On June 9, Weilai released its first-quarter financial report, and a number of core data fell sharply: revenue increased by 7.7% year-on-year to 10.676 billion yuan, which was lower than market expectations of 11.7 billion yuan; net loss expanded by 66% year-on-year to 4.74 billion yuan , Since its listing, it has lost money for 19 consecutive quarters; the gross profit margin of the company and the gross profit margin of the automobile business have dropped to 1.5% and 5.1% respectively.

The goal of achieving breakeven in the fourth quarter of this year has also been dashed. Weilai CEO Li Bin said in the earnings conference call: “The timetable must be pushed back, and I hope that the time of this push can be controlled within one year.”

Ideal Auto called out the aggressive slogan of using 3 models to challenge monthly sales of 40,000 vehicles, while NIO hopes to make a turnaround in the second half of the year with the help of 8 models with the new ES6 as the main force, but this has almost become an impossible task. Task.

Crashed deliveries

As the first new top force to land in the capital market, Weilai showed signs of falling behind at the beginning of 2023.

In the first quarter, Weilai’s delivery volume fell by 22.5% from the previous quarter to 31,000 vehicles. In the first round of competition within “Wei Xiaoli”, Weilai led Xiaopeng by less than 13,000 vehicles and was 21,000 vehicles behind Ideal. In the fourth quarter of last year, the delivery volume of NIO and Ideal was more than 40,000 vehicles, slightly higher than Ideal.

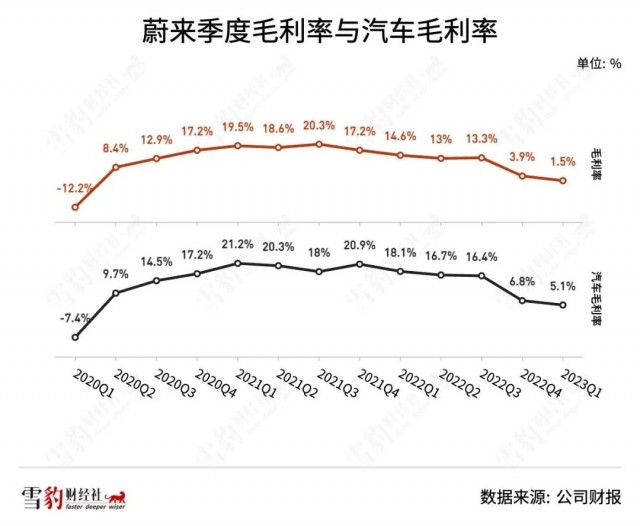

In addition, Weilai’s main delivery force has changed from the “866” models (ES8, ES6, EC6) in the same period last year to the ES7, ET5 and ET7 with lower gross profit margins, which also led to the gross profit margin falling to 1.5% during the reporting period, a record high. 12-quarter low. In the first quarter and the fourth quarter of last year, the gross profit margins of Ideal and Xiaopeng were higher than that of Weilai.

On the day when Weilai’s financial report was released, Ideal Auto CEO Li Xiang posted on Weibo: “After reaching a revenue scale of 100 billion yuan, a product gross profit rate of 15% to 25% is the benchmark requirement for a healthy and surviving auto company, with leading sales. This is true of BYD and Tesla.”

The most direct impact of the decline in delivery is the car sales revenue. In the first quarter, Weilai’s revenue from this category fell by 37.5% from the previous quarter to 9.22 billion yuan, only half of the ideal. In the same period last year and throughout the year, the corresponding revenues of the two car companies were basically at the same level, and the total revenue of Weilai was much higher than ideal.

Since the beginning of the year, new energy subsidies have been completely withdrawn and Tesla has launched a price war. Competition in the domestic auto market has intensified. Many car companies have responded by directly reducing prices, reducing prices in disguise, or launching low-priced models with reduced configuration.

However, when the launch of the second-generation platform models was delayed and the product portfolio could not be connected, Weilai did not follow up with price cuts. Li Bin emphasized on many public occasions: “Wei Lai will not reduce allocations or reduce prices.”

At the earnings conference call, an analyst asked: “Will the ET5 and other running models consider launching low-priced versions, and reduce the price through configuration reduction and version adjustments to obtain better sales?” Li Bin reiterated that he would not do anything like this. Adjustment.

The stubborn Li Bin and Weilai also paid the price for this persistence.

In April and May, ET5, ET7, etc. failed to take on the important task of recovering the decline. NIO delivered less than 7,000 vehicles for two consecutive months, and the delivery volume in May hit a 13-month low. In the new round of sales competition with Xiaopeng and Ideal, NIO is 1,772 and 41,000 behind, respectively.

Li Bin explained that the market performance of the ES7, ET5 and ET7 released last year, especially in the second quarter, fell short of the company’s expectations. On the one hand, without subsidies and car purchase rights, the average price has actually increased by 10,000 to 20,000 yuan; on the other hand, the overall environment and the competition in the target market this year are very fierce, causing some users to flow to competing models.

Weilai’s backwardness has been traced before.

In 2022, among the major new car-making forces, Weilai, which has the most models on sale, will only rank third in terms of total delivery volume, behind Nezha and Ideal, and will be at the bottom for 3 months; among “Wei Xiaoli”, it will be at the bottom time reaches 6 months.

