deeply uneasy.

To ease market sentiment, Cai Songsong posted a message on his personal WeChat account late on Tuesday (20th), saying he was “on vacation”.

With the ups and downs of China’s chip industry

Cai Songsong, who joined Lion Fund in 2017 and became a fund manager two years later, quickly became a star investor thanks to his aggressive strategy in chip stocks, the report said. Among them, the scale of Lion’s innovation-driven hybrid fund has exceeded 30 billion yuan from 1.4 billion yuan in March 2019 to the end of 2021.

Assets under Cai’s management continued to soar during a boom in China’s chip industry. The Paper quoted Wind data showing that in 2019, when Cai Songsong began to manage Lion, the fund’s annual rate of return was as high as 95.44%, ranking 5/633 in the same category.

However, as the enthusiasm for the semiconductor sector subsided, Lion’s net worth also retreated sharply. The performance this year has been poor. As of September 20, it has closed down 35.36% year-to-date, ranking 2,657/2,669 in the same category.

According to iFind, a financial data service, in the first five months of this year, Lion’s innovation-driven hybrid fund evaporated by 40%, becoming one of the worst-performing funds during that period.

Securities Star said that in the past few months, Cai Songsong increased his holdings of Zhuo Shengwei five times, involving a total amount of more than 1.55 billion yuan. However, Zhuo Shengwei’s decline from the beginning of the year to September 13 was 53.28%. During the same period, its performance not only lagged the market, but also did not outperform the industry.

Investors exit as chip bubble bursts

The South China Morning Post said Cai Songsong’s loss was just one of the problems facing China’s semiconductor industry as it grapples with U.S. sanctions, weak consumer demand and a corruption probe in Beijing.

When China’s chip bubble burst last summer, investor enthusiasm for the semiconductor sector waned, many of China’s leading chip companies lost more than half their market value in 15 months, and the value of funds managed by Cai plummeted.

Many chip companies are struggling to turn Beijing’s demand for domestic products into sustainable profits. But a record 3,470 companies were written off between January and August this year — including those that used the word “chip” in their branding or operations, according to statistics from business database platform Qichacha.

The South China Morning Post quoted an investor surnamed Liu in Changsha, Hunan province, as saying he bought shares in GigaDevice in 2019. However, the public company has lost nearly 60% of its market value since peaking in July 2021.

To stop losses, Liu said, he has sold all his Chinese chip stocks.

Responsible editor: Li Yuan#