The third batch of interbank deposit certificates indexfundStill in hot release, the fourth batch is here.

On May 24, Harvest, China Universal,Huatai-Pinebridge Fundwait for releaseannouncementthe company’s inter-bank certificate of deposit index funds will be launched from May 30 (next Monday) to June 1, and investors will have new tools for low-risk investment.

It is reported that there are five approved institutions in the fourth batch of interbank depository index funds, Harvest, China Universal,InvescoGreat Wall, Huatai-Pine Rui, Huabao Fund, etc., industry insiders expect that the release announcements of the other two fund managers will also be released in the near future. Hand to hand combat”.

According to the fund Jun, the total issuance of the third batch of products on May 23 may exceed 10 billion by 5 funds, and some funds have raised more than 3 billion in a single day, which is still the hottest variety in the new fund market recently.

The fourth batch is here!

1 yuan purchase, 10 billion purchase limit, the fastest on sale next Monday

Approved just last week, the fund share offering announcement will be released this week, and the fourth batch of interbank deposit receipt indices will be released.Fund issuanceThe rhythm is also intense.

On May 24th, Harvest, China Universal, and Huatai-Pinebridge Funds announced that these funds will be launched on May 30th (next Monday) at the earliest.Harvest FundThe first release date is set on May 30, the deadline is June 10, and the subscription days are 12 days.

In addition, China Universal and Huatai Bai Rui are scheduled to be released on June 1, and the subscription days are 10 days and 14 days respectively.

The same as the first three batches of products, this batch of products also stipulates that the minimum subscription amount for each fund account is 1 yuan, and the upper limit of the fundraising scale of 10 billion yuan will be implemented. .

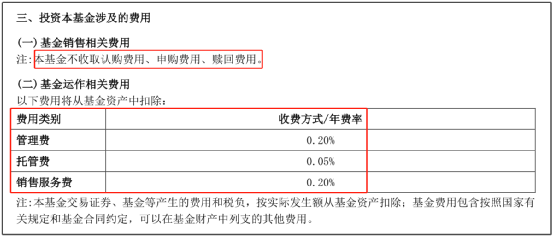

It is worth noting that the fee rate of the interbank certificate of deposit index fund is relatively low, the subscription fee, subscription fee and redemption fee are all zero, and the total annual management fee, annual custody fee, and annual sales service fee is only 0.45%, which minimizes investment. participation costs of the participants.

In order to avoid short-term operationFund NAVIn order to avoid the loss of income and improve the investment experience, the above funds have set a minimum holding period of 7 days. After the fund is opened for redemption, it can be redeemed at any time after the shortest 7-day holding period, and the redemption will arrive in the account on T+1 day at the earliest. The capital utility is high, and it is convenient and flexible.

Harvest Fund said that under the volatile stock market this year, it is especially suitable for investors who have a certain equity position and expect to balance risks and diversify asset allocation; or for stable investors with low risk appetite and high liquidity requirements. spare moneyfinancial managementconfiguration.

A public fund in Shanghai also said that due to the advantages of low risk, high liquidity, and stable income, the interbank deposit certificate index fund has comparative advantages such as high cost performance under the background of this year’s stock market adjustment and comprehensive net worth transformation of wealth management products. Therefore, this type of product has been sought after by funds this year, and many tens of billions of explosive funds have been born. It is expected that the popularity of this type of product will continue for some time.

More than 80% are invested in interbank certificates of deposit

Annualized income of 2.96% in the past three years

In terms of main investment strategies, the interbank certificate of deposit index fund mainly adopts the method of sampling replication and dynamic optimization, and adopts the construction strategy of the investment portfolio of the interbank certificate of deposit, the adjustment strategy of the investment portfolio of the interbank certificate of deposit, the duration strategy, the investment in credit bonds, and the asset support.securitiesInvestment, leveraged investment and other strategies, and strive to obtain stable returns and reduce volatility.

In terms of investment scope, the proportion of the fund’s investment in interbank certificates of deposit shall not be lower than 80% of the fund’s assets, and the proportion of investment in the underlying index constituent bonds and alternative constituent bonds shall not be lower than 80% of the non-cash fund assets. The general risk-return characteristics betweenMonetary Fundwith shortdebt basebetween gold.

In terms of index performance, as of May 23, the interbank deposit certificate AAA index has increased by 1.23% this year, the annualized return in the past three years is 2.96%, and the annualized return in the past five years is 3.5%. The investment income is generally higher thancurrencyFund, lower than short-term debt fund varieties.

It is reported that the interbank certificate of deposit isbankOne of the important short-term financing tools for depository financial institutions in the countrybankThe negotiable book-entry time deposit certificates issued in the intermediary market with a term of less than one year are mostly issued by large state-owned banks and joint-stock companies.bank, with a high credit rating. As of the end of the first quarter of 2022, the stock of interbank certificates of deposit was 1.459 billion yuan, accounting for 12.42% of the interbank bond market.

Since the current interbank certificate of deposit is mainly for institutional investors, individual investors cannot invest directly. The launch of the interbank certificate of deposit index fund provides a new channel for individual investors to easily participate in the investment of the interbank certificate of deposit. The minimum investment starts from 1 yuan, which greatly reduces the cost of investors Participation threshold is a new choice for spare money management.

Senior Fund Manager Management

Profound accumulation in fixed income field

In order to do a good job in interbank depository index fund investment, each public offering has a deep accumulation in the field of fixed income, and also arranges senior fund managers to manage new funds.

Relevant information shows that Chang Xiaoyao, the fund manager of Harvest Fund’s Interbank Depository Index Fund, has more than 13 years of experience.securitiesPractical experience, 9 years of bond investment experience, rich experience in trading and liquidity management, good at judging and judging money market funds and timing, good at tracking market trends, adjusting duration strategies in a timely manner, and grasping band operations.

Behind the fund manager is the earliest and most comprehensive Harvest Fund credit research team in the industry. The entire team relies on the Harvest Large Fixed Income Platform, cross-verifies credit information through multi-party data, and dynamically adjusts core research resources. It has formed a rigorous and scientific research team. credit rating system.

It is reported that the Harvest CSI Interbank Depository AAA Index 7-day holding fund will rely on the “Harvest Credit Analysis System” and the Harvest Central Research Platform, based on in-depth research on fundamentals such as the macro credit environment and industry development trends, and use qualitative and quantitative models. On the basis of the bottom-up individual bond selection strategy, a moderately dispersed industry allocation strategy is adopted to dynamically optimize risk returns from the portfolio level.

In recent years, based on the rapid development of the capital market and the different needs of investors, the large fixed income system of Harvest Fund has formed three core tracks of short-term debt, pure debt, and “fixed income +”, and is committed to creating for holders. More solid earnings and a better holding experience. Wind data shows that as of the end of the first quarter of 2021, Harvest Fund onlybond fundThe scale is 140.137 billion yuan, ranking the forefront of the industry.

China Universal FundThe proposed fund manager of its products is Wen Kaiqiang, a master of management from Tianjin University, a formerGreat Wall FundBond Trader, CICCFund transactionsSupervisor, Senior Manager. Joined China Universal Fund in August 2016. From August 30, 2016 to January 25, 2019, he served as the fund manager assistant of China Universal Money Market Fund, and then served as the fund manager assistant of China Universal Wealth Management 60-day bond fund, China Universal Wealth Management 14-day bond and other products . Since August 7, 2018, he has been the fund manager of China Universal Xinxi Bond Fund, China Universal Money Market Fund and many other products.

China Universal Fund is also strong in fixed income investment.according toHaitong SecuritiesPublished on April 2, 2022fund companyEquity and Fixed Income AssetsperformanceRanking” data, the performance of China Universal’s fixed income products in the past 10 years ranked third among large fixed income companies.

Zheng Qing, the proposed fund manager of Huatai-Pineapple China Securities Interbank Depository AAA Index AAA Index 7-day Holding Period Fund, is the deputy director of the fixed income department of Huatai-Pineapple. He has 16 years of experience.securitiesProfessional experience and 10 years of first-line fund management experience. He has a wealth of practical investment accumulation in monetary funds, pure debt funds and other fields. According to public reports, as of the end of the first quarter, the scale of its products under management exceeded 86 billion.

Public information also shows that Zheng Qing once worked inGuosen SecuritiesPing An Asset Management Co., Ltd., from March 2008 to April 2010China Overseas FundTrader, joined Huatai-Pinebridge Fund in 2010 as a bond researcher. Since June 2012, he has served as the money market fund manager of Huatai-Pineapple, and from July 2013 to November 2017, he has served as the fund manager of Huatai-Pineapple Credit Enhancement Bonds. Since January 2015, he has been the Deputy Director of the Fixed Income Department. Currently, he is the fund manager of Huatai-Pineapple exchange-traded money market fund and Huatai-Pineapple Xinli flexible allocation of mixed funds.

(Article source: China Fund News)