NIO expects to deliver between 23,000 and 25,000 vehicles in the second quarter of this year. Combined with the published data for April and May, the delivery volume in June will struggle to return to 10,000 units, which also reflects the first complete monthly delivery data of the new ES6 since its launch at the end of May.

However, Weilai is likely to lose again in the competition in June. Li Xiang previously stated in the first-quarter earnings conference call of Ideal Auto that he will strive to achieve the goal of delivering more than 30,000 vehicles in a single month in June.

ES6 Difficult Savior

Can the new ES6, which is “released and delivered” become NIO’s “rescue vehicle”?

As Weilai’s second mass-produced model, the ES6 has been taking on the company’s heavy responsibility for delivery since it started delivery in June 2019. As of the end of 2022, ES6 has delivered a total of 122,000 vehicles in three and a half years, accounting for almost half of Weilai’s total delivery volume.

Li Bin did not respond positively to the overall order status of the new ES6 at the earnings conference call. He only revealed that the locked orders met the company’s expectations, and the test drive conversion rate reached the highest ever among all models.

According to Weilai’s previous statement, the new ES6 will complete the ramp-up of production capacity in June. However, from the point of view of the delivery cycle (from the date when the user places an order to the delivery to the user), there are still not small production capacity problems. According to NIO’s annual report, the company has established a delivery cycle of 3 to 4 weeks as the standard speed.

At present, the delivery cycle of the new ES6 is about 5 weeks, the longest among NIO models on sale. Li Bin said that ES6 will definitely be in the process of ramping up production in June, and the company hopes to achieve the goal of producing and delivering 10,000 vehicles in July.

The price of the new ES6 has been lowered by 18,000 yuan to 368,000 to 426,000 yuan compared with the 2022 model. This is the first time that NIO has reduced the price during a model change, and it is also the company’s cheapest SUV. Weilai has always regarded BBA as a competitor internally, and the competing products of ES6 include Mercedes-Benz GLC 300, BMW X3, and Audi Q5L.

But today’s market environment is completely different. Compared with similar new energy models such as Tesla Model Y, Wenjie M7, Ideal L7, and Xiaopeng G9, the price range of the new ES6 has no obvious advantage.

The Bank of Communications International Research Report believes that although the new ES6 is based on the second-generation technology platform, it has larger interior space and advanced advanced driver assistance systems, etc., but due to the lack of differentiation, sales growth is expected to be limited. The bank also said that combined with weak orders in hand and fierce competition from more other brand models, NIO still faced delivery pressure in the second and third quarters.

Judging from the business outlook provided by NIO, sluggish delivery will continue to put pressure on the company’s revenue. Weilai expects revenue in the second quarter to fall by 9.0% to 15.1% year-on-year to 8.742 billion to 9.370 billion yuan. Previously, Weilai has achieved revenue exceeding 10 billion for four consecutive quarters.

Production capacity is still climbing and lack of price advantage, the new ES6 is unlikely to become a blockbuster model in the short term.

lower than expected demand

With the expansion of the second-generation platform model lineup to 8 models, the “5566” (ET5, ET5 travel version, ES6, EC6) mentioned by the management many times in the earnings conference call has become NIO’s key product portfolio and new delivery main force. NIO CFO Feng Wei said that in the long run, the sales volume of the “5566” model should account for about 80%.

In response to analysts’ questions about whether Weilai would consider optimizing its current models and marketing layout, Li Bin responded that each model has its own product positioning. The four high-volume models of “5566”, including strategic models such as the ES8, will definitely have some inclinations in resources. In general, the focus is still on how to ensure that these eight models can achieve a sufficient share in the target market.

However, Deutsche Bank analysts said in a research report: “Nio’s demand is lower than expected, and it is facing the biggest headwind since it almost went bankrupt in 2020.” The weak demand in the pure electric market and the popularity of plug-in hybrid models are the main reasons for the recent weak sales of NIO.

According to the data from the Passenger Federation, from January to April this year, the cumulative retail sales of high-end plug-in hybrid models increased by 138.7% year-on-year to 138,000 units, surpassing pure electric models in both scale and growth rate; in April, pure electric sales fell by as much as 18.6% month-on-month , plug-mix sales are still growing.

In terms of the corresponding segment market share, none of NIO’s SUV models on sale has entered the sales rankings of the Passenger Association last year and the first two months of this year; the two high-end sedans ET5 and ET7 are also unable to compete with BBA-related models , sales are not of the same order of magnitude.

TF Securities believes that under the fierce competition in the new energy vehicle market, 150,000 to 300,000 yuan will be the key price range that contributes to incremental growth and increases penetration in June and the second half of this year. Brands with new cars covering this range are expected to Get a new increment.

In the earnings conference call, UBS Securities analysts expressed concerns about the competitiveness of NIO’s low-priced brand Alps, which will be launched in the second half of next year.

In this regard, Li Bin’s response was a little helpless: it is indeed still in the chaotic period of the brand, and users are still choosing according to the price. “It’s a reality of the moment that the value is not fully reflected in the price.”