Wall Street up on Fed-Day, the day in which the American central bank will announce the decision on fed funds rates. The consensus foresees a 50 basis point squeeze from the current range between 0.25% and 0.50%; at about 4 pm Italian time the Dow Jones is up by 130.35 points (+ 0.39%); the S&P 500 advanced 0.20% to 4,184 and the Nasdaq fell 0.10% to 12,547. Yesterday the Dow Jones index finished the session up 0.22%, the S&P rose 0.48% and the Nasdaq Composite 0.22%.

Focus on the trend in US Treasury rates, with ten-year rates now one step away from the 3% threshold: at the moment yields are advancing to 2.97%.

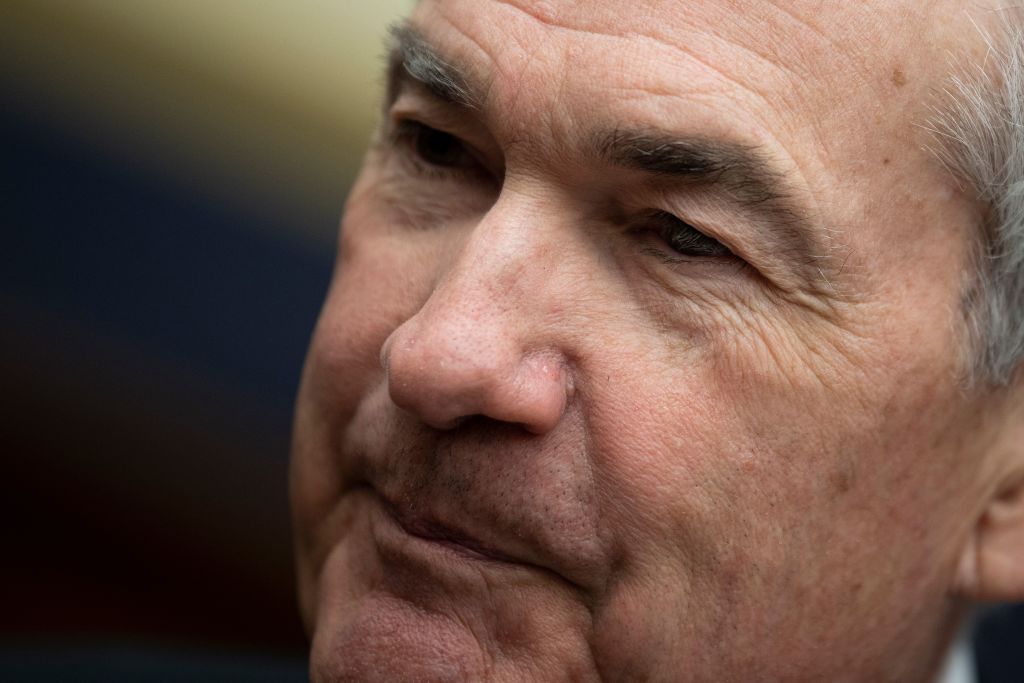

Jerome Powell’s Fed hiked rates on March 16 for the first time since 2018, kicking off a cycle of hikes that, according to some economists, predicts seven monetary tightenings, if not more, by the end of 2022. to counter the rise in inflation in the United States, which jumped 8%. According to the trend of futures on fed funds, the markets are betting on a tightening of 50 basis points, today, with a probability of 91.6%. The probability that the Fed will raise rates by 75 basis points is just 8.4%.

The American central bank is ready, in addition to launching the second monetary tightening since 2018, to announce the beginning of the Quantitative Tightening, or the gradual reduction of its balance sheet, which should take place at the pace of a cut in asset purchases for a value of $ 95 billion a month.

Keep an eye on the survey launched by the CNBC, which revealed, also in this case, that the forecasts for today are for a monetary tightening of 50 basis points, the first in 22 years, followed by another rate hike always of 50 basis points. in the June meeting. For subsequent meetings, a majority of the 30 experts interviewed believe that the squeeze will return to 25 basis points.

However, the outlook on rates is very hawkish: respondents, which include economists, strategists and fund managers, believe that rates will rise to 2.25% by the end of the year, and then rise again to 3.08. % by August 2023, and drop to 2.6% at the end of next year.

Pending the big announcement, the global head of Macquarie’s strategy division warned that, in the years 2023-2024, the Fed will be forced to turn around, reintroducing new expansionary monetary policy measures. “What will happen is that the Federal Reserve will start to initiate a restrictive policy, both through Quantitative tightening and by raising rates; at that point, rates will get closer and closer to the neutral level, and the volatility of asset prices will increase significantly. – said Viktor Shvets, global head of the strategy division of Macquarie, according to the Australian Financial Review – When that happens, the index of financial conditions will shoot up and at that point, the rates of inflation and GDP growth will begin to disappear and the Fed will have no choice but to turn around. “

Among the stocks sinks that of the ride sharing company Lyft, which lost more than a quarter of its value in the afterhours trading on Wall Street, after the publication of its quarterly. Uber’s rival in the sharing mobility market provided weak guidance, after announcing that it ended the first quarter with an adjusted earnings per share of 7 cents on an adjusted basis, better than the consensus estimated loss per share of 7 cents; revenue stood at $ 876 million, better than the expected $ 846 million, with the number of active riders at 17.8 million, less than the expected 17.9 million. Revenue per active rider was $ 49.18, higher than the estimated $ 47.07. However, Lyft has announced that it expects revenue for the second quarter between $ 950 million and $ 1 billion, lower than the expected $ 1.02 billion.

The prices capitulate by over -33%, with the stock traveling at its lowest value since October 2020.

The collapse initially infected rival Uber, which collapsed by over -9%; the stock then regained ground after the disclosure of the financial statements in the premarket. Uber announced that it ended the first quarter of the year with a loss per share of $ 3.04 (GAAP), considered not comparable with analysts’ estimates, against a turnover of $ 6.85 billion, up +36 % yoy, better than the expected $ 6.13 billion. In total the group suffered a net loss of $ 5.9 billion, mainly caused by its investments in euity. Its adjusted EBITD was $ 168 million.

The Moderna stock rallied, rising by more than + 5% after the vaccine manufacturer released a better-than-expected quarterly report. Net income stood at $ 3.66 billion, three times as much as the $ 1.2 billion earnings of the same period last year. Strong revenue growth, on the back of the boom in Covid vaccine sales, which stood at $ 5.9 billion. In the first quarter of 2021, revenue from vaccine sales – deliveries of which to various parts of the world had just started – amounted to just $ 1.7 billion (versus $ 5.9 billion in the first quarter of 2022). Moderna’s adjusted eps broke the estimates, at $ 8.58 per share, significantly better than the expected $ 5.21, while the total turnover was $ 6.07 billion, well above the expected $ 4.62 billion. .

Also keep an eye on Advanced Micro Devices (AMD), after the publication of a quarterly report that beat analysts’ expectations both in terms of profits and turnover. The stock jumped up to + 8% in afterhours trading. The chip maker announced that it ended the first quarter of the year with an eps of $ 1.13 on an adjusted basis, well above the expected $ 0.91, up well + 117% on an annual basis. Turnover rose 71% year-on-year to $ 5.89 billion, over an estimated $ 5.52 billion.

In the face of some analysts who believe that the boom in PC demand has ended with the end of the darkest period of the Covid pandemic, the chip giant, which supplies processors necessary for the production of many laptops and desktops, is not blaming the feared. slowdown in demand. AMD added that it estimates second-quarter sales of $ 6.5 billion, above analysts’ expected $ 6.38 billion.