Co-founder of Affari Miei

12 March 2024

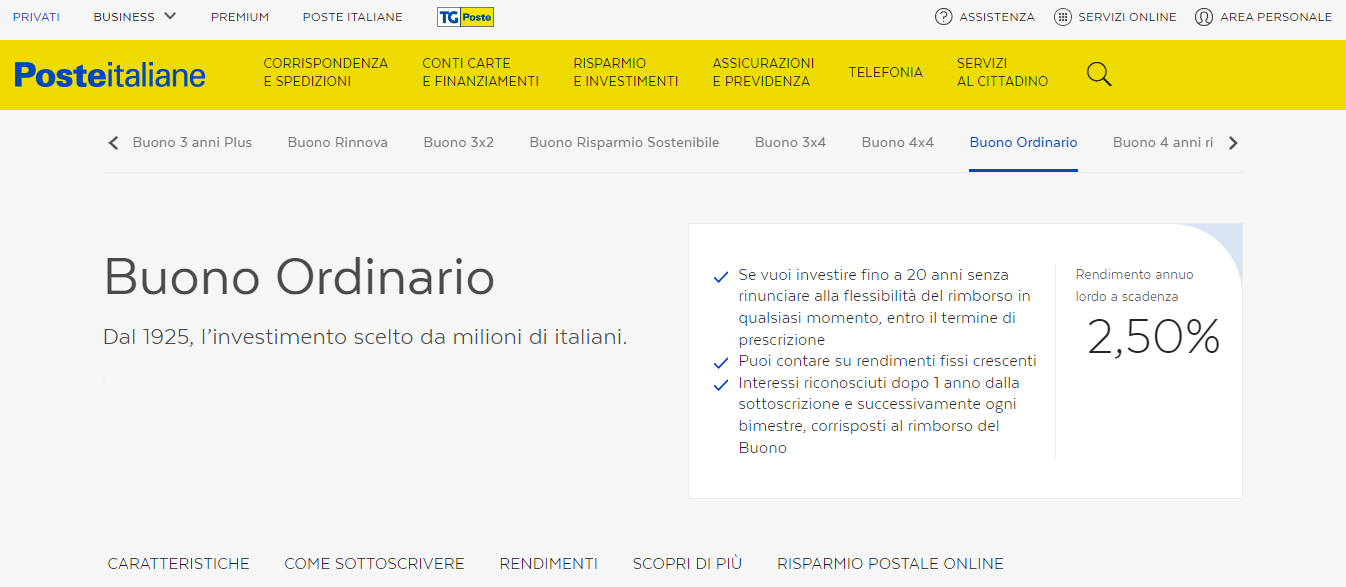

If you are looking for a safe and peaceful investment you will certainly have considered the very famous ones ordinary postal savings bonds, which have always been praised by families as the main tool for safe and convenient savings. Once upon a time, at least, it was like that. Can we say the same today?

In this guide we will see together the characteristics and returns of ordinary savings bondstrying to understand if they are convenient or if it is better to look at other beaches to warm up your savings.

Keep reading!

This article talks about:

What are ordinary postal savings bonds?

I BFP they have always represented a form of safe investment, guaranteed by the Italian State and characterized by preferential taxation, as we will have the opportunity to delve deeper into in the course of this article.

Compared to BOTs, which are also guaranteed by the State and issued by Cassa Depositi e Prestiti, the price of postal vouchers it does not fluctuate: it is the nominal one, while government bonds fluctuate on the market and the price could decrease or increase every day.

However, the returns of BFPs are on average lower than BOTs, in relation to the risk. Up here My business I always say it: the greater the risk the greater the return.

But now let’s focus on the ordinary vouchers: here, instead, you will find the in-depth guide on all BFPs in force.

Don’t know how to invest?

Find out what kind of investor you are. Are enough 3 minutes to discover the best strategy for you.

>> START NOW!

Characteristics of postal savings bonds

With these tools you have the opportunity to invest up to 20 years (maximum duration period) without giving up the flexibility of repayment at any time, counting on increasing fixed returns. This is an investment suitable for those who want to invest their savings in the long term.

When subscribing to it, you do not have to pay commission or opening costs, and the capital invested by you can be reimbursed at any time, without losing the right to accrued interest (provided that one year has passed since subscribing to the Voucher).

How do you sign up?

If you want to subscribe to your voucher, you can opt for either paper form than for that dematerialized. To obtain it, you can go to the nearest post office, or use the smartphone app.

In this second case, if you have a BancoPosta account enabled for online device services, you can subscribe to the vouchers with BancoPosta online or with BancoPosta Click, both from the web and from the BancoPosta App.

If you are the owner of Libretto Smart enabled for online device services, you can subscribe to them from the web, via online Postal Savings and from the Postal Savings App. The reference amount is 50 euros, or multiples.

Yield on postal savings bonds

The gross annual return is equal to 3,50%awarded upon maturity, however interest begins to be recognized 1 year after subscription and subsequently every two months, and paid upon reimbursement of the Voucher.

In fact, it currently seems to be a favorable period since rates have been raised, with the yields on postal savings certificates having been raised and on some bonds they can even reach 6%.

For completeness of information I attach it here table relating to the conditions in force from 28 December 2023 regarding the returns of the voucher:

The tax regime

These savings instruments are exempt from stamp duty: be careful, however, this rule applies to postal savings bonds with a total redemption value of no more than 5,000 euros.

Otherwise, taxation is applied according to current legislation.

Method and value of reimbursement

When you want to get the reimbursement of your money, if you subscribe to the security in paper form, you will get the entire value in a single solution, at any time during the life of the voucher and without additional costs.

In the case of the dematerialized formula, however, you can decide whether to request a refund for the entire value in a single solution or partially for amounts equal to 50 euros and multiples, without additional costs and at any time during the life of the voucher.

As regards the value, before the completion of the first year, the value of the reimbursement is equal to the nominal value subscribed, net of any tax charges. After the first year, the reimbursement amount will be equal to the nominal value subscribed, net of any tax charges, plus accrued interest.

Don’t know how to invest?

Find out what kind of investor you are. Are enough 3 minutes to discover the best strategy for you.

>> START NOW!

Prescription

As regards the limitation periods, this starts from the day following the expiry: postal savings bonds become non-interest bearing and, after 10 years, they are prescribed.

Conclusions: My Business Opinions

Now that we have seen what the characteristics of these vouchers are, we can try to sum them up together. In the meantime, here’s a video in which I show you my thoughts on the post office.

In short, I think that investing your savings in this instrument is not really a good idea.

I advantages there are, of course: the tool is safe and guaranteed, but is it worth it? Is it worth burying your money in a grave for 20 years for a return that isn’t very high?

BFPs were once really tempting, my generation still took some advantage from the vouchers subscribed in their name by far-sighted grandparents and relatives, but with today’s fluctuations and declines we can see that these advantages have almost disappeared. Of course, you can get hold of your money whenever you want, but losing a good part of the interest…

However, we are currently in a period in which interest rates are higher and, in fact, they reach 3.50% gross which is not even that bad: it is a similar return to some deposit accounts, which I will tell you about in very little.

Let’s say that if your risk profile is low, your knowledge is not many and you want to feel comfortable, then rather than keeping a nest egg under the proverbial mattress or in a bank account, then you can also think about vouchers, but there are really too many equally safe options that can perform even better: just take a look around section dedicated to the best deposit accounts to discover more profitable offers and with decidedly shorter periods!

I recommend you take a look at it and read the following in-depth articles you find here:

Good continuation on Affari Miei.

Find out what kind of investor you are

I have created a short questionnaire to help you understand what type of investor you are. At the end, I will guide you towards the best contents selected based on your starting situation:

>> Get Started Now