Source: Caijing.comAuthor: Peng Linli2023-06-11 16:51

On June 9, NIO released its first quarter performance report.

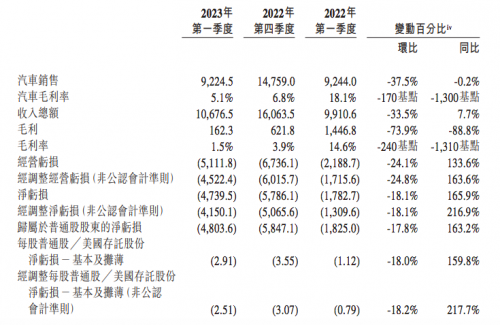

The report shows that Weilai Automobile will achieve revenue of 10.68 billion yuan in the first quarter of 2023, a year-on-year increase of 7.7% from 9.911 billion yuan in the same period last year. Among them, automobile sales were 9.2245 billion yuan, a decrease of 0.2% from 9.244 billion yuan in the first quarter of 2022, and a decrease of 37.5% from the fourth quarter of 2022.

Source: Weilai official

During the reporting period, NIO delivered 31,041 vehicles, including 10,430 high-end smart electric SUVs and 20,611 high-end smart electric cars, a year-on-year increase of 20.5% from the first quarter of 2022 and a year-on-year increase of 2022. In the fourth quarter, the chain decreased by 22.5%.

Automobile sales revenue in the first quarter of 2023 was RMB 9.2245 billion, a decrease of 0.2% from the first quarter of 2022 and a decrease of 37.5% from the fourth quarter of 2022.

According to the data, the gross profit margin of Weilai Automobile in the first quarter of 2023 will be 1.5%, compared with 14.6% in the first quarter of 2022. This is a 73.9% decrease from the fourth quarter of 2022.

Automotive gross margin in the first quarter of 2023 was 5.1%, compared to 18.1% in the first quarter of 2022 and 6.8% in the fourth quarter of 2022.

Source: Weilai official

Weilai officially stated that the gross profit margin has decreased compared with the first quarter of 2022 and the fourth quarter of 2022, mainly due to the decline in gross profit margin of automobiles. Automobile gross margin decreased from the first quarter of 2022, mainly due to changes in product mix and higher battery unit costs.

Some organizations pointed out that for all new energy vehicle companies, crossing the life-and-death line of 12% single-vehicle gross profit margin is the most important thing in 2023.

Li Xiang, CEO of Ideal Auto, also posted on social platforms that after reaching a revenue scale of 100 billion yuan, a product gross profit rate of 15%-25% is the benchmark requirement for a healthy and surviving auto company. The gross profit margin of the product is far lower than expected, and the gross profit margin fluctuates greatly. This is not the conscience of the company’s pricing, but the need to improve the operation and management of the company and continue to expand its scale.

As for how to improve gross profit, in the conference call, Li Bin, chairman of Weilai Automobile, mentioned that if the sales of the new ES6 can meet expectations, and all NT2.0 models will be delivered in the third quarter, the gross profit margin is expected to improve. It is confident to return to the “20% gross profit rate”, and it is not even a dream to achieve a “25% gross profit rate” in the long run.

According to the report, NIO’s operating loss in the first quarter of 2023 was RMB 5.1118 billion, an increase of 133.6% from the first quarter of 2022 and a decrease of 24.1% from the fourth quarter of 2022.

Among them, the net loss in the first quarter of this year was 4.7395 billion yuan, a year-on-year increase of 165.9% from the 1.7827 billion yuan in the first quarter of 2022. The adjusted net loss was 4.1501 billion yuan, an increase of 216.9% from the first quarter of 2022.

Source: Weilai official

In the first quarter of 2023, the net loss attributable to ordinary shareholders of Weilai Company was 4.8036 billion yuan, a year-on-year increase of 163.2% from the first quarter of 2022.

In the earnings conference call, Li Bin repeatedly mentioned the fierce competition in the auto market. He said that the market has changed a lot recently, and the competition has further intensified. For example, the market performance of ET7, ES7, and ET5 is not as good as expected. This year, the benefits and subsidies have declined, which is equivalent to an average increase of 20,000 yuan. Due to the fiercer market competition, a group of target users have lost in the competition.

Regarding the profitability issue that the market is concerned about, Li Bin said frankly that at present, the time point of break-even will be pushed back, and it is expected to not exceed one year. As of March 31, Weilai’s cash reserves were 37.8 billion yuan. Li Bin said that the current cash flow is sufficient to support the company’s operations and the financing channels are smooth, but “we will manage our cash carefully.”

Regarding the performance of the next quarter, NIO expects total revenue in the second quarter of 2023 to be between RMB 8.742 billion and RMB 9.370 billion, a decrease of approximately 15.1% to 9% compared to the second quarter of 2022. Vehicle deliveries in the second quarter are expected to be between 23,000 and 25,000 vehicles.