The Moratti family announced the transfer of control of the Saras refineries to the giant Vitol. This is what emerges from a press release issued today, Sunday 11 February.

To be precise, we read in the note issued by Saras, Massimo Moratti SapA di Massimo Moratti, Angel Capital Management SpA and Stella Holding SpA and Vitol BV, a company based in the Netherlands, have stipulated a purchase and sale contract on the basis of which the Moratti family has undertaken to sell to Vitol shares of Saras SpA which represent approximately 35% of Saras’ share capital, at a price of €1.75 per share.

If you want updates on Italian news enter your email in the box below:

By filling out this form I agree to receive information relating to the services on this page in accordance with the privacy policy.

Saras and the sale to Vitol: the price and the premium compared to the pre-scoop date

The price of €1.75 per share implies a capitalization of Saras of approximately €1.7 billion represents a premium of approximately 10% compared to the price on the reference date, the reference date being the closing market price of 6 February 2024, the eve of the date on which the news relating to the possible sale of part of a share package by the Moratti family, who had commented on the reported rumors, was released by Bloomberg with one note for this.

READ ALSO

Saras triggers speculative appeal: Vitol rumors give wings to the stock. The Moratti note

The price of 1.75 euros per share it is also at a premium of 7% compared to the volume-weighted average daily price of the month preceding the reference date; by approximately 12% compared to the average daily volume-weighted price of the 3 months prior to the reference date, by approximately 21% compared to the average daily volume-weighted price of the 6 months prior to the reference date; by approximately 30% compared to the volume-weighted average daily price of the 12 months preceding the reference date.

The press release states that pursuant to the purchase and sale contract “and subject to the occurrence of certain circumstances provided therein, ACM (Angel Capital Management) has undertaken to sell any Saras shares to Vitol which it could receive on the basis of the existing funded collar derivative contract, concerning approximately 5% of Saras’ share capital.

The completion of the sale of Vitol to the Swiss is exclusively subject to obtaining the necessary regulatory authorizations.

To be precise, authorizations are required under the European Union Regulations on Foreign Subsidies and Competition (Antitrust) and the Italian golden power legislation.

Completion of the operation entails that the entire stake held by the Moratti family in Saras be transferred to Vitol.

“The operation will give rise to an obligation to promote a takeover bid (“OPA”) mandatory on Saras’ share capital, which will be promoted by Vitol at the same Price per Share therefore, €1.75 per share), or at the price adjusted in the event of distribution of a dividend before completion of the Transaction.

L’objective of the OPA is to obtain the revocation of Saras ordinary shares from listing and trading on Euronext

Milan, which can also be achieved through a merger in the presence of the relevant conditions.

Upon completion of the purchase transaction, Vitol will have over 800 thousand barrels/day of refining capacity in seven refineries4GW of thermal energy production and over 1.4GW of renewable energy generation.

The Moratti family is assisted by BofA Securities e Four Partners Advisory as financial advisors and from Linklaters Milano as legal advisor.

Vitol is assisted by J.P. Morgan as exclusive financial advisor and from Chiomenti and Weil, Gotshal & Manges as legal advisors.

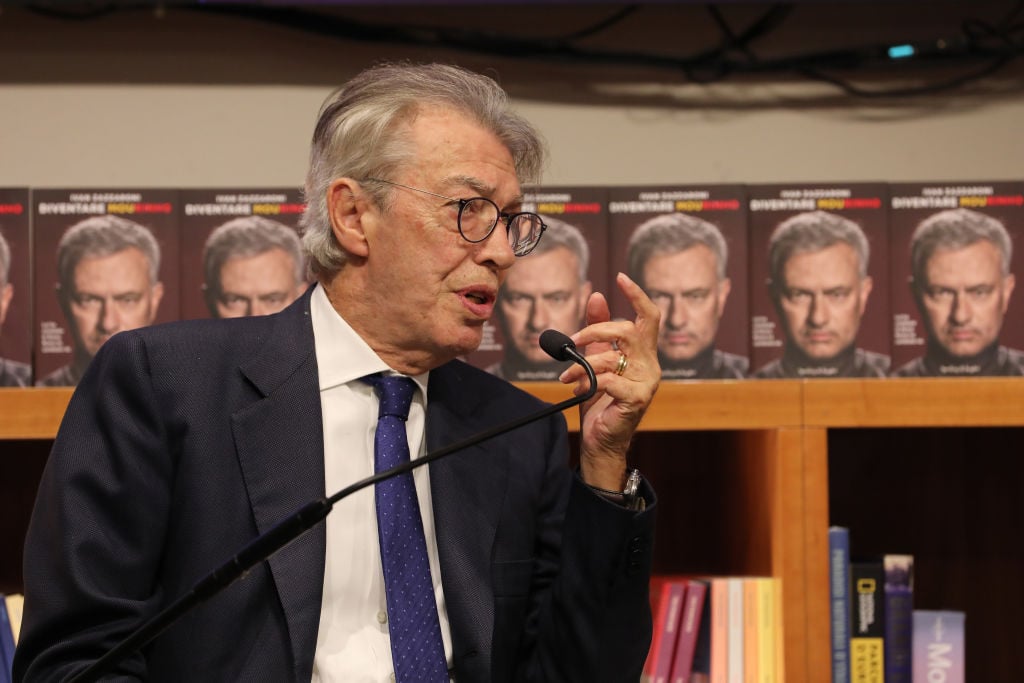

As Massimo Moratti, President and CEO of Saras, commenting on the Moratti family’s announcement to sell their 35% stake:

After 62 years from its foundation by my father, with my nephews Angelo and Gabriele and my sons Angelomario and Giovanni, I believed that the best guarantee for the future success of the Sarroch refinery was the aggregation with a primary industrial operator in the global energy sector, such as Vitol, equipped with resources necessary relational, financial and managerial aspects to compete in the current international market context.

Vitol, the Saras note recalls, has a long history of investing in energy infrastructures around the world, from oil production and refining to renewable energy and CO2 storage.

For Vitol, the operation – we read again in the press release – represents an opportunity to invest in a high-quality assetwell positioned to meet current and future energy needs in Italy and Europe.

Massimo Moratti he continued, emphasizing that “this operation will be positive for all shareholders, for the workers, for the customers and all the other stakeholders, whom I thank for the trust they have always placed in us”.

“Today Saras is a solid and profitable company, leader in the entire Mediterranean basinand we wish Vitol to be able to expand on the successes achieved so far.”

Saras, the note highlights, is a leading company in the industrial and energy sector based in Italy.

Its facilities include the largest single-site refinery in the Mediterranean. Strategically positioned in an industrial site in Sardinia, the refinery with a capacity of 300 thousand barrels/day supplies petroleum products to Italy and the rest of Europe, while its perfectly integrated electricity generation plant, one of the largest of its kind, has an installed power of 575MW and contributes over 40% of Sardinia’s energy needs. Furthermore, Saras has a significant renewables portfolio which includes 171MW of operational wind plants and a pipeline of wind and solar projects of 593MW and 79MW respectively.

Russell Hardy, CEO of Vitol, commented on the transaction as follows:

“Our ambition is to invest in a strong Italian company in the energy sector, managed by autonomous local management and supported by Vitol’s experience and market access. We appreciate the importance of Saras in Sardinia, and in the country more generally, and we are committed to carrying on the Moratti family legacy of diligent management, safe operations and support for the local community and employees. Saras’ activities are well complementary to Vitol’s core business and this transaction will strengthen European energy security and improve the supply of a key plant in the European energy sector.”