After yesterday’s “tremor”, game stocks “recovered blood” today. As of the close, Tencent closed up 2.42%,Zen Tour TechnologyUp 1.6%,Xindong CompanyUp 1.70%;BilibiliRose 0.54%.

It is said that some people went to Beijing to rush to the examination room starry night, and some people resigned overnight and returned to their hometowns. After the “Great Earthquake”, the market’s disagreement on the game and even the Internet industry has also increased.shareholder, Many public offerings have withdrawn ahead of schedule. On the other hand, some foreign-funded institutions have begun to make arrangements in advance.

After the “Great Earthquake”

fundManagers have widened disagreement on Hong Kong stock technology stocks

The Chinese game industry has encountered a “black swan” in the secondary market, and the stock prices of game and Internet companies represented by Tencent have intensified. As the valuation of hardcore technology is rising, what do you think about the future of the game industry, the Internet industry, and Hong Kong stock technology stocks?

Cathay Pacific FundIt is believed that the current market is highly uncertain and the risk of selecting individual stocks is relatively high. It is recommended that investors who pay attention to the game sector may useETFFunds, to avoid individual stock risks, deploy in batches, and seize industry investment opportunities.

The current valuation of the game sector is still at the historical low level when the 2018 version number and the youth protection policy were introduced. The overall direction of the policy has not changed much, and the policy or driving industry concentration has increased, and the trend of quality from quantity to quality has accelerated.From a fundamental point of view, listed companies in the game sector in 2021 are still inPerformanceGrowth period, and is expected to usher in oversold valuation repair.

Du Meng, investment director of China International Investment Corporation, believes that Hong Kong stock technology stocks may still have performance opportunities in the second half of the year. Short-term policies have put pressure on market sentiment, but in the long run, the Internet industry still has strong growth flexibility.

A medium-sized in Shanghaifund companyEquity fund managers revealed that many funds have paid little attention to the game industry. Even if they have positions, their proportions are not high. The top ten major stocks of funds are mainly new energy, chips, and pharmaceuticals. The reason for not paying attention to the game industry is that the leading players in the game industry, such as Tencent, are not listed on A-shares, and most of them are in Hong Kong stocks or U.S. stocks. On the other hand, the regulation and rectification of the game industry has always existed. From historical experience, there will be periodic measures to strengthen the supervision of the game industry. Some institutions have a mentality that they would rather miss it and not do something wrong, and remain cautious about the prospects of the track. . Some game companies do have areas for improvement in terms of user privacy and data security. He believes that from a long-term perspective, data regulation in the Internet industry such as games is a major industry trend. The purpose of regulation is to regulate platform behavior rather than change its profit logic. Especially for Internet companies in Hong Kong stocks and A-shares, their data privacy compliance Relatively stronger and more cautious. At present, the market is relatively cautious about the Internet sector. Funds are concentrated on popular tracks such as new energy. Institutions in other industries will choose to adjust their positions when they have a little problem, which has also intensified the volatility.

A cultural and entertainment-themed fund manager in Shanghai said that a series of stricter regulations and rectification policies have been introduced since the new formulation of “platform anti-monopoly” and “preventing the disorderly expansion of capital” was put forward at the end of last year. Regulatory policies on the Internet industry will put pressure on the industry in the short-term, but the policy is not to completely destroy the industry. He emphasized that the core of the fundamental difference between the path of socialism with Chinese characteristics and the West is that capital cannot dominate the country. Capital should play a constructive role in promoting economic development and promoting the national economy and people’s livelihood. The goal of adjustment is to consolidate the necessary political norms and strengthen the legal governance system during development. Capital can only sincerely serve users and society, sincerely be an active element under China’s major system, take advantage of the trend in the interaction with the country’s major policies, and constantly release its vitality in the market. I believe that it will definitely work, and there will be more Many opportunities to be recognized by the market. In the long run, the Internet sector still has investment value, but there will not be too many opportunities in the short term.

As of the fund’s second quarterly report, a total of 219 funds have increased their holdingsTencent Holdings.From a single fund product point of view, as of the end of the second quarter, E Fund’s Blue Chip Select heldTencent Holdings18.1 million shares, an increase of 2 million shares from the first quarter.Tencent HoldingsThe fund with the largest number of stocks. Xingquan Heyi managed by Xie Zhiyu holds 3,993,200 shares. In addition, E Fund Research Selection managed by Feng Bo, Qianhai Kaiyuan Shanghai-Hong Kong Deep Blue Chip managed by Qu Yang, Guangfa Shanghai-Hong Kong-Shenzhen New Starting Point managed by Li Yaozhu, and Penghua Ingenious Selection managed by Wang Zonghe all hold a considerable amount of Tencent Holding.

From the perspective of fund companies,E FundTencent Holdings holds the largest position with 55,152,900 shares, followed by ShanghaiOrient SecuritiesAsset management company,China Asset Management、China Universal FundThe three positions held by Tencent Holdings are all above 10 million shares.

An industry insider also told the fund manager that it is true that some young people are addicted to online games and the problem is very serious. The education sector and parents have complained about them for a long time, but the solution to this problem requires comprehensive management and will not be eliminated. Governance will of course bring some adjustments, but the Politburo meeting on July 30 specifically emphasized the need to adhere to the general tone of seeking progress while maintaining stability, fully, accurately and comprehensively implement the new development concept, accelerate the construction of a new development pattern, and promote high-quality development. For the recent network economic governance, this is the governance and regulatory upgrade that must be experienced, and it is one of the measures to modernize the national governance system and governance capabilities. He pointed out that it needs to be admitted that the early development of Internet companies is a bit of “barbaric growth”. Now it is time to strengthen regulations, but the purpose of governance is to develop more healthily, not to attack the Internet platform economy. China needs a number of Internet high-tech companies with fast development speed and strong innovation capabilities. This is an indispensable part of China’s competitiveness. Promoting the continuous modernization of the economy and meeting the people’s needs for a better life are inseparable from the contributions of Internet high-tech companies. Of course, Internet companies need to actively cooperate with related governance, and no one should have resistance and hands or feet. This is the common expectation and requirement of the whole society on them.

Major shareholders and some public offerings have withdrawn ahead of schedule

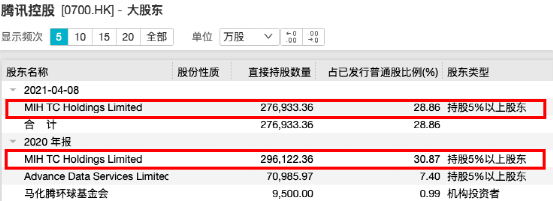

The reporter noticed that as of April this year, MIH, the largest shareholder, had completed its shareholding reduction ahead of schedule.Previously issued by major shareholdersannouncementSaid that after the sale of 190 million Tencent shares, the shareholding ratio will be reduced from 30% to 28.9% after the cash-out is completed.

Except bigShareholder reduction, Some public funds have also been significantly reduced since the second quarter.

According to the data, as of the end of the second quarter, Tencent Holdings currently holds a total of 506 funds, involving 75 fund companies, holding a total of 198 million shares, a reduction of 13 million shares from the end of the first quarter. Specifically, there were a total of 625 funds at the end of the first quarter, while only 506 were left at the end of the second quarter. There were 302 funds including clearances that were underweight, while the remaining 104 funds remained unchanged.

It is worth noting that the media industry in the second quarter of 2021 accounted for 1.43% of the public funds’ heavy holdings, which is currently significantly lower than the historical average.

Well-known foreign investors began to buy the bottom of Hong Kong stock technology stocks

As the valuation of hard-core technology has risen, the Internet industry has gradually faded out of the vision of public funds, but well-known foreign investors have begun to buy the bottom of Hong Kong stock technology stocks.

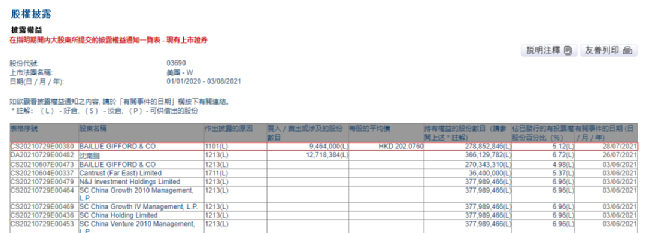

According to data from the Hong Kong Stock Exchange, BAILLIE GIFFORD & CO, a well-known foreign institution, increased its holdings of 9.464 million shares of Meituan on July 28, at an average purchase price of HK$202, involving an amount of approximately RMB 1.589 billion.

Baiji Investment was established in 1908 and is headquartered in Edinburgh, England, with a management scale of more than US$300 billion. The companies that Berky Investments are interested in are those with huge growth potential in the next five to ten years.

Baiji Investment due to investmentTeslaKnown to the market, the company has continued to buy since 2013Tesla, Which becameTeslaThe company’s second largest shareholder, the company continued to reduce its holdings in Tesla since 2020, and its shareholding dropped to 1.61% at the end of June this year. Parkey is also very fond of Chinese companies.Alibaba, Tencent, Meituan Dianping, etc. are all its long-term investment targets.

(Source: China Fund News)

(Original title: Game stocks are terrified! Major shareholders and some public offerings withdrew early! There are also tens of billions of fund managers who bucked the trend and increased their positions, and well-known foreign investors bought the bottom!)

(Editor in charge: DF552)

